"The perpetrators were scholars, doctors, nurses, justice officials, the police and the health and workers’ administration.

The victims were poor, desperate, rebellious or in need of help. They came from psychiatric clinics and childrens' hospitals, from old age homes and welfare institutions, from military hospitals and internment camps.

The number of victims is huge, the number of offenders who were sentenced, small."

Commemorative Tablet at Tiergartenstraße 4, Berlin

“Hate obscures all distinctions.”

C.S. Lewis

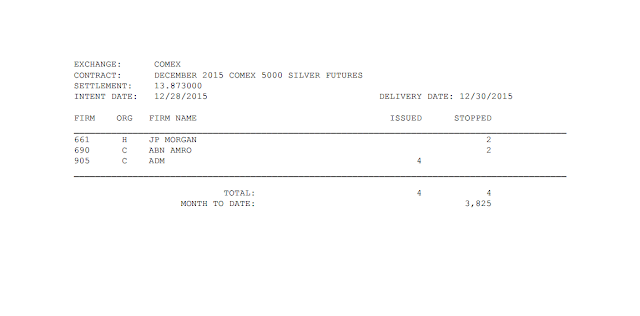

There were 241 gold contracts 'delivered' yesterday at the Comex.

And JPM took 240 of them for their 'house account.'

This has been the story this entire month for gold.

And this is in addition to deliveries themselves being at historic lows, and miniscule compared to what is happening in the physical markets, of which the Comex is certainly not.

But even the LBMA is rather short of available and unencumbered bullion for quick delivery. Or at least the research through public documents which some fellows have done seems to clearly show that.

Someone asked me today how the price can be so routinely held down, given the huge physical offtakes being reported.

The current price of gold in the Western markets is based on the trading of gold derivatives with little or no physical bullion changing hands, almost like a 'currency' and probably with currency crosses in mind, among other things.

The problem with this of course is that while the central banks do own printing presses, they do not own bullion creation machines. But the financial system can 'gin up 'synthetic gold' claims in abundance at least in the short term.

The failure of MF Global offered us a taste of this. All of the usual signs of trouble behind the curtains are present.

This divergence between the metal and its physical fundamental backing has been fomented by a few large multinational players, who are like serial felons in their rigging of many other global markets.

And of course this is enabled by the willing blindness of the regulators and involved parties to the growing risks of such an obvious scheme.

While there is little downside punishment and great financial reward the kinds of reforms that are necessary for the markets to be cleaned up and made productive again are not likely to happen.

And one fundamental part of this problem is that so many of those who have complaints about this lack of transparent honesty are narrowly focused on the priority of their own specific areas of interest.

Nowhere is this more apparent than in the 'identity politics' of the current US presidential contest, and the ability of the political stooges to turn one group on another. After all, it is easier to enable one's anger against the weak and often innocent victims, rather than the powerful oppressor.

Corruption is contagious. And its success can cause it to spread like a plague from one market to another, and one critical area and function of a cynically corrupt society to another as well.

I realize that this paints a rather dismal view of things going forward. I suspect we will see a number of cathartic events, at times approaching almost bestial cruelty and ignorance, before the American people are done with allowing the irresponsibles to steer them willingly along the edge of an abyss.

Oh I know Jesse, but really this seems unlikely.

Seriously? It is already happening. We are just gradually accepting the previously unacceptable, as a matter of course. Torture, murder, aggressive war, false flags, mass surveillance, selling drugs and weapons-- enabled by self-delusion and cynicism and apathy, and all quite necessary for us to create and protect and expand our 'living space.' Everywhere. From over 700 globally dispersed military bases.

Still, history shows that we and others have been here many times before. So the outcome is hardly certain. Except of course that it will inevitably end, and badly, unless we choose to change.

Have a pleasant evening.