"...people believed that everything was going to be great always, always. There was a feeling of optimism in the air that you cannot even describe today."

"There was great hope. America came out of World War I with the economy intact. We were the only strong country in the world. The dollar was king. We had a very popular president in the middle of the decade, Calvin Coolidge, and an even more popular one elected in 1928, Herbert Hoover. So things looked pretty good."

"The economy was changing in this new America. It was the dawn of the consumer revolution. New inventions, mass marketing, factories turning out amazing products like radios, rayon, air conditioners, underarm deodorant...One of the most wondrous inventions of the age was consumer credit. Before 1920, the average worker couldn't borrow money. By 1929, "buy now, pay later" had become a way of life."

"Wall Street got the credit for this prosperity and Wall Street was dominated by just a small group of wealthy men. Rarely in the history of this nation had so much raw power been concentrated in the hands of a few businessmen..."

"One of the most common tactics was to manipulate the price of a particular stock, a stock like Radio Corporation of America...Wealthy investors would pool their money in a secret agreement to buy a stock, inflate its price and then sell it to an unsuspecting public. Most stocks in the 1920s were regularly manipulated by insiders "

"I would say that practically all the financial journals were on the take. This includes reporters for The Wall Street Journal, The New York Times, The Herald-Tribune, you name it. So if you were a pool operator, you'd call your friend at The Times and say, "Look, Charlie, there's an envelope waiting for you here and we think that perhaps you should write something nice about RCA." And Charlie would write something nice about RCA. A publicity man called A. Newton Plummer had canceled checks from practically every major journalist in New York City... Then, they would begin to -- what was called "painting the tape" and they would make the stock look exciting. They would trade among themselves and you'd see these big prints on RCA and people will say, "Oh, it looks as though that stock is being accumulated. Now, if they are behind it, you want to join them, so you go out and you buy stock also. Now, what's happening is the stock goes from 10 to 15 to 20 and now, it's at 20 and you start buying, other people start buying at 30, 40. The original group, the pool, they've stopped buying. They're selling you the stock. It's now 50 and they're out of it. And what happens, of course, is the stock collapses."

"The pools were a little like musical chairs. When the music stopped, somebody owned the stocks and those were the sufferers. If small investors suffered, they would soon be back for more. They knew the game was rigged, but maybe next time, they could beat the system. Wall Street had its critics, among them economist Roger Babson. He questioned the boom and was accused of lack of patriotism, of selling America short."

"Roger Babson warned of the speculation and said, "There's going to be a crash and the aftermath is going to be quite terrible." And people jumped on Babson from all around for saying such a thing, so that people who were cautious about their personal reputation, who did not want to call down on themselves a lot of calumny, kept quiet."

"Politicians came and went, but in the 20s, the businessman was king."

"With everyone trying to borrow money to cover the falling value of their stocks, there was a credit crunch. Interest rates soared. At 20 percent, few people could afford to borrow more money. The boom was about to collapse like a house of cards."

"...the National City Bank would provide $25 million of credit...immediately, the credit crisis was alleviated. In fact, within the next 24 hours, call money went from 20 percent to eight percent and that stopped the panic, then, in March [1929]"

"Everything was not fine that spring with the American economy. It was showing ominous signs of trouble. Steel production was declining. The construction industry was sluggish. Car sales dropped. Customers were getting harder to find. And because of easy credit, many people were deeply in debt. Large sections of the population were poor and getting poorer."

"Just as Wall Street had reflected a steady growth in the economy throughout most of the 20s, it would seem that now the market should reflect the economic slowdown. Instead, it soared to record heights. Stock prices no longer had anything to do with company profits, the economy or anything else. The speculative boom had acquired a momentum of its own."

"It was this nature of mass illusion. Prices were going up, people bought. That forced prices up further, that brought in more people. And eventually, the process becomes self-perpetuating. Every increase brings in more people convinced of their God-given right to get rich."

"The 20s was a decade of all sorts of fast money schemes. Three years earlier, everyone was buying Florida real estate. As prices of land skyrocketed, more people jumped in, hoping to make a killing. Then, overnight, the boom turned to bust and investors lost everything."

"On September 5th, economist Roger Babson gave a speech to a group of businessmen. 'Sooner or later, a crash is coming and it may be terrific.' He'd been saying the same thing for two years, but now, for some reason, investors were listening. The market took a severe dip. They called it the "Babson Break." The next day, prices stabilized, but several days later, they began to drift lower. Though investors had no way of knowing it, the collapse had already begun."

"...the market fluctuated wildly up and down. On September 12th, prices dropped ten percent. They dipped sharply again on the 20th. Stock markets around the world were falling, too. Then, on September 25th, the market suddenly rallied."

