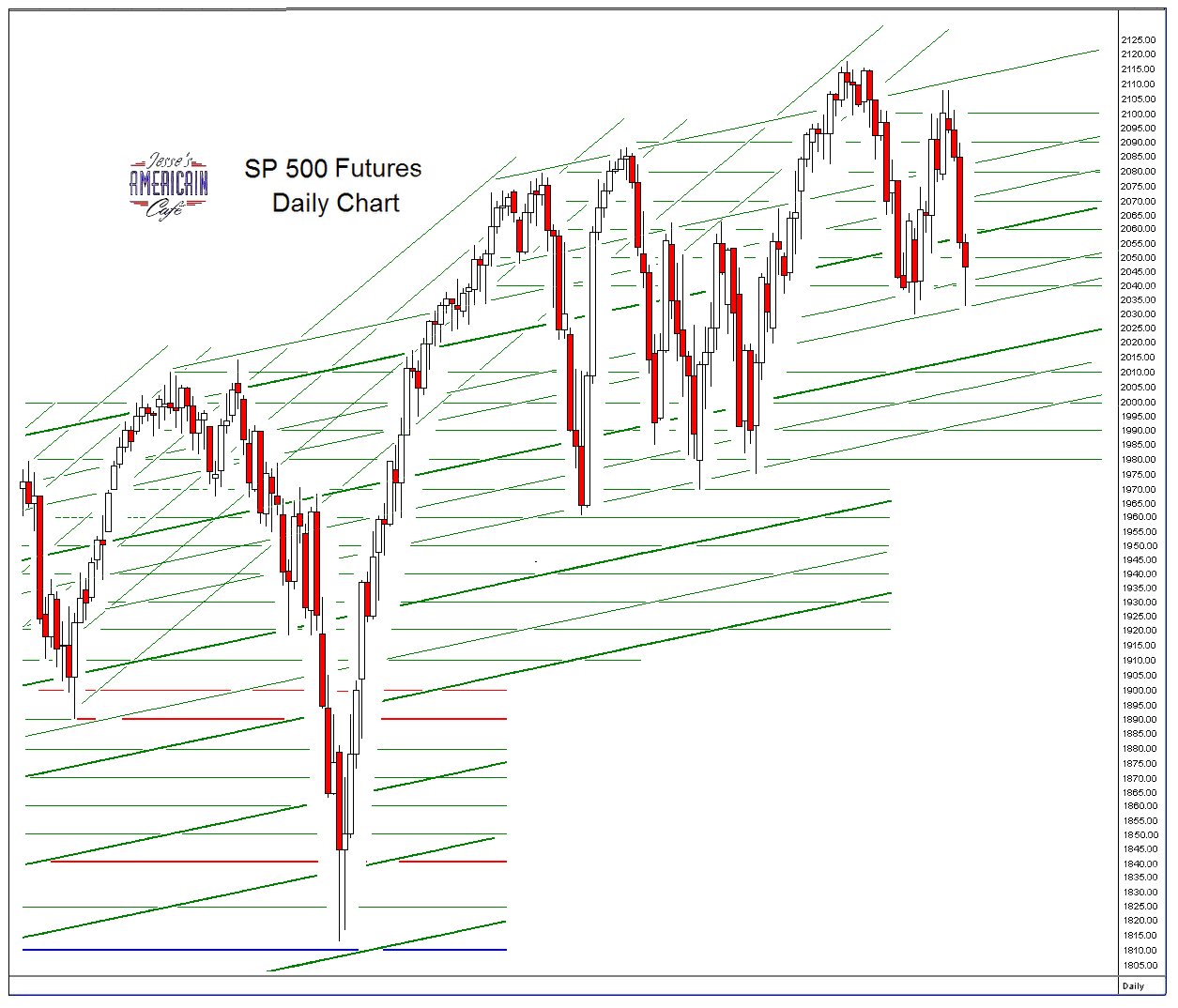

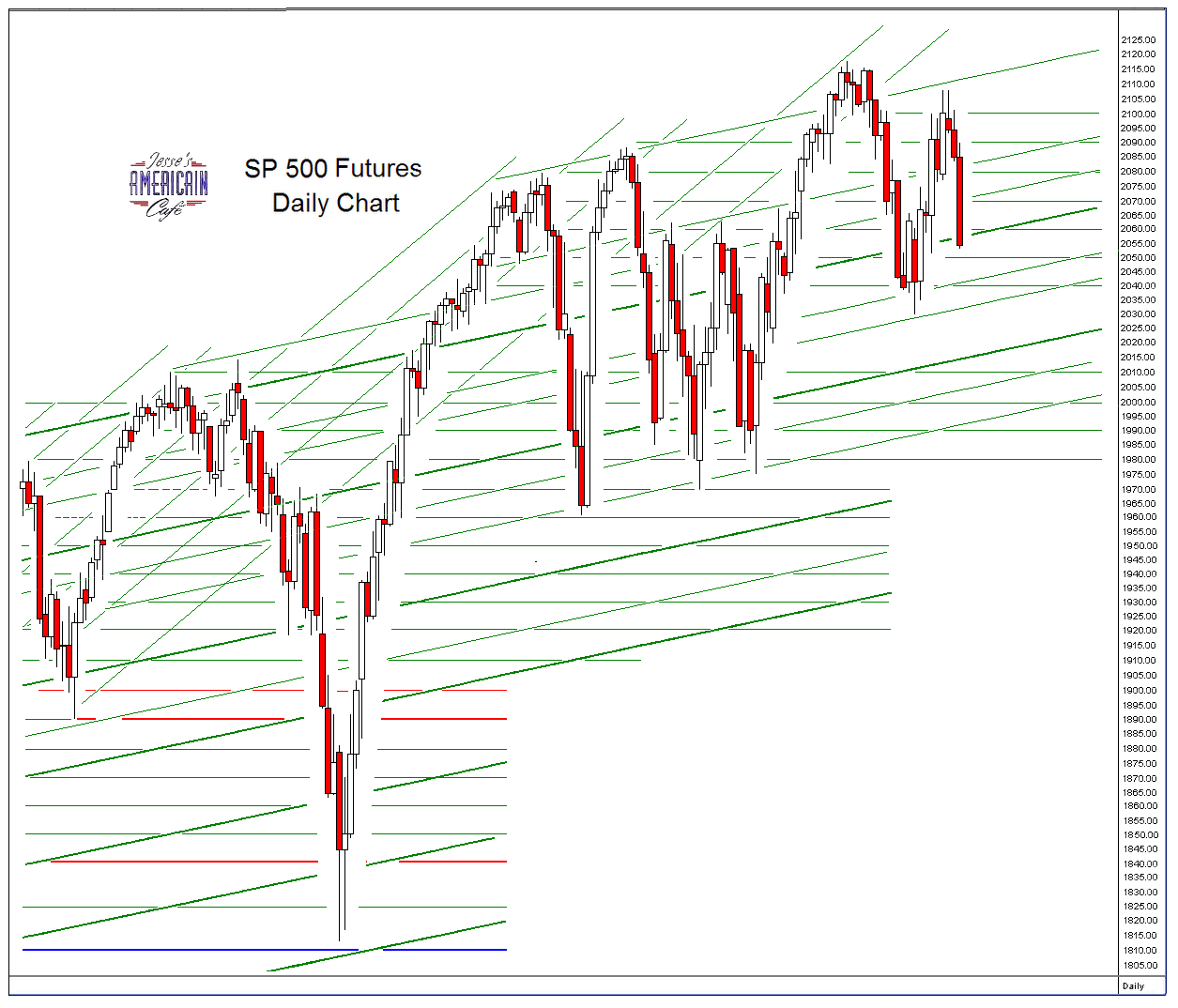

Stocks largely moved sideways on the weak economic data this morning.

After the bell it was revealed that Intel would like to purchase chipmaker Altera. The consolidation of industry continues.

After a largely directionless day, there was a little bit of a lift into the close as Chairman Yellen talked about the bias to raise interest rates for the purpose of 'normalization,' but slowly and with an eye on the data.

Nothing new here. The Fed wishes to get off ZIRP at least nominally to give themselves some policy latitude for the future and to widen the spreads and bets available to the Banks.

And so they are likely to 'get her done' and not blanch from the task until they start to blow up the real economy in a manner more overtly than they have already been doing through their distortions over the past thirty years or so.

The Fed is bank-centric. They are a creature of the Banks. Unfortunately so are the politicians, so the broader public may find themselves in difficult circumstances.

I doubt that this will change or improve until there is substantial discomfort felt by the ruling elite. Nothing new there. And the more vocal portion of the public, the twenty percent I like to think of as the 'beguiled,' will be busy trying to push each other under the bus as it were, and kick the other guy off the life raft, because that is much easier than facing the real issues of reform.

At some point the beguiled will wake up, and then we will see a social phenomenon that 'no one will understand.' It is hard to get the herd moving, but once they start to move the force and momentum of their movement can be impressive and fairly durable. As a child of the 50's and 60's who was not unfamiliar with seeing armed soldiers and tanks in the streets of major urban areas, I can assure you that this phenomenon is more common in history than you probably imagine.

That is not to say it is a good thing, or a desirable thing. But it is becoming almost an inevitable thing given the inability of the upper crust to disengage themselves from the credibility trap, and their ill gotten gains from their abuses of power.

