"The one who does most to avoid suffering is, in the end, the one who suffers the most: and his suffering comes to him from things so little and so trivial that one can say that it is no longer objective at all. It is his own existence, his own being, that is at once the subject and the source of his pain, and his very existence and consciousness is his greatest torture."

Thomas Merton

“One reason we rush so quickly to the vulgar satisfactions of judgement, and love to revel in our righteous outrage, is that it spares us from the impotent pain of empathy, and the harder, messier work of understanding.

Let me propose that if your beliefs or convictions matter more to you than people—if they require you to act as though you were a worse person than you are—you may have lost perspective.”

Tim Kreider

"The Pharisee took up his position and spoke this prayer to himself: ‘O God, I thank you that I am not like the rest of humanity—greedy, dishonest, adulterous—or even like this tax collector over there."

Luke 18:11

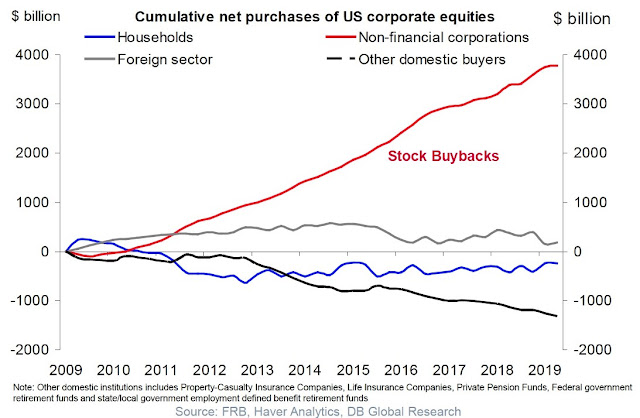

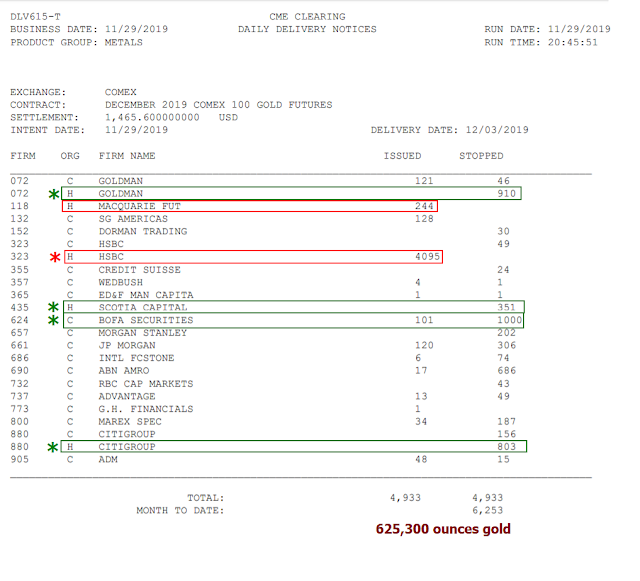

Stocks rebounded today on a resurgence of risk-seeking.

The Dollar and the precious metals, along with the VIX, were lower.

The poor economic data from this morning was set aside with fresh rumours, for the hundredth time, of striking progress in the US-China trade talks.

As a reminder there will be the Non-Farm Payrolls report on Friday.

Outrage over the petty and careless and foolish things that other people do can be like a narcotic. It can become a preoccupation with the imperfections of others, so that we can look down on them, and thereby feel so much better about ourselves. Thank God that we are better, the most worthy, and not like them. We are special— exceptionally gifted, and especially deserving of favor.

This narcotic selfishness and delusional pride blinds us to who we are, and what we are becoming. Truly, why do we look so hard at the speck in our brother's eye? It is so that we can ignore the festering sore in our own that distorts our true sense of things even more.

It can become addictive, an unfortunate habit, and eventually a way of life. There are places in the media and on the Internet, politicians and pundits, that pander to this looking down upon other people, and of groups of people. They search far and wide, and expose the imperfections and faults of others, putting them into the most unattractive and unforgiving perspective. And thereby they shape and feed an exasperation with a caricature of 'the other.'

It is ironic. If you read the comments section on such sites, those places that pander to this sort of thing, you will find the least attractive and ignorantly distorted things being said, but with an intense sort of pride.

It can be very discouraging to see. But it is addictive to some, and pandering to it pays. And so it tends to flourish here and there.

What is the solution to this sort of trap? Don't do it. Do not read it. Do not fall into the sin of thinking that only you and a few people like you are worthy of creation. And if you are feeling truly brave, pray to God fervently to show your sins to you now rather than later. You may be surprised.

You are human, and full of faults. And so you are most surely not most worthy. And fooling yourself into thinking that you are better betrays you into the snare of lawlessness, of treating your brothers and sisters as less worthy and deserving of mercy than you. And so you become less than human, while making yourself feel better, and puffed up with pride.

“A proud man is always looking down on things and people; and, of course, as long as you are looking down, you cannot see something that is above you.”You cannot justify or forgive yourself. And deceiving yourself about who you are does not last. You are not damaged goods or unworthy in the eyes of your heavenly Father. But you are not super human or exceptional either. This sick pride is a defense mechanism that prevents you seeing things as they are, and from giving yourself over to what you need to live a fully human and happy life: repentance, forgiveness, and thankfulness.

C. S. Lewis

Have a pleasant evening.