24 July 2015

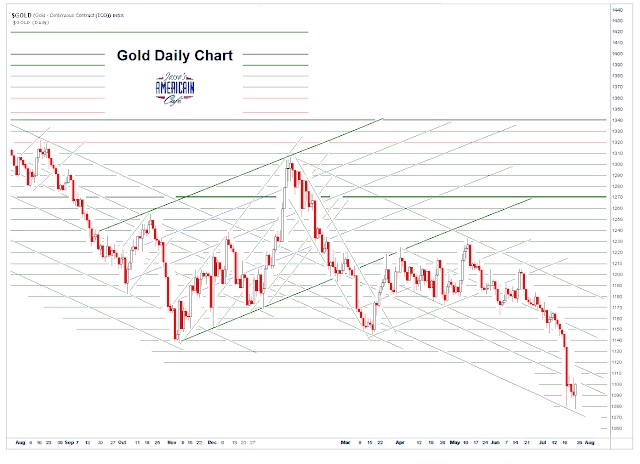

Gold Daily and Silver Weekly Charts - Rebound - Option Expiration Next Week

“In a room where

people unanimously maintain

a conspiracy of silence,

one word of truth

sounds like a pistol shot.”

Czesław Miłosz

Gold led a stiff rebound off support at 1180 today as it just was not going to go any lower, and the wiseguys grabbed some profits off the table.

This was a very obviously short term oversold condition.

Now we will see if gold and silver can put in a real bottom here, or something else.

Next Tuesday will be the August metals expiration at The Bucket Shop. August is also an active month for gold.

I have included the latest 'owners per ounce' charts from Nick Laird at sharelynx.com. They were able to knock down the open interest a bit, but could not produce more physical bullion for sale yet.

The Fed accidentally leaked its staff projections about rate hikes today. It looks like one for this year and four more next year for about 1.26%.

I hope they wait for The Recovery to get on their magic bus.

Have a pleasant weekend.

SP 500 and NDX Futures Daily Charts - Slippery Slope

Stock had their worst week of the year. I hope you were able to take something off the table.

New housing sales slumped badly according to this morning's economic data.

We are obviously in the rinse cycle now of the usual wash n' rinse mo-mo scam that substitutes for market price discovery these days.

Let's see if it keeps going or continues to stay well-behaving and responsive to the whims of the algos and insiders.

Have a pleasant weekend.

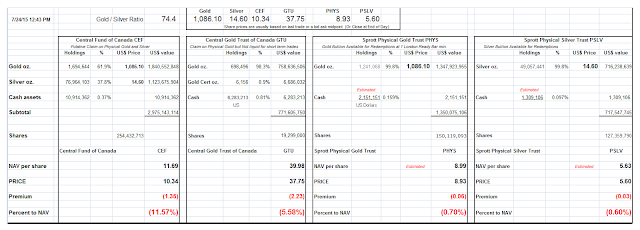

NAV Premiums of Certain Precious Metal Trusts and Funds

The discount on CEF is remarkable.

The gold to silver ratio is quite high.

Both metals are oversold.

If the precious metals rebound silver will have quite a bit of catching up to do, and will likely outperform to the upside as they have outperformed to the downside. Beta giveth, and beta taketh away.

Silver has done this over the last six months for example.

Category:

NAV of precious metal funds

Subscribe to:

Posts (Atom)