“Not everyone who says to me, ‘Lord, Lord,’ will enter the kingdom of heaven, but the one who does the will of my Father who is in heaven."

Matthew 7:21

Stocks were attempting to rally again today, led by the SP500 futures, but gave up much of their gains into the close.

Gold and silver were up a bit, but still remain within a short term trading range, caught below overhead resistance and underlying support.

Individual company earnings reports are driving much of the stock action now.

The marcoeconomic results are still rather lackluster despite the 'enthusiasm' of Wall Street when it is convenient for their ends.

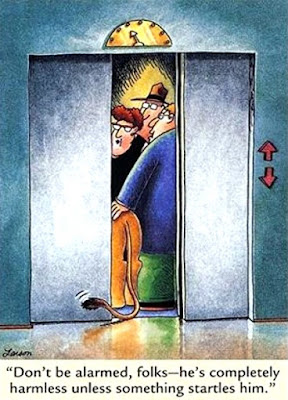

It is noticeable how often some sites seek to stir up outrage and indignation, making big things out of little ones, distorting and amplifying issues and events to keep people from thinking clearly and rationally, filled with hate and fear and contempt for each other.

Lies roll all too easily off the lips of this self-loving, hard-hearted generation.

Be as careful what you may put into your minds, as you would the quality of food and water in your mouths.

Have a pleasant evening.