"And the beast was given a mouth for uttering haughty and blasphemous words, and it was allowed to exercise authority for forty-two months."

Rev 13:5

The attendees were describing the mood in Davos today as 'exuberant.'

Trump addressed the assorted billionaires movers and shakers, there this afternoon, asserting that 'the US is open for business.' He also took some time to take a shot at the press and 'fake news' in response to reports that he had tried to fire the special counsel Mueller last June, and was stopped by the White House counsel who threatened to resign. And he was loudly booed by the august gathering.

Trumpolini is now on his way back to Washington, and will be delivering his first State of the Union address to Congress next week. He needs to get busy on developing those infrastructure plans, or we might never be able to say that he made the trains run on time. The 'tax cut' is more likely to fuel speculation and monopolization than productive growth.

Speaking of the need for an infrastructure program, the second revision to the 4Q17 GDP number missed estimates, coming in at 2.6%, down from the initial 3.2%.

Perhaps more concerning in the numbers was the fact that at current consumption rates the US consumer is not saving, and continues to fall more underwater because of the stagnant wage situation.

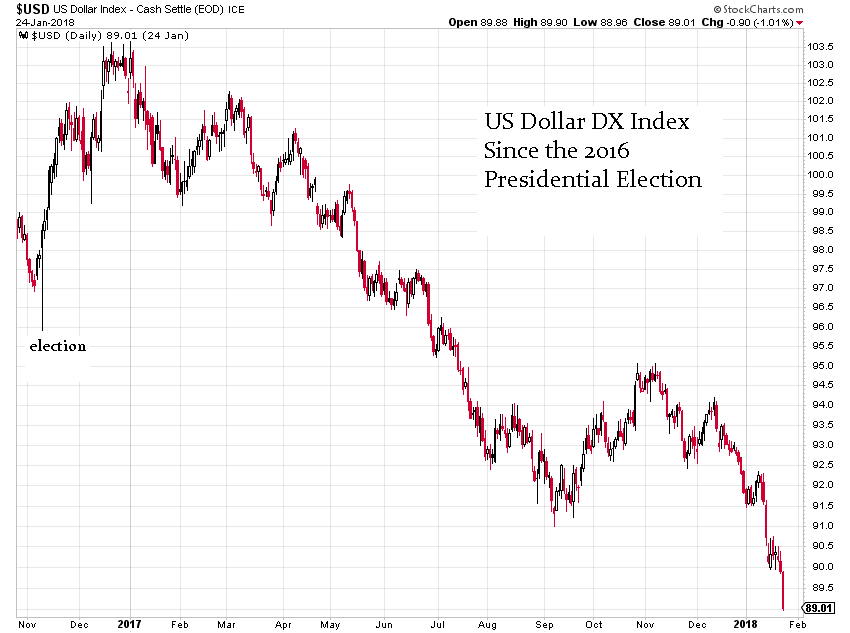

Gold and Silver managed to move a little higher, off renewed US dollar DX weakness, finishing up the day at 88.90. Monsieur Draghi has a problem on his hands. And with 18 European nations sporting 2 Year negative real yields, one might understand his frustration.

There will be a double hurdle for the metals next week, if recent history is any guide, with the FOMC rate decision on Wednesday 31 January, and the January Non-Farm Payrolls report on Friday 2 February.

The US is experiencing its worst outbreak of flu since 2009.

I still believe that the Banks are continuing to scrape the bottom of the physical barrel for gold, to meet the continuing offtake in Asia. Although they have been innovative and risk-taking in their leverage, it does make one wonder how suddenly this might end.

And some others and I have been discussing how quickly the US economy may jump the rails, and what effect this might have on the global economy and the political landscape.

If the economy does falter, one has to wonder if there is enough collective experience and wisdom and basic humanity in Washington to help avert a greater disaster. I would not like to use post-disaster Puerto Rico as an example of their competency and compassion.

Have a pleasant weekend.