"Narcissists gravitate towards professions where they can control people and elicit adulation. They are more likely to work in politics, finance or medicine than in shoemaking...They are aware of what they are doing to others - but they do not care.”

Sam Vaknin, Malignant Self Love

"Lack of accountability is a pet peeve for sure, and also a common problem with narcissists. Although there are many disturbing factors in the personality of a narcissist, this one is tough to deal with in any relationship. It’s hard to understand. What is so difficult about owning up to mistakes when we’re wrong?"

Karyl McBriade, Narcissists Are Not Accountable

"The narcissist looks down on everyone and exploits people all of his life. For many narcissists life is all about money and power. Getting more and giving less is his motto."

Linda Martinez-Lewi, Narcissist’s Outrageous Self Entitlement

The Non-Farm Payrolls report showed a moderate number of jobs added with a continuing weakness in wage growwth.

Stocks were hestitant at first, and then the traders saw that a rally into the weekend would be largely unopposed.

And so equities were able to finish the week largely unchanged.

Near the end of the day one of Obama's trade secretaries was talking on Bloomberg about trade deals like the TPP, and their inevitability and goodness.

And I watched a new performance by Hillary in which she explains why her staunch commitment to capitalism cost her the election, and how she was failed by the voters.

This helped me to remember why, despite what a terrible President that Trumpolini may be, and he is, that I am still glad that Hillary and her Merry Corporate Pranksters are not in office.

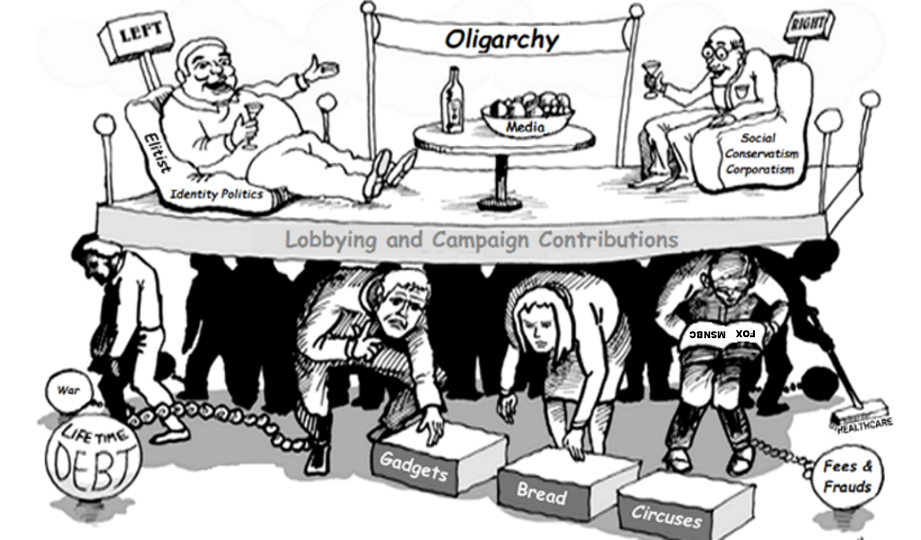

It is not much of an election when your 'choice' is between two different flavors of narcissist from competing crime families. Especially when both are seeking to sustain a self-destructive, kleptocratic system while doing whatever is required to circumvent and distract from meaningful reform.

The choice for a lesser of two evils is still evil. And how much less one is than another is too often just a matter of perspective.

Remember to care for His simplest creatures, and those who are most in need of His mercy.

Have a pleasant weekend.