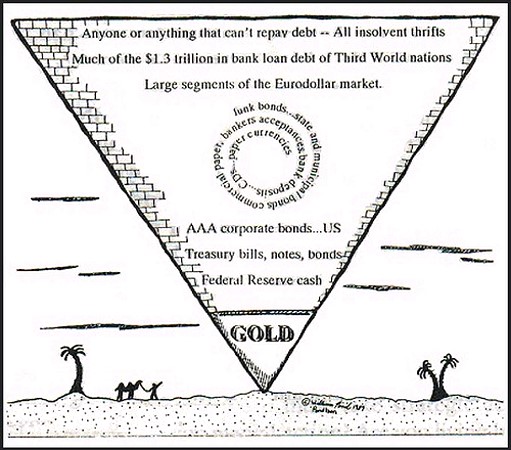

"I thought of this upside down debt pyramid when I was at Citibank in the early ‘60s. I first gave talks on it inside the bank, trying to influence the bank because I saw too much borrowing short term and lending long term. It was just awful! I kept on warning the bank, but was just brushed aside.

When Nixon closed the gold window I said, 'This is my chance to get out,' so I took it. [laughing] It was a great move on my part because I could buy gold and gold mining shares when gold was F$50 an ounce or less. Now Citibank is on the problem list because it has so many bad assets."

John Exter, 1991, Simplex Munditis

The evolution of Exter's Pyramid over time.

The first image is purported to be the original which he used in the 1960's. On an overhead projector perhaps, remember those?

It seems to have obtained circulation in newsletter writers, investment types, especially those with an interest in gold.

It became much more widely circulated after Nixon closed the gold window on August 15, 1971.

It gained some controversy in the debate between inflation and deflation. The pundits thought it sound in describing an inflationary scenario.

But they balked at Exter's notion that during a deflation that the economy would work its way back down the pyramid as well. They thought that this would require a return to barter and a systemic collapse.

I think it is moot because of the improbability of a deflationary collapse as compared to an inflationary one while a system is coherent, especially in a system of fiat money.

Granted if we are in a post apocalyptic world, then all bets are off. In which case I would like to have lead, in the form of bullets, and medical supplies and water filters as much as gold. I don't plan on it as a primary outcome though. lol