22 April 2016

Gold Daily and Silver Weekly Charts - Management of Perceptions

Gold took a $20 hit after the European close today, moving down from 1250 to 1230.

And the theme of the day seemed to be 'buy paper, don't worry' with the pushing of the SP 500 futures, even though techs kept threatening to roll over here on weak to bad earnings reports.

Silver managed to hang on to the $17 handle which was very good news. I am watching the NDX for stocks and silver for the precious metals to get a better idea of where these asset prices might be moving in the short term.

The charts are fairly obvious if you look at them. Nothing new has really developed. Silver seems to have activated its cup and handle with the breaking out above the rim, and so far so good there.

Mary moved her fingers and toes on her right side this morning, her fingers while we were there last night for the first time. It was the prettiest thing I have ever seen. Next week we have a minor surgery to provide a permanent drain for her cerebral fluid called a 'shunt' and then hopefully she will be released to an inpatient rehab facility.

Have a pleasant weekend.

SP 500 and NDX Futures Daily Charts - On the Edge

With the lack of fresh macroeconomic news today, it was the earnings that was driving equities, even though volumes remain somewhat low.

The tech sector in particular is not reporting the types of results that would reflect a growing economy. Instead the numbers show that the consumers are still struggling, both at home and abroad.

The financial sector heavy SP 500 seems to be hanging on a bit better, but the NDX with its tech weightings is starting to roll over. Indeed it was buying in the SP 500 futures that seemed to sustain the equities during the worst of today's declines, but again on low volumes.

There will be more earnings reports and macroeconomic news next week.

Volatility is rather low as measured by the VIX. But with these light volumes that could change in a Manhattan minute.

Have a pleasant weekend.

21 April 2016

The US Government Is Holding Counterparty Risk for Wall Street Derivatives (And So Are You)

"Gentlemen! I too have been a close observer of the doings of the Bank of the United States. I have had men watching you for a long time, and am convinced that you have used the funds of the bank to speculate in the breadstuffs of the country.

When you won, you divided the profits amongst you, and when you lost, you charged it to the bank. You tell me that if I take the deposits from the bank and annul its charter I shall ruin ten thousand families. That may be true, gentlemen, but that is your sin! Should I let you go on, you will ruin fifty thousand families, and that would be my sin!

You are a den of vipers and thieves. I have determined to rout you out, and by the Eternal, (bringing his fist down on the table) I will rout you out."

Andrew Jackson, in a meeting with the Bankers in Philadelphia, February 1834

Just as in the case of AIG, which was 'bailed out' at 100 cents on the dollar not to help them, but to provide a big cash infusion to places like Goldman Sachs, so Wall Street continues to socialize their reckless gambling with the help of their 'friends' in the government and the media.

U.S. Government Is Now a Major Counterparty to Wall Street Derivatives

By Pam Martens and Russ Martens: April 21, 2016

According to a study released by the Federal Reserve Bank of New York in March of last year, U.S. taxpayers have already injected $187.5 billion into Fannie Mae and Freddie Mac, two companies that prior to the 2008 financial crash traded on the New York Stock Exchange, had shareholders and their own Board of Directors while also receiving an implicit taxpayer guarantee on their debt. The U.S. government put the pair into conservatorship on September 6, 2008. The public has been led to believe that the $187.5 billion bailout of the pair was the full extent of the taxpayers’ tab. But in an astonishing acknowledgement on February 25 of this year, the Government Accountability Office, the nonpartisan investigative arm of Congress, issued an audit report of the U.S. government’s finances, revealing that the government’s “remaining contractual commitment to the GSEs, if needed, is $258.1 billion.”

This suggests that somehow, without the American public’s awareness, the U.S. government is on the hook to two failed companies for $445.6 billion dollars. And that may be just the tip of the iceberg of this story.

The official narrative around the bailout of Fannie and Freddie is that they were loaded up with toxic subprime debt piled high by the Wall Street banks that sold them dodgy mortgages. While that is factually true, the other potentially more important part of this story is the counterparty exposure the Wall Street banks had to Fannie and Freddie’s derivatives if the firms had been allowed to fail...

