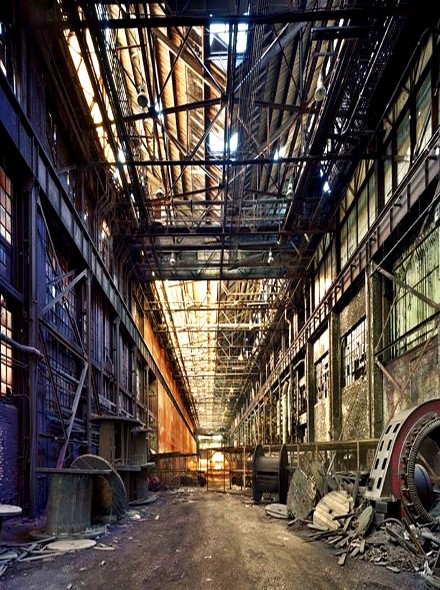

'Bare Ruined Choirs' - Detroit, Michigan "By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some.

The sight of this arbitrary rearrangement of riches strikes not only at security but at confidence in the equity of the existing distribution of wealth."

John Maynard Keynes

"In reality high profits tend much more to raise the price of work than high wages."

Adam Smith

"That time of year thou mayst in me behold

When yellow leaves, or none, or few, do hang

Upon those boughs which shake against the cold,

Bare ruined choirs, where late the sweet birds sang."

William Shakespeare, Sonnet LXXIII

The FOMC increased the target range for its benchmark interest rate by 0.25% to a range of 1.75%-2%. There was no dissent among the eight voting members.

In its statement the Fed said the economy is growing at a 'solid rate,' a change from its May statement that the economy was growing at a 'moderate rate.' They eliminated their language about policy being 'accomodative' for some time, and said that 'recent data suggest that growth of household spending has picked up, while business fixed investment has continued to grow strongly.'

Fed officials thank that monetary policy is near the interest rate at which the economy would experience full employment and price stability, which the Fed has defines as 2% inflation.

The Fed’s statement also includes a summary of economic projections, which are economic, labor market, and interest rate forecasts from Fed officials.

The Fed raised its outlook for growth and inflation this year, while lowering its expectations for the unemployment rate.

The dot plot now shows most Fed officials believe that two additional rate hikes are coming in 2018, bringing the year’s total up from three to four.

In other words, The Recovery™ is alive and well.

In the press briefing, Chair Powell said that the Fed is keeping an eye on non-financial corporations and households, and see no real problems with either with regard to debt and leverage there.

Are you kidding me? The average American working household is living paycheck to paycheck, with almost no cushion to cover a myriad of common incidents that occur in life that can quickly become personal tragedies.

I see no reason yet to change my longer term forecast of economic stagflation to be resolved through exogenously motivated systemic changes, prompted perhaps by broad rejection of the status quo and expressions of civil dissatisfaction reminiscent of the late 1960s.

Stagflation is such an unnatural economic outcome that it takes a remarkable dedication to policy errors and self-deception to achieve it. And as surprising and utterly improbable an outcome it seemed back in 2005, it sure seems more likely now given what the Fed and fiscal authorities have done.

And it is still improbable. But if stagflation does come, I am fairly confident that the establishment and their technocrats will blame it on Trump and his trade policies. That I think is almost a sure thing. The credibility trap would demand it.

Keep an eye on the yield curve.

Based on this more hawkish perspective gold and silver slid and then recovered and finished marginally higher. Silver took the 17 handle and gold at 1300. The dollar drifted a little lower.

Stocks gave up much of their early gains of the day to finish lower.

Need little, want less, love more. For those that abide in love abide in God, and God in them.

Have a pleasant evening.