"Most men of business think 'Anyhow this system will probably last my time. It has gone on a long time, and is likely to go on still.'"

Walter Bagehot, Lombard Street

"Greed is a bottomless pit which exhausts the person in an endless effort to satisfy the need without ever reaching satisfaction."

Erich Fromm

Gold and silver were off a bit today, along with the US dollar, and crude oil.

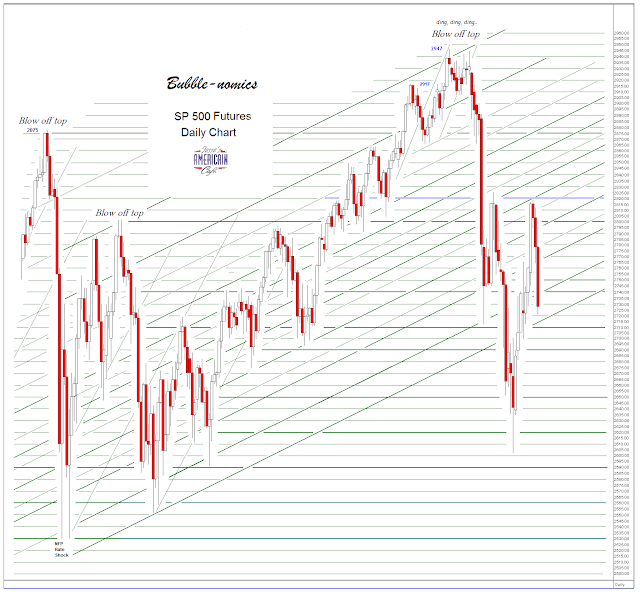

Stocks had another volatile, wide-ranging day that managed to finish closer to unchanged than not.

Nice rescue guys.

As a reminder there will be a stock option expiration on Friday.

I don't sense a lot of fear in this market, or high conviction buying either. Maybe that will change, but the trading feels 'synthetic.'

It's generally just a game in the daily trade, but now thanks to the Fed and the regulators and the toads in the government it's all fun and games most of the time now.

We may be getting to the point when the games lose their energy, and the apogee of control fraud to the upside has been reached. And the wiseguys will be eyeing each other thinking 'what next?'

Even things that seem to be so substantial as to be irreplaceable have their day, and then are no more.

Like the systems programmer said, 'CICS keep getting harder to find.'

Have a pleasant evening.