Jean Giraudoux

Perhaps this quote above ought to have been the theme for the World Economic Forum at Davos.

The view from the top is quite exhilarating. Not so much, when an arrogant disregard for the limitations of power and the inevitable banquet of consequences of being out of touch and unrealistic brings it down around the ears of the elite, in ruins.

Overreach of pride blinded by greed is an old theme, but a recurrent malady.

We had the usual antics this morning, the quick down or up in the prices of the precious metals, designed to make some quick profits for the underregulated trading desks, many of whom are complicit in the price rigging led by the Western central banks.

But it didn't really stick, fading into the afternoon. And we really ought not to complain about the rally in the metals this week, thanks in great part to the clear signal from the ECB that the Banks will be devaluing their currencies for the foreseeable future, in large part to make up for their horrific policy errors ongoing since the mid 1990's at least.

Next week is a February option expiration for precious metals on the Comex, and the return to a look at active month contact.

We will also see an FOMC decision. I have included both the economic and the Comex calendars below.

I am sticking to my stagflation forecast for now. We have the stag, but not yet much inflation, unless you eat or get sick or pay rent, especially relative to the real wage.

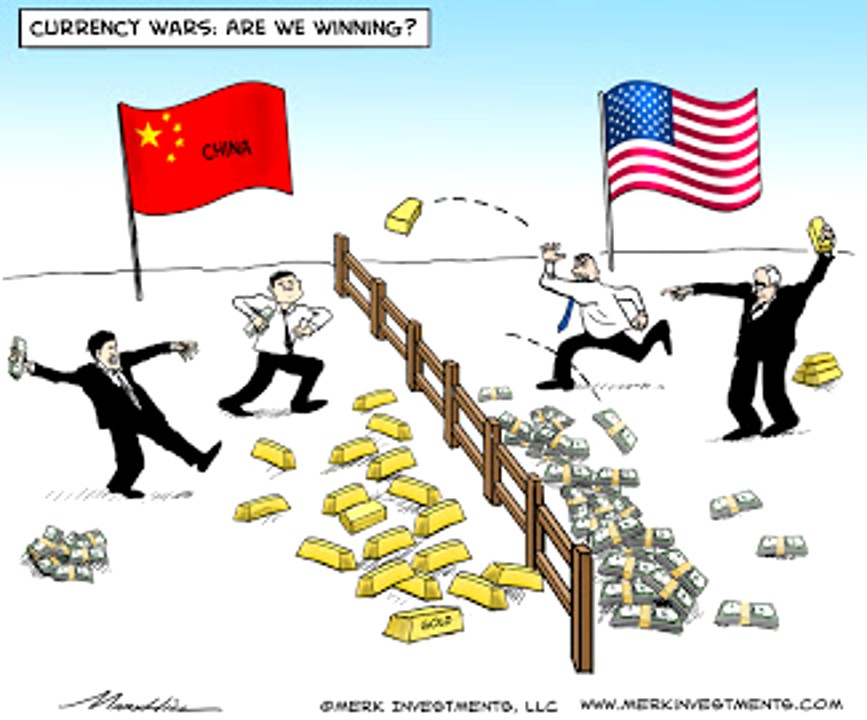

There is no doubt in my mind that there is a currency war on a slow boil behind the scenes, and that it is centered around the role of the dollar and international payments/trade. And there is also little doubt that the parties at odds are the Anglo-Americans, that being the US and its 'attendant allies,' and the Rest of the World.

Like most great changes, it will come at us slowly, so slowly, so that many will deny and ignore it. And then one day it will come at us, all in a rush. And people will say, 'who could have seen it coming?'

Have a pleasant weekend. See you Sunday evening.

Tsar Nicholas II: I know what will make them happy. They're children, and they need a Tsar! They need tradition. Not this! They're the victims of agitators. A Duma would make them bewildered and discontented And don't tell me about London and Berlin. God save us from the mess they're in!Count Witte: I see. So they talk, pray, march, plead, petition and what do they get? Cossacks, prison, flogging, police, spies, and now, after today, they will be shot. Is this God's will? Are these His methods? Make war on your own people? How long do you think they're going to stand there and let you shoot them? YOU ask ME who's responsible? YOU ask?