Read the entire story here.

Stock and Precious Metals Updates As Of 11 AM on Thursday - The Predators

"Over the last thirty years, the United States has been taken over by an amoral financial oligarchy, and the American dream of opportunity, education, and upward mobility is now largely confined to the top few percent of the population.

Federal policy is increasingly dictated by the wealthy, by the financial sector, and by powerful (though sometimes badly mismanaged) industries such as telecommunications, health care, automobiles, and energy. These policies are implemented and praised by these groups’ willing servants, namely the increasingly bought-and-paid-for leadership of America’s political parties, academia, and lobbying industry.

If allowed to continue, this process will turn the United States into a declining, unfair society with an impoverished, angry, uneducated population under the control of a small, ultrawealthy elite. Such a society would be not only immoral but also eventually unstable, dangerously ripe for religious and political extremism."

Charles Ferguson, Predator Nation, 2012

As you can see, gold was pushing much higher this morning, up to $1270, and silver to 17.60, and then they were slammed down rather hard by selling. Some will say that this was because the ECB had done nothing in their meeting today. Nothing that is, except to continue to provide unprecedented stimulus designed to prop up their financial sector while doing little for the broader public economy.

Financial assets in the US like stocks are being pushed steadily higher for some time now, I believe as either an instrument or an artifact of the bubble-nomics being promoted by the Federal Reserve and the Administration. One tries to provide some semblance of prosperity for the sake of perception management, while others cash in based on their information about what is happening.

Again, this is not capitalism, by any stretch of the imagination; it is mere plunder. And it will remain as such until it stops being highly profitable with little risk of serious punishment to the predator class and their enablers. And if you are expecting serious reform from the leading presidential candidates, then you may still be breathing the fumes from the pipe of 'hope and change.'

There will not be further updates today unless something extraordinary happens.

Mary continues on in intensive care. Thank you for your kind thoughts and prayers. One step at a time.

Category:

Dr. Evil

19 April 2016

Stock and Precious Metal Charts At the End of Day - Silver Cup and Handle

Stocks were mixed today on weaker than expected home sales and some poor reports from finance and the tech sector.

The US dollar turned lower, and gold and silver 'popped' in a two step rally. Gold stands a little over 1250 and silver is hanging on to the 17 handle.

Today is the NY primary for President.

The Bucket Shop was relatively quiet yesterday with a few gold deliveries, and a bit of a build in the deliverable gold in the warehouses over the past week, back up over 550,000 ounces.

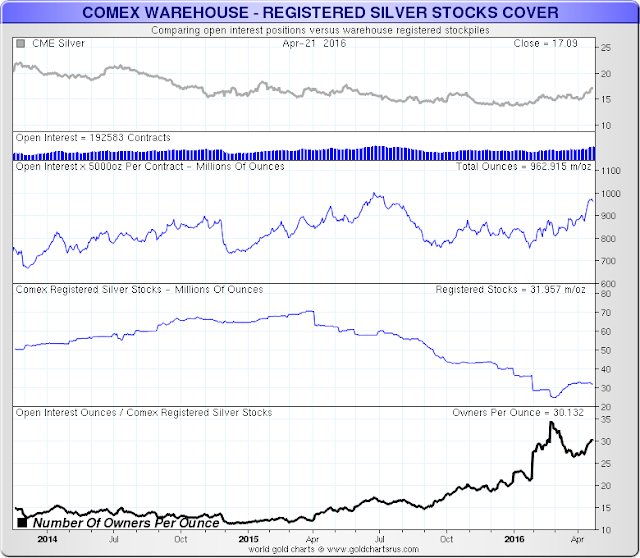

Silver is shining a bit, and on the weekly chart below has 'set' a cup and handle formation. Now it must hold these gains and move higher. If it can do this I would think silver will test that old support level around 19$ and try to fight its way back into the old trend channel.

In the chart on the right you can see the year to date performance of gold, silver, the SP 500 and NDX. Silver is the leading asset.

Have a pleasant evening.

Subscribe to:

Posts (Atom)