“They were careless people, Tom and Daisy — they smashed up things and creatures and then retreated back into their money or their vast carelessness, or whatever it was that kept them together, and let other people clean up the mess they had made.”

F. Scott Fitzgerald, The Great Gatsby

"Come, you spirits

That tend on mortal thoughts, unsex me here,

And fill me from the crown to the toe top-full

Of direst cruelty!"

"Stars, hide your fires;

Let not light see my black and deep desires:

The eye wink at the hand; yet let that be,

Which the eye fears, when it is done, to see."

William Shakespeare, Macbeth

Stocks were led higher by expectations of higher oil prices based on some proposed price and production collusion between Russia and Saudi Arabia.

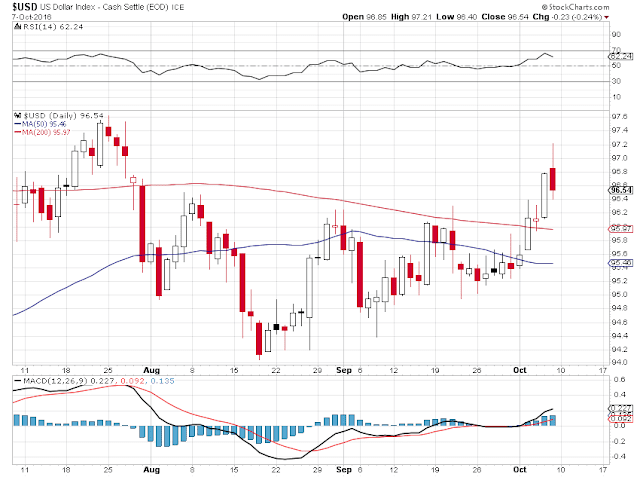

Gold and silver initially rallied, but were bucking a stronger dollar. The cross trades in FX can be quite strong at times. Totally divorced from the fundamentals with their eyes closely focused on their own very short term technicals, but that is how it goes.

I did not watch the debate between Lord and Lady Macbeth. I am so disappointed in all of this self-serving hypocrisy, crude wit, and sly prevarication that is all the fashion among our ruling elite.

Let's see if the precious metal chart formations can sort themselves out after the latest Non-Farm Payroll sequenced smackdown.

The delivery reports were thin to nil.

The warehouse reports were nothing of note, but I did include those for completeness and future reference.

Have a pleasant evening.