“For us to achieve 3 percent GDP growth over the next 10 years from tax reform, we have to have welfare reform. We need people who are mentally and physically able to work to get into the workforce. In my district, a lot of employers can’t find employees... Sometimes we need to force people to go to work.”It is a disgrace that the economy and markets are organized and regulated so badly that people have to suffer poverty and be sustained on welfare in the midst of general and unprecedented prosperity. Unlike these congressional fellows quoted above, however, who seem to believe that killing welfare programs is the solution, most human beings will tend to believe that the cure for this is in reform based on social and human values. That is, before they are subjected to a constant and heavy application of stereotypes and propaganda about what has caused our current record economic inequality, and those naturally inferior beings whose lot in life is to be poor and oppressed.

Rod Blum (R-Iowa)

“If we pass tax reform, we have to have welfare reform. When you have a vibrant economy, there’s no reason for Americans to suffer on welfare.”

Clay Higgins (R-La.)

"There is felt today very widely the inconsistency in this condition of political democracy and industrial absolutism. The people are beginning to doubt whether in the long run democracy and absolutism can coexist in the same community; beginning to doubt whether there is a justification for the great inequalities in the distribution of wealth, for the rapid creation of fortunes, more mysterious than the deeds of Aladdin’s lamp."

Louis D. Brandeis, The Opportunity in Law, Speech to Harvard Ethical Society, May 4, 1905

"Starting around 1980, American society began to undergo a series of deep shifts. Deregulation, weakened antitrust enforcement, and technological changes led to increasing concentration of industry and finance. Money began to play a larger and more corrupting role in politics. America fell behind other nations in education, in infrastructure, and in the performance of many of its major industries. Inequality increased.

As a result of these and other changes, America was turning into a rigged game— a society that denies opportunity to those who are not born into wealthy families, one that resembles a third-world dictatorship more than an advanced democracy."

Charles H. Ferguson, Predator Nation

“When the system is rigged, when ordinary citizens are powerless, and when whistle-blowers are pariahs at best, three things happen. First, the worst people rise to the top. They behave appallingly, and they wreak havoc. Second, people who could make productive contributions to society are incented to become destructive, because corruption is far more lucrative than honest work. And third, everyone else pays, both economically and emotionally; people become cynical, selfish, and fatalistic. Often they go along with the system, but they hate themselves for it. They play the game to survive and feed their families, but both they and society suffer.”

Charles H. Ferguson, Inside Job

We saw how the last Gilded Age ended. The gilding was covering a pervasive internal rot and creeping corruption, like a whited sepulcher. And it ended in violence and blood. And this time will be different.

Today was the Non-Farm Payrolls report, and to sum it up in a nutshell, there are plenty of part time and dead end jobs at non-living wages. And the cheerleaders of the status quo have declared the arrival of The Recovery™ , hallowed be its name.

I thought it was cute that the 228,000 jobs added this past month are a bit outweighed by almost the same number of new initial jobless claims each week.

The Labor Participation Rate continues to be rather tepid, if not dismal. Maybe we should force people to go to work, at whatever job and wage we choose, as the Congressman from Iowa has proposed.

Or perhaps we can build a society where those who choose to work can do so with dignity and a living wage. As Franklin Roosevelt noted in 1933,

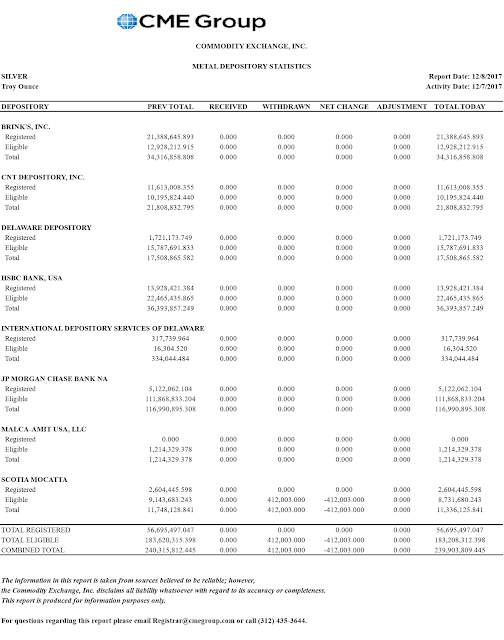

"In my Inaugural I laid down the simple proposition that nobody is going to starve in this country. It seems to me to be equally plain that no business which depends for existence on paying less than living wages to its workers has any right to continue in this country. By 'business I mean the whole of commerce as well as the whole of industry; by workers I mean all workers, the white collar class as well as the men in overalls; and by living wages I mean more than a bare subsistence level-— I mean the wages of decent living."It occurred to me today that this crypto-mania took off about the time that a small group of people identified a structural shortage in the available physical gold supply in London. Despite some stopgap loans and virtual bullion seizures, the shortage remains. Well, let's see how that works out for them.

A friend sent a photo of the snowfall in her yard just west of Atlanta this morning. We are expecting the same storm to roll up the coast through this evening, giving us our first snow of the season at about 3-5". Ho ho ho.

Have a pleasant weekend.