Have a pleasant weekend.

After the bell it was revealed that Intel would like to purchase chipmaker Altera. The consolidation of industry continues.

After a largely directionless day, there was a little bit of a lift into the close as Chairman Yellen talked about the bias to raise interest rates for the purpose of 'normalization,' but slowly and with an eye on the data.

Nothing new here. The Fed wishes to get off ZIRP at least nominally to give themselves some policy latitude for the future and to widen the spreads and bets available to the Banks.

And so they are likely to 'get her done' and not blanch from the task until they start to blow up the real economy in a manner more overtly than they have already been doing through their distortions over the past thirty years or so.

The Fed is bank-centric. They are a creature of the Banks. Unfortunately so are the politicians, so the broader public may find themselves in difficult circumstances.

I doubt that this will change or improve until there is substantial discomfort felt by the ruling elite. Nothing new there. And the more vocal portion of the public, the twenty percent I like to think of as the 'beguiled,' will be busy trying to push each other under the bus as it were, and kick the other guy off the life raft, because that is much easier than facing the real issues of reform.

At some point the beguiled will wake up, and then we will see a social phenomenon that 'no one will understand.' It is hard to get the herd moving, but once they start to move the force and momentum of their movement can be impressive and fairly durable. As a child of the 50's and 60's who was not unfamiliar with seeing armed soldiers and tanks in the streets of major urban areas, I can assure you that this phenomenon is more common in history than you probably imagine.

That is not to say it is a good thing, or a desirable thing. But it is becoming almost an inevitable thing given the inability of the upper crust to disengage themselves from the credibility trap, and their ill gotten gains from their abuses of power.

Have a pleasant weekend.