"Peace I leave you, my peace I give to you; not as the world gives do I give it to you. So do not let your heart be troubled— do not let it be afraid."

John 14:27

"Let us feel what we really are— sinners attempting great things. Let us simply obey God's will, whatever may come. He can turn all things to our eternal good. Easter day is preceded by the forty days of Lent, to show us that they only who sow in tears shall reap in joy."

J. H. Newman

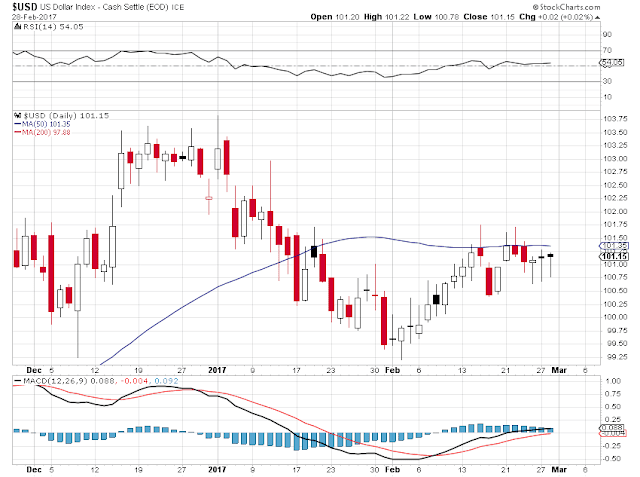

Another interesting day in The Recovery™ as the US Dollar remained steady at the close, gold was hit in a series of little cheap shots, stocks were weak, and the VIX rose once again.

The Donald speaks to the professional politocrats in Washington this evening.

Snapchat IPO should be getting its final pricing tomorrow, and be out trading on March 2. I hear the voice of a fat lady singing.

There was a serious problem with Amazon's cloud computing services today, that caused problems across a wide range of platforms on the East coast of the US. I had trouble getting my email from this site today for most of the afternoon.

Have a pleasant evening.