"Reuben L. Cain, Stock Salesman, 1929: I remember well that I thought, "Why is this doing this?" And then I thought, "Well, I'm new here and these people" -- like every day in the paper, Charlie Mitchell would have something to say, the J.P. Morgan people would have something to say about how good things were -- and I thought, "Well, they know a lot more about this market than I do. I'm fairly new here and I really can't see why it's going up." But then, when they say it can't go down or if it does go down today, it'll go back tomorrow, you think, "Well, they really are like God. They know it all and it must be the way it's going because they say so."

"As the market floundered, financial leaders were as optimistic as ever, more so. Just five days before the crash, Thomas Lamont, acting head of the highly conservative Morgan Bank, wrote a letter to President Hoover. "The future appears brilliant. Our securities are the most desirable in the world."

"Practically every business leader in American and banker, right around the time of 1929, was saying how wonderful things were and the economy had only one way to go and that was up."

"There came a Wednesday, October 23rd, when the market was a little shaky, weak. And whether this caused some spread of pessimism, one doesn't know. It certainly led a lot of people to think they should get out. And so, Thursday, October the 24th -- the first Black Thursday -- the market, beginning in the morning, took a terrific tumble. The market opened in an absolutely free fall and some people couldn't even get any bids for their shares and it was wild panic. And an ugly crowd gathered outside the stock exchange and it was described as making weird and threatening noises. It was, indeed, one of the worst days that had ever been seen down there."

"There was a glimmer of hope on Black Thursday...About 12:30, there was an announcement that this group of bankers would make available a very substantial sum to ease the credit stringency and support the market. And right after that, Dick Whitney made his famous walk across the floor of the New York Stock Exchange.... At 1:30 in the afternoon, at the height of the panic, he strolled across the floor and in a loud, clear voice, ordered 10,000 shares of U.S. Steel at a price considerably higher than the last bid. He then went from post to post, shouting buy orders for key stocks."

"And sure enough, this seemed to be evidence that the bankers had moved in to end the panic. And they did end it for that day. The market then stabilized and even went up."

"But Monday was not good. Apparently, people had thought about things over the weekend, over Sunday, and decided maybe they might be safer to get out. And then came the real crash, which was on Tuesday, when the market went down and down and down, without seeming limit...Morgan's bankers could no longer stem the tide. It was like trying to stop Niagara Falls. Everyone wanted to sell."

"In brokers' offices across the country, the small investors -- the tailors, the grocers, the secretaries -- stared at the moving ticker in numb silence. Hope of an easy retirement, the new home, their children's education, everything was gone."

"At the end of 1929, as they celebrated New Year's Eve, all that lay in the future. Nobody knew that the Great Depression was coming -- unemployment, bread lines, bank failures -- this was unimaginable. But the bubble had burst. Gone was that innocent optimism, the confidence, the illusion of wealth without work. One era had ended. They toasted the coming of the 30s, but somewhere, deep down, they knew the party was over."

29 June 2017

The Crash of 1929 - But somewhere, deep down, they knew the party was over.

28 June 2017

Stocks and Precious Metals Charts - Wild Swings Back and Forth In Equities

"For truth is precious and divine,

Too rich a pearl for carnal swine."

Samuel Butler

"Listen, and I will tell you a mystery."

1 Cor 15:51

During the Summer of 1929 the stock market was characterized by wild swings up and down that left market participants feeling almost dizzy and exhausted.

Now would be an excellent time to take inventory of your finances and provisions for the future, and perhaps to order yourself with regard to a more realistic stance towards mispriced risks.

Have a pleasant evening.

27 June 2017

Stocks and Precious Metals Charts - Quiet Metals Options Expiration on the Comex

"Will I say there will never, ever be another financial crisis? No, probably that would be going too far. But I do think we’re much safer and I hope that it will not be in our lifetimes and I don’t believe it will."

