“But you can't make people listen. They have to come round in their own time, wondering what happened and why the world blew up around them.”

Ray Bradbury, Fahrenheit 451

“The masses had reached the point where they would, at the same time, believe everything and nothing, think that everything was possible and that nothing was true. Mass propaganda discovered that its audience was ready at all times to believe the worst, no matter how absurd, and did not particularly object to being deceived because it held every statement to be a lie anyhow.”

Hannah Arendt, The Origins of Totalitarianism

Totalitarian regimes energize their base and forge national unity by emphasizing an us vs. them mentality— If only there weren't [Jews, immigrants, Muslims, blacks, homosexuals] our country would achieve its intended prosperity."

Christopher Lebron, What Totalitarianism Looks Like

After the bell Uber put forward a massive loss, as was expected. But they also missed on the topline revenues which was far less excusable.

Uber missed. How poetic is that?

Stocks were in massive rally mode, as the recent realizations of mispriced risks were dismissed.

Fear was cast aside by greed. Wash and rinse.

The volatility surprises some.

How else could it be, when all standards and measurements of objectivity have been cast aside in an overwhelming tide of willfulness?

Whatever we say, goes.

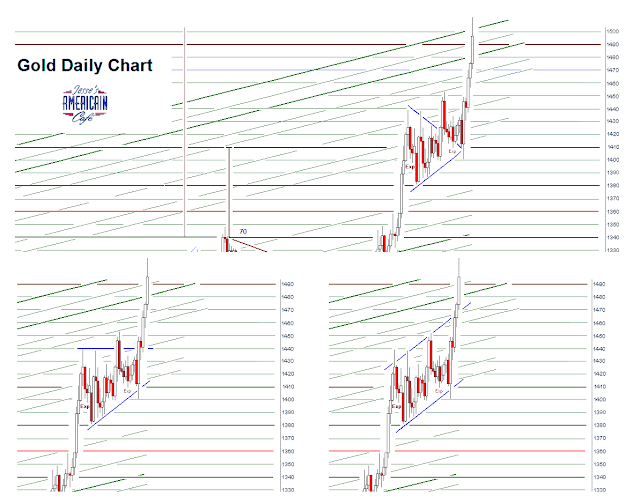

Gold snapped back in the late afternoon, and retook the 1500 handle.

Silver held on to the 17 handle.

Mortgage refi activity is skyrocketing thanks to the recent plunge in interest rates.

This appears like a setup for a major, bone shattering correction.

History would suggest the early fall, but last year it came in December.

Timing this sort of break in overconfidence and reckless disregard for risk is notoriously difficult, even in ordinary circumstances.

Nothing is certain in the time of madness and the raw love of power unleashed.

Trump himself says he is one thing, and then another, at complete opposites to each other. Without even the blink of an eye or the slightest hint of a blush.

It is a behaviour that is being widely imitated. It is a sign of the times.

There is little accountability, the slightest of consequence if any, and certainly no shame.

It is not only profitable, it has become highly fashionable. A mark of talent, a class distinction.

For they would be as gods, beyond good and evil.

Have a pleasant evening.