I am restraining an impulse to create some new intermediate long positions out of trading discipline. There has been no buy signal yet.

I also wish to see how we fare through the Non-Farm Payrolls Report on Friday.

This smackdown in the metals is starting to look very over-extended.

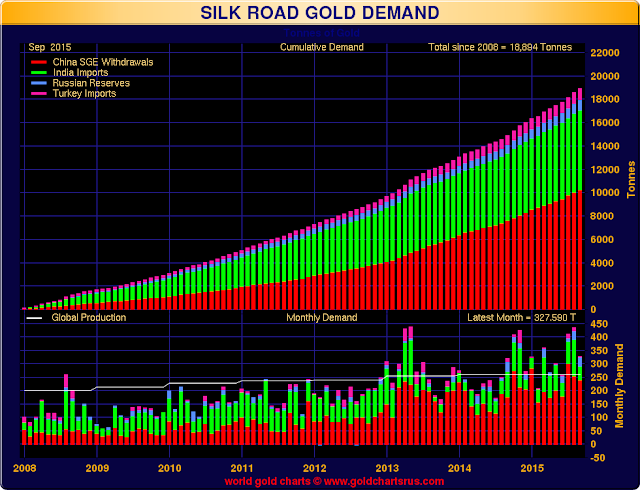

I don't like to traffic in 'feelings' and 'intuitions' but I must say this is starting to look like something important is developing within the long precious metals and monetary reserves macro trend that has been in place since at least 1999.

And, be still your beating hearts, Facebook will be reporting their numbers after the bell tomorrow.

A nation of virtual shopkeepers, con men, and consumers.

Have a pleasant evening.