"Love is patient, love is kind. It does not envy, it does not boast, it is not proud.

It does not dishonor others, it is not self-seeking, it is not easily angered, it keeps no record of wrongs. Love does not delight in evil but rejoices with the truth. It always protects, always trusts, always hopes, always perseveres."

Gold and silver were stronger than expected today as the US dollar was soaring on the shocker that the Bank of Japan is going negative on yen interest rates.

This set the markets back on their heels because just a week ago BoJ's Kuroda publicly dismissed the possibility.

This is a possible artifact of the currency war, in which certain countries will be seeking to devalue their currencies through various mechanisms in the hope of stimulating their economies, among other things.

On that announcement the US dollar index lit its afterburners and rallied harder. I am wondering if these currency interventions, because this is exactly what the BoJ has done, will do anything to roil the massive currency carry trades and derivatives associated with these.

BoJ purportedly acted to stimulate Banks to make loans, which is a bunch of hoo-haw. All the BoJ would require is for a few well placed people to pick up the phone and make some phone calls.

Gold is still outpacing silver, and this is due to the 'flight to safety' environment, even though we saw a sharp reversal in the Risk equilibrium in equities today that I suspect is more technical and short term.

I will probably have something more to say about January a littler later on.

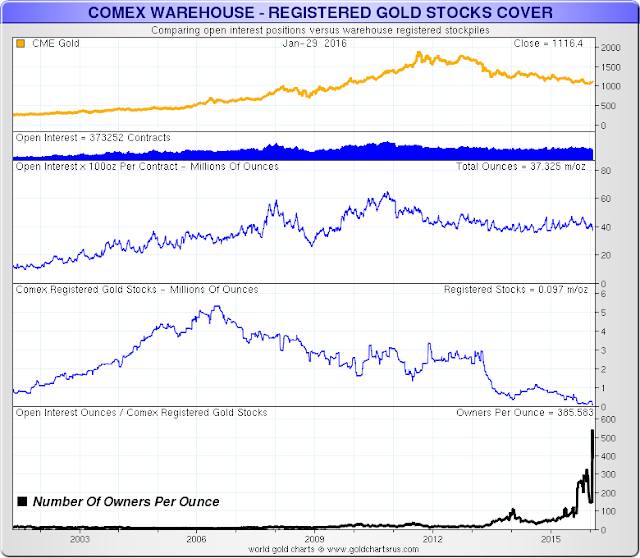

There was some actual movement in the Comex licensed gold warehouses, bring the monthly delivery total to a staggering 5,800 ounces. Wow.

Silver was most interesting with a 21.5% drop in registered bullion which is a big one day move. I commented on this earlier today

here. There are plenty of screaming headlines one can write about this in the search for clicks, but for now it is just an interesting fact with a significance that is not known, excepting that it is not 'business as usual.'

One theory I have heard is that the recent 'glitch' with the new London silver price fix that was so oddly far below the market spooked some holders of the metal into fears of having their registered bullion delivered out from under them 'on the cheap.'

There are also the usual rumours involving China which is said to be scooping up the remnants of gold and silver where they may. This I cannot address, but the notion that the 80 cents below prevailing market 'price fix' in London tightened up some strong hands makes some sense.

Let's continue to keep an eye on the chart formations and try to listen to the markets.

Have a pleasant weekend.