Janet Yellen

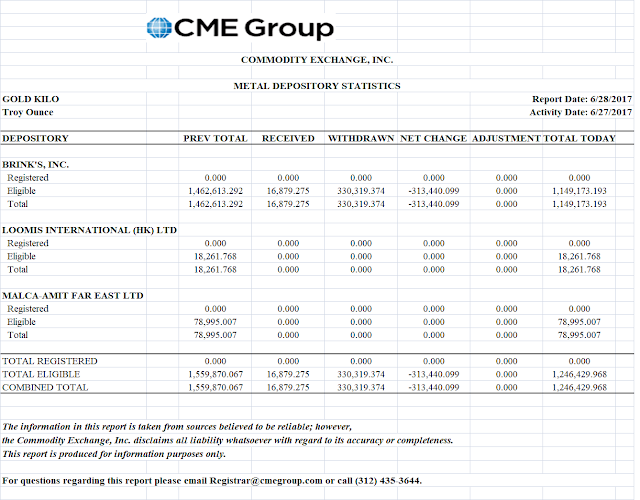

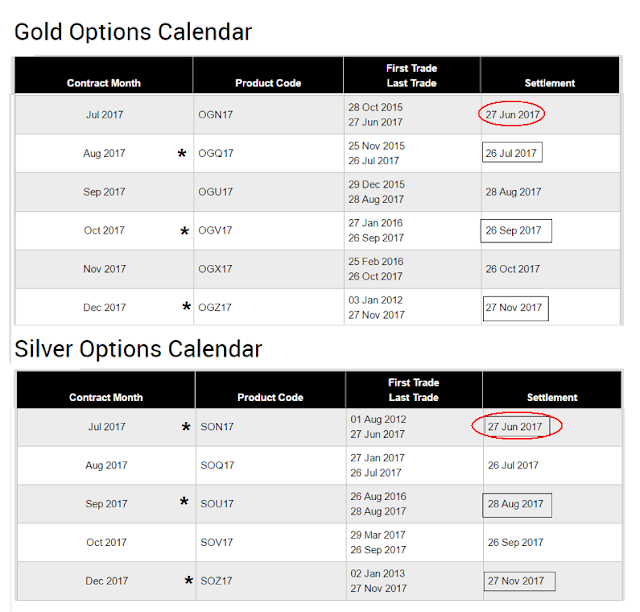

Today there was a quiet options expiration on the Comex for gold and silver.

The July contract is active for silver, but the gold action is already moved to August.

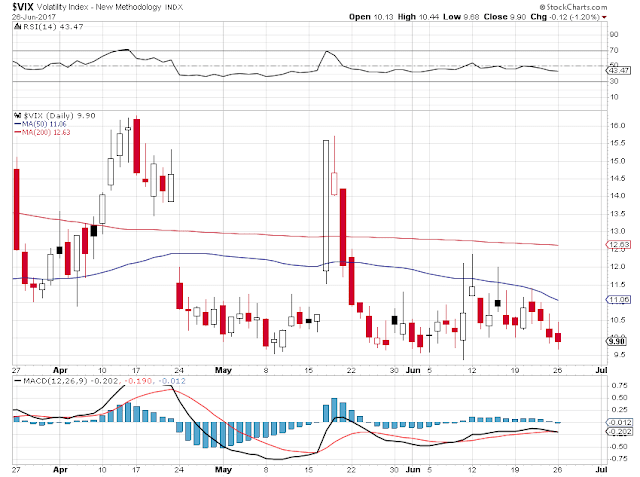

Stocks took a dive today and the VIX was up as you can see below.

The US Dollar took a real dive relatively speaking as well. I have not looked at the key cross currency results to see what drove it, but the reaction in the precious metals priced in dollars was relatively subdued.

I am not going to say what I expect the price of gold and silver to do for the rest of the year. But I do have a keen eye on the charts, and will let you know when the market tips its hand.

I came to the realization today that the US has largely given up its pretenses to a higher moral standing. 'Immoral' is the best way one could describe a healthcare reform bill that inflicts pain and suffering on the poor and vulnerable, almost gratuitously, in order to provide even more tax breaks for the wealthiest few who already have been taking the lion's share of growth in the national income.

Karma. Ain't it a bitch.

Have a pleasant evening.

26 June 2017

Stocks and Precious Metals Charts - Fat Fingers

"Bad men need nothing more to compass their ends, than that good men should look on and do nothing."

John Stuart Mill

The 'fat finger' of fairly raw and obvious market manipulation hit gold in the early hours.

No one dumps that many contracts against a much thinner bid side without intent. We have exposed that here many times before.

There are those who are greatly exercised by the consequences of a system gone corrupt when it affects them.

But they too often say nothing, or even nod pridefully according to some ideological formulation of their superiority, when that same corrupt system first preys on the weak and vulnerable.

Have a pleasant evening.

25 June 2017

Seymour Hersh: Trump's Red Line

The intelligence made clear that a Syrian Air Force SU-24 fighter bomber had used a conventional weapon to hit its target: There had been no chemical warhead. And yet it was impossible for the experts to persuade the president of this once he had made up his mind.

“The president saw the photographs of poisoned little girls and said it was an Assad atrocity,” the senior adviser said. “It’s typical of human nature. You jump to the conclusion you want. Intelligence analysts do not argue with a president. They’re not going to tell the president, ‘if you interpret the data this way, I quit.’”

