"But there is a sort of 'Ok guys, you're mad, but how are you going to stop me' mentality at the top."

Robert Johnson, Audacious Oligarchy

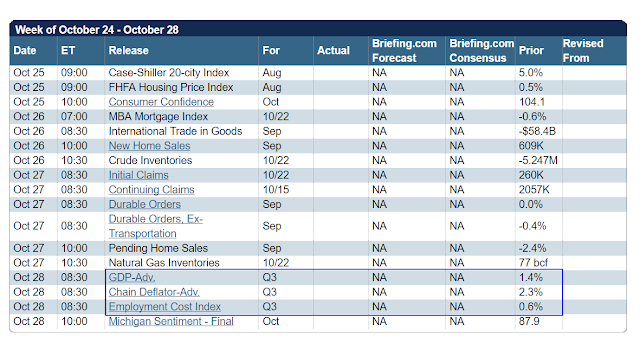

The US dollar continued powering higher today, which is not good at all for the real economy but certainly serves the global purposes of the financial class.

Gold and silver held their own against this, and a continuing decline in stock market volatility as measured by the VIX.

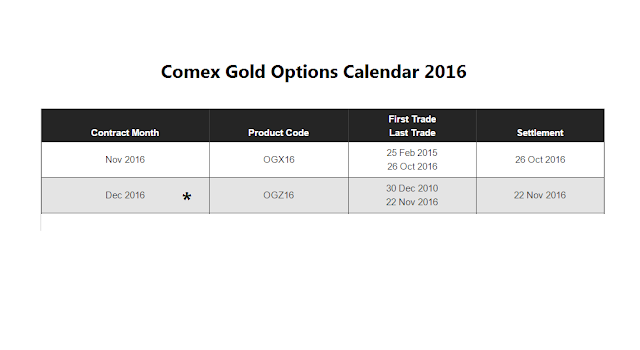

The deliveries were notable only for gold, as Macquarie continued to offer up their house account gold claim checks position, taken up largely by the bullion bank Nova Scotia and the 'mystery customer' at JPM.

Macquarie certainly painted a big target on their back with that position taken on the Comex. If I were of a mind to acquire gold I probably would not do it at that venue, even for a trading position. But that's just my opinion, and I could be wrong.

The last two days were taken up with my exploration of the mysterious ways of the US car makers. They are not quite at outrageous as the financial and health sectors, but they are working on it. It seems as though we are entering some phase of peak corporatism from the oligarchy grown increasingly audacious.

The punters are betting that Hillary will be the next President, and the media has certainly come to bury Trump. I am mulling over what that might mean for investment strategies. She certainly 'knows the ropes,' but the big issue is what are her priorities? Mussolini made the trains run on time, but he was truly a swine for all intents and purposes, more than most people realize.

I don't like to assume the worst, and like to give a new President at least a month or so to tip their hand with their appointments, especially in the economic and financial areas, but it seems that recently assuming the worst has not been that bad of a bet if you are not in the ruling elite.

Have a pleasant weekend.