"Judge them by their works. What have they done for mankind beyond the spinning of airy fancies and the mistaking of their own shadows for gods?"

Jack London, The Iron Heel

Gold was pressed down to support at 1250 this morning.

This is a support level that goes back to the day before the Brexit announcement.

Gold and silver both bounced back a bit from the lows of the day. But the slamming of the metals has been particularly relentless ahead of this NFP.

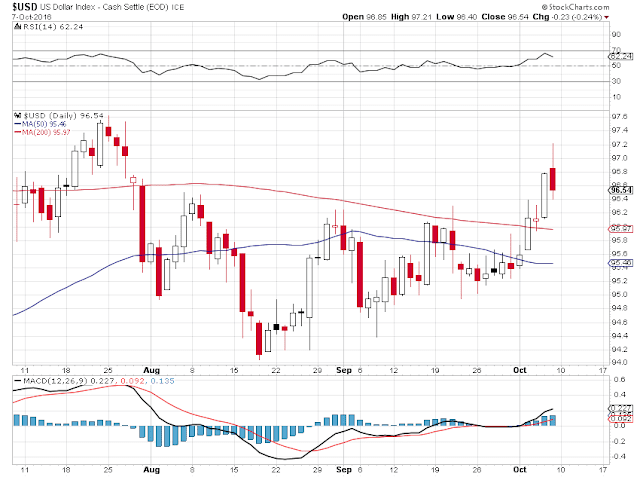

The dollar rallied strongly today on European weakness and the notion that the Fed will be increasing rates aggressively in response to a stronger economy.

You know what I think about this, and I still do. I think they will do a 'one and done' probably in December, and that there is no sustainable recovery except that which is created by smoke and mirrors.

There was intraday commentary from Thomas Frank about the Presidential election and the hypocrisy of our political class

here.

Jim Rickards is floating the theory that the Western banks are conspiring to drive down the price of gold to allow China to 'catch up' to their gold reserves levels before the big reveal of a new global currency regime and gold at much higher prices.

I would not give this a lot of credit, even though Jim is a very smart guy, unless he has insider knowledge that lends credibility to this. And if he does, he would be a fool to be openly selling the information.

So I will stick with the simpler theory that gold is under steady accumulation by a lot of strong hands, including the central banks as a group from around 2006, and that the available supply of unemcumbered gold is greatly strained by this buying.

The price ascent has been fought every step of the way by central bank leasing of gold reserves to bullion banks who use it to smack the price down for their own profits. Silver had been in a somewhat similar position except the central banks have no stores of it to lease.

And now we are nearing the

denouement.

Why would they do this? Because they know that fiat currencies are a confidence game, where the valuation must be sustained against abuses by force or fraud. And it should be fairly obvious that the Banks have been abusing the currency like a rented mule for their own benefits.

So let's see what happens tomorrow.

Have a pleasant evening.