Trump Chief Of Staff Priebus Is Out — In Biggest White House Staff Shake-Up Yet

July 28, 20175:01 PM ET

He rose from relative state-party obscurity and reached an unlikely pinnacle as the man responsible for the agenda of the president of the United States.

Now, Reince Priebus is out of that job as White House chief of staff in the most significant shakeup of the rocky Trump presidency.

Trump announced on Twitter that Homeland Security Secretary John Kelly has been named as Priebus' replacement.

28 July 2017

Night of the Little Knives - Reince Priebus Out, Former General John Kelly In

27 July 2017

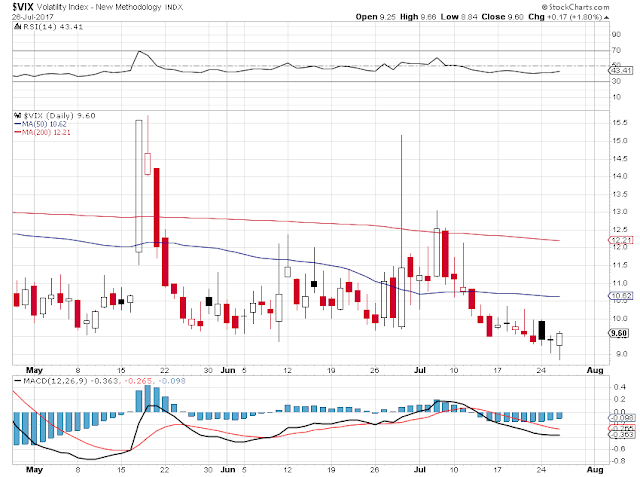

Stocks and Precious Metals Charts - Blue Skies

"Seek the Lord, all you humble of the land,

who have observed his law;

Seek justice, seek humility;

And perhaps you will be sheltered

on the day of the Lord’s justice.

This was the triumphal city, high and mighty,

Saying to herself, ‘I am the one, and none dare stand beside me.’

How desolate now has she become, a place fit only for wild beasts.

Those who pass by her scoff, and shake their heads at her ruin."

Zephaniah 2:3-15

“I'm not crazy about reality, but it's still the only place to get a decent meal.”

Groucho Marx

I have a feeling that we are going to be seeing some real fireworks in the precious metals before the end of the year.

But feelings really do not count in markets. But it is there, tempting my trading discipline. I know that you have never experienced that. lol.

Stocks bobbled a bit today. I also think we will be seeing a slide in stocks. But let's see how the earnings come out, and what the Fed does about their bloated balance sheet.

While I am not so sure yet about where gold and silver and stocks are going, here are three things that I am pretty sure about.

1. There is no sustainable recovery. Basic items like housing and healthcare are fast outstripping the growth in real wages. This is sustainable? There is, and for too long has been, a well-funded class war underway, and the middle class is losing.

2. Trump is a terrible president, and way over his head in the job. I do not refer so much to the social graces, of which he has none or at least sees no need to use them, but in terms of organizing and managing and leading a very large enterprise. From pitting underlings against each other to shooting from the hip and trying to get lucky he has some of the very management and strategy weaknesses that brought a certain German leader in the last century to his eventual downfall. Hopefully the span of his control over fanatical followers will not achieve the same critical mass.

3. The Democrats need to purge their ranks of the Clinton crowd who are hanging on to stubbornly to positions of power. It is just killing them, and failing to provide a fruitful and leverageable counterweight to the corporate Republicans who are pretty much beyond all hope. What the Democratic power brokers did to the Sanders grass roots movement and Occupy Wall Street is the real deplorable abuse of power and position that precludes any second or third chance for them. They are a disgraceful elite.

These three items will bear a heavy influence on what transpires between now and the midterm elections on a number of fronts and dimensions: social, economic, political.

Have a pleasant evening.

26 July 2017

Stocks and Precious Metals Charts - Nocturne

"A horse walks into a bar, the bartender says, 'Why the long face?'"

And so we had both an FOMC and a precious metals option expiration on the Comex today.

Let's see if we get any post-FOMC, post-expiration shenanigans for the rest of the week. Once gold breaks out it could be tough to stop, although I am not liking the small advances it has been making on such steady dollar weakness.

Stocks are continuing to edge higher, although with a big less verve than previously.

Pundits are now saying that a crash is probably at least two months away, so now is a good time to buy more stocks.

You cannot make this stuff up.

I think the theory is that when the Fed starts unwinding their balance sheet in September, that the air of liquidity, which is one of key components of these bubbles, is going to start coming out of the markets much faster than it went in.

And the result may be terrific— not with a bang, but a whimper.

"She walks in beauty, like the night

Of cloudless climes and starry skies;

And all that’s best of dark and bright

Meet in her aspect and her eyes;

Thus mellowed to that tender light

Which heaven to gaudy day denies."

George Gordon Lord Byron

Have a pleasant evening.

Thinking Like An Economist

Most economists have to significantly reduce the complexity and finer details of the economy through a set of reality crushing assumptions in order to make their models work coherently. See the artist's depiction of how an economist thinks below.

Then again, the really harmful economists are relatively unconstrained by reality in the first place, and can freely draw their conclusions and make policy recommendations basic on gnostic wisdom received from the ascended masters of malarkey.

This has given rise to a priori based models, spawned by well-funded think tanks and other hired servants of Big Money, about the way markets work. The economies they describe are evidenced only in an incorporeal universe of the economist's fevered imagination, and have been rarely seen in the real world.

Nevertheless, there are whole schools of thought that engage in herculean attempts to erect an homage to their particular madness out of well-tortured statistical bones. Some recent examples are the efficient markets hypothesis, free trade, supply side economics, and the infamous trillion dollar platinum coin that solves budget problems at a single 'clink.'

As a rule of thumb, the more arrogant certainty with which the economist states their revelations, and the more reliant they are on jargon and assumptions that suck the reality out of the room like intellectual black holes, the less space there is likely to be between their hat and their ass.

Housing Bubble 2.0: Making America More Unstable, Again

With low inflation and continuing stagnation in median wages another housing bubble is just what the doctor ordered as a cure for the last financial crisis, caused in part by the rampant financial fraud associated with Housing Bubble 1.0.

And it looks like we have yet another tech stock bubble well underway.

Meanwhile the public is distracted by the corporate media's endless coverage of clown car antics and foreign plots to pollute our precious bodily fluids.

Well done, elites, well done.

And no one could have seen it coming, again.

Category:

Housing Bubble,

Housing Crash

Subscribe to:

Posts (Atom)