The national security advisers understood their dilemma: Trump wanted to respond to the affront to humanity committed by Syria and he did not want to be dissuaded. They were dealing with a man they considered to be not unkind and not stupid, but his limitations when it came to national security decisions were severe.

"Everyone close to him knows his proclivity for acting precipitously when he does not know the facts," the adviser said. "He doesn’t read anything and has no real historical knowledge. He wants verbal briefings and photographs. He’s a risk-taker. He can accept the consequences of a bad decision in the business world; he will just lose money. But in our world, lives will be lost and there will be long-term damage to our national security if he guesses wrong. He was told we did not have evidence of Syrian involvement and yet Trump says: 'Do it.”’

Read the entire article by Seymour Hersh here.

24 June 2017

Love Is the Refuge of the Way

"Beware of false prophets, who come to you in sheep’s clothing, but inwardly are ravenous wolves. You will know them by their fruits. Grapes are not gathered from thorn bushes, nor figs from thistles."

Nor will love be seen coming from the hearts of those who are fallen into wickedness: they are the fruit of hate, deceit, greed, fear, pride, possession, and aggression. And they will not only forsake love by washing their hands of it, they will eventually come to condemn it, and persecute it— and thereby condemn themselves.

For the people of God love is the touchstone of faith, the way to know if what we believe is with Him, or from something else; if we are walking with Him, or with something else; if the one who speaks is speaking for Him, or for something else; if we are keeping Him in our hearts, or something else; if we love Him, or ourselves, or something else.

Love does not speak with hate or fear or derision, but with the fullness of existence which is joy and mercy.

Love is ridiculed and trampled upon by that which is in opposition to His creation.

When you are in doubt or confusion about what is true and what is false, look for the light of love. This is the hallmark of the spirit in the world.

And if it is not there, if an act is wrapped in the hardness of pride, disguised even as an elaborate ritual observance and Pharisaical pride, then you will know what it truly is. It is a sin against the spirit.

Love is not easy; it is not a natural state. It seems weak and foolish, and despicable to the fallen of this world and the next who by declaration of their hearts and minds non serviam, will not serve.

Love is an attitude of the mind and of the heart, a living for oneself in the other, an act of acceptance of grace, not by but through the will. Love is a shield against temptation. It is a predisposition, a habit of acting and looking at things in a certain way.

The disposition to love becomes easier and more comfortable as we carry that yoke, that restraint on our weaker nature and our harsher emotions. Over time the yoke that restrains our anger and pride becomes lighter, and a light to steady us in life's darker moments.

But it is rarely easy or natural, which makes it the stuff of the brave, of the spiritually and emotionally hardy, and especially of God's knights. The way of the world, of anger and oppression and power, is the easy path. But it is not the way of the truly human.

So we remember that we are sinners, but reaching out to the eternal, and thereby attempting great things— if but clumsily and with a number failings and denials like the apostle himself.

This is how the people of God may guide themselves and their own actions along the way. If there is no love evident in the words and the heart, then the words and the actions are not of God, but of something else.

Love is not what we do, but how we do what we do. Love is found in the most ordinary things, not in grand gestures and elaborate mannerisms. It resides in small daily acts of kindness and fellowship, done lovingly and with care, for His sake. It is how we carry our cross, not in front of a cheering crowd, but in the quiet moments, and the little things, while walking with Him.

The hardened heart judges others, while ignoring its own sins, thinking itself good. Love is mercy, as it shows us our commonality with our fellow humanity as a weak and sinful creature.

We do not need to hate and reject the world, and despise and subdue His creation. Creation is a gift from God, to which we bring our own good use and order in His name. And if we are wise, with our reverent humility and wonder.

We can work with His gifts lovingly, and not abuse them from an excess of greed. It is not the world itself that is a source of evil, but the willfulness of our hearts, hardened by pride.

Only love is creative and productive. Only love is accepting and uplifting, able to bring all things forward to His plan and make them new. Love consecrates, while sin desecrates and destroys in its lust for possession and the will to power.

Obviously this law of love is applicable to all people, but is of particular attention to those whose hearts have been already touched by God's mercy. It is the way to be abundant and merciful, in a time of spiritual wickedness, and dark powers in high places.

God is the essence of all existence, which is His love. The pity for those who would otherwise be faithful to the word, the spirit of the Logos, then, is not to love. Love endures all.

Because of the increase in wickedness, the love of many will grow cold. But those who stand firm to the end will be saved. And the gospel of the kingdom will be preached throughout the whole world, as a testimony to all nations. And then the end will come.

Subscribe to:

Posts (Atom)