Under the harvest moon,

When the soft silver

Drips shimmering

Over the garden nights,

Death, the gray mocker,

Comes and whispers to you

As a beautiful friend

Who remembers.

Under the summer roses

When the flagrant crimson

Lurks in the dusk

Of the wild red leaves,

Love, with little hands,

Comes and touches you

With a thousand memories,

And asks you

Beautiful, unanswerable questions.

Carl Sandburg

"If the two great semantic beacons of our time are the terms 'transition' and 'crisis,' then a third term is perhaps necessary to capture the special quality of this transition and this crisis. That term—the third semantic beacon—is 'alienation.' It expresses a unique facet of the crisis of our times: the widespread belief that there has been a revolutionary change in the psychological condition of man, reflected in the individual’s feeling of isolation, homelessness, insecurity, restlessness, anxiety."

Nathan Glazer, The Alienation of Modern Man, 1947

I'm posting a little early today because I have things to do outside.

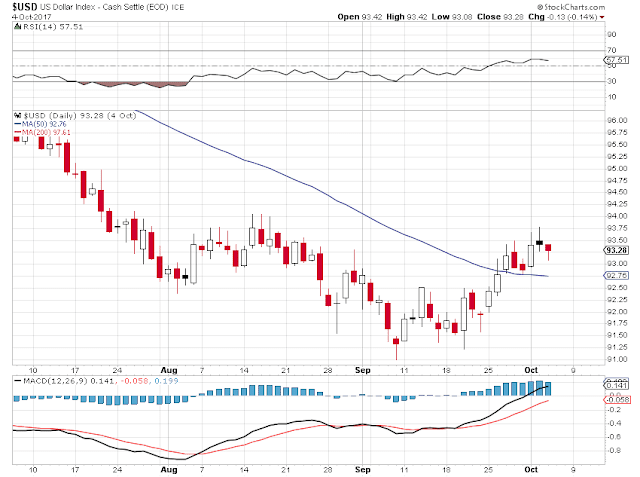

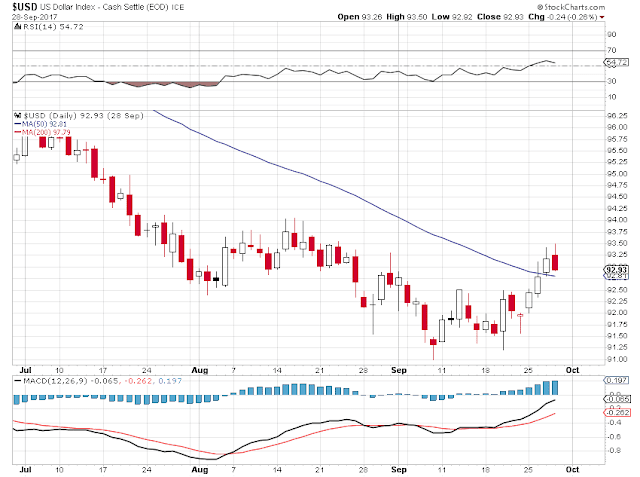

It was a 'risk on' day all the way, with the shorts being properly squeezed in stocks.

And with a risk on day, and ahead of non-farm payrolls, gold took a hit, while silver remained largely unchanged.

We will be enjoying a harvest moon tonight.

It is an uncommon gift, even in our modern alienation from nature. For we have for the most part lost our relationships with all that does not bend easily to our will, and provide an opportunity for a quick profit.

Perhaps alienation, a notion so last century as to seem almost quaint now, is not the right term to use for our elite and the post-modern world. We are not aware enough to feel alienated; we are insensate, and our existence is a series of meaningless, impersonal transactions, ruled by Mammon.

Or perhaps we can skip thinking and feeling anything, and sell each other 'moon glasses.'

Have a pleasant evening.