And here I thought that July would be a quiet month for gold here in NY.

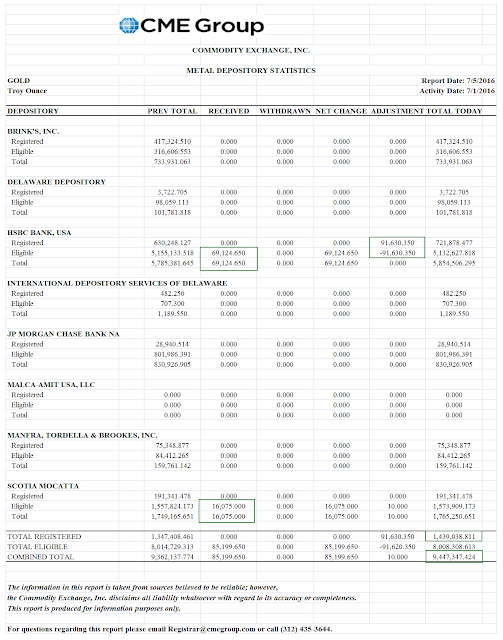

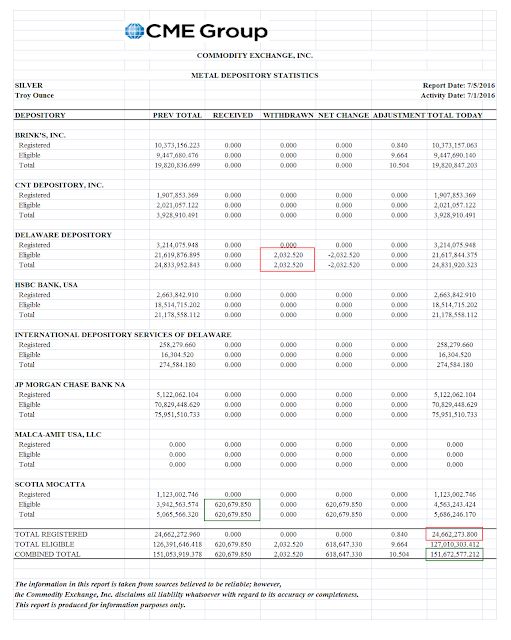

You can see from the delivery report below that the metal is moving, at least in the sense of changing hands in ownership, if not actually going anywhere in the physical sense. And that assumes it is physical in the first place, and not some hypothecated illusion.

Gold is breaking out. Silver gave us a thrill over the holiday weekend with a run to 21, but has since backed off, but held on to the 20 handle, by its fingernails.

The Non-Farm Payrolls for June will be out at the end of this week. Along with a few other economic goodies that could open the door to further shenanigans.

The British pound dropped to a 30 year low against the dollar at 1.30. Thoughts of a trip to London are crossing my mind on this, but air travel has become so tedious as compared to prior days that I hate to subject ourselves to it. And the queen, while doing well, is still a bit on the fragile side, and requires more rest than usual.

Gold needs to hold prior resistance. Let's see if it can do it. Silver needs to break out. And that looks promising.

Have a pleasant evening.