“At the center of our being is a point of nothingness which is untouched by sin and by illusion, a point of pure truth, a point or spark which belongs entirely to God, which is never at our disposal, from which God disposes our lives, which is inaccessible to the fantasies of our own mind or the brutalities of our own will.This little point of nothingness and of absolute poverty is the pure glory of God in us. It is like a pure diamond, blazing with the invisible light of heaven. It is in everybody, and if we could see it we would see these billions of points of light coming together in the face and blaze of a sun that would make all the darkness and cruelty of life vanish completely."Thomas Merton, Conjectures of a Guilty Bystander"There may be a great fire in our soul, yet no one ever comes to warm himself at it, and the passers-by see only a wisp of smoke coming through the chimney, and go along their way. Look here, now, what must be done? Must one tend that inner fire, have salt in oneself, wait patiently yet with how much impatience for the hour when somebody will come and sit down near it-maybe to stay? Let him who believes in God wait for the hour that will come sooner or later."Vincent Van Gogh, Letter 133

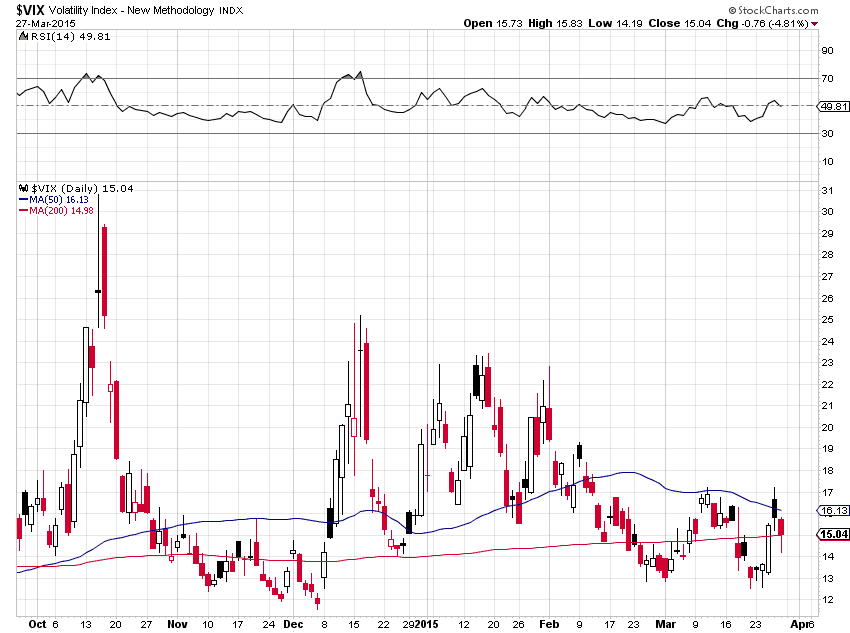

We're on the April contract delivery process now, and the action today was likely a follow through from last week's option expiration.

April will be an 'active month' for gold.

Non-Farm Payrolls on Friday.

Have a pleasant evening.