During the latest week there were 54.2 tonnes of gold withdrawn from the Shanghai Gold Exchange.

Since the beginning of 2009 there have been 9,030 tonnes of gold taken out of the Shanghai Exchange into China.

That is more than 290,320,000 troy ounces of fine gold in bars.

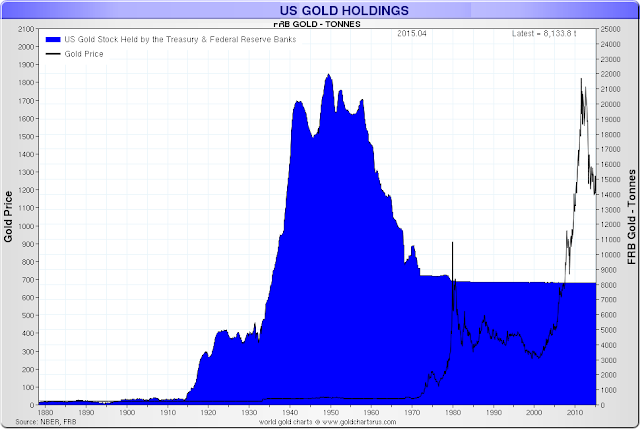

Just for the sake of comparison, as shown in the last chart below, the total official holdings of the United States are about 261,498,926 ounces of gold.

So it does seem that since 2009 more gold has been withdrawn from the Shanghai Exchange than is in all the official holdings, vaults, forts, mints and Federal Reserve Banks of the United States.

Related: Why Shanghai Gold Withdrawals Equal Chinese Gold Demand

Current Report: May 31, 2015

Deep Storage: That portion of the U.S.Government-owned Gold Bullion Reserve which the Mint securesin sealed vaults that are examined annually by the Treasury Department's Office of the Inspector General.

Deep-Storage gold comprises the vast majority of the Reserve and consists primarily of gold bars. (Formerly called "Bullion Reserve" or "Custodial Gold Bullion Reserve").

Working Stock: That portion of the U.S. Government-owned Gold Bullion Reserve which the Mint uses as the raw material for minting Congresssionally authorized coins.

Working-Stock gold comprises only about 1 percent of the Reserve and consists of bars, blanks, unsold coins, and condemned coins. (Formerly listed as individual coins and blanks or called "PEF Gold").