|

| The Bankers Save the Market - October 24, 1929 |

"On October 24, Black Thursday, the market lost 11 percent of its value at the opening bell on very heavy trading. Several leading Wall Street bankers met to find a solution to the panic and chaos on the trading floor. They chose Richard Whitney, vice president of the Exchange, to act on their behalf.

With the bankers' financial resources behind him, Whitney placed a bid to purchase a large block of shares in U.S. Steel at a price well above the current market. As traders watched, Whitney then placed similar bids on other 'blue chip' stocks. The tactic was similar to one that had ended the Panic of 1907, and succeeded in halting the slide. The Dow Jones Industrial Average recovered, closing with it down only 6.38 points for the day."

Wikipedia, Wall Street Crash of 1929

"A common feature of all these earlier troubles [panics such as 1907 and 1921] was that having happened they were over. The worst was reasonably recognizable as such.

The singular feature of the great crash of 1929 was that the worst continued to worsen. What looked one day like the end proved on the next day to have been only the beginning.

Nothing could have been more ingeniously designed to maximize the suffering, and also to insure that as few as possible escaped the common misfortune. The fortunate speculator who had funds to answer the first margin call presently got another and equally urgent one, and if he met that there would still be another. In the end all the money he had was extracted from him and lost.

The man with the smart money, who was safely out of the market when the first crash came, naturally went back in to pick up bargains. (Not only were a recorded 12,894,650 shares sold on 24 October; precisely the same number were bought.) The bargains then suffered a ruinous fall.

Even the man who waited out all of October and all of November, who saw the volume of trading return to normal and saw Wall Street become as placid as a produce market, and who then bought common stocks would see their value drop to a third or a fourth of the purchase price in the next twenty-four months.

The Coolidge bull market was a remarkable phenomenon. The ruthlessness of its liquidation was, in its own way, equally remarkable."

John Kenneth Galbraith, The Great Crash of 1929

For those of you who are not fans of financial history, the market later crashed badly on October 29.

A few years later saw the bankers' hero Dick Whitney in prison, after it was discovered that he had been stealing from the NYSE Widows and Orphans Fund.

The story today was bailouts for corporate America. Zimbabwe Ben went all in on 'cash for trash.'

Companies that blew

billions on stock buybacks and bonuses are now lining up saying that they need cash to keep on going.

And it looks like they are going to get it, and then some.

I hope we put a few strings on those bailouts, like warrants and restrictions on their spending priorities, which generally have been putting more money into the wealthiest pockets, and the least into product value and workers' wages.

Despite the determined opposition by some GOP Congressmen, who are afraid that paid sick leave will make workers 'lazy', there might actually be something coming for the working public.

Giving money to badly managed and essentially corrupt companies without reforms, and fairly stiff conditions, this will do little for us in the long run. But it does let some zombie companies keep shambling along unchanged.

This is a

demand shock. Meaning the solutions would well be centered on the consumer.

A recovery may be found from the bottom up. But alas, that is not where the power and money reside these days, in this rotten system.

But why keep saying the same old things to the corrupt and willfully blind, when they have placed themselves beyond reason, and redemption. And I'll leave it at that.

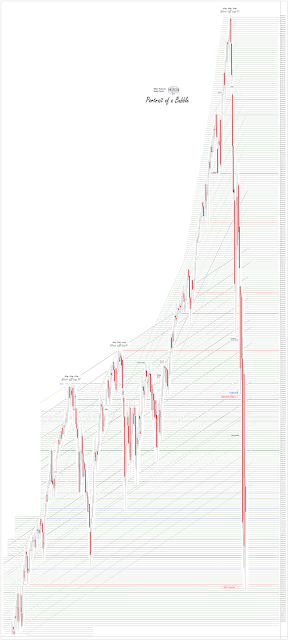

Stocks cracked down to new lows today.

The Nasdaq 100 finally broke the 30% decline level, and the SP 500 was there and then some.

This is no bear market. This is a

crash. The bear market may come later on.

I would not be too quick to buy into this, to buy the bounces. We should see at least one multi day bounce that sucks a lot of eager dip buyers back in.

And then

bang, it will be down into the abyss, bounce a few more times, and then down to the floor of hell.

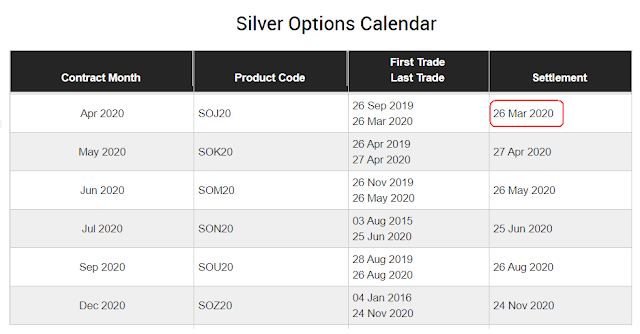

Silver was beat senseless today. I would let that one go for a little while since it is a weaker safe haven play, and a certain Bank who will not be named is just having its way with it.

Gold took some shots as well, in part because of an amazing Dollar rally, almost to the 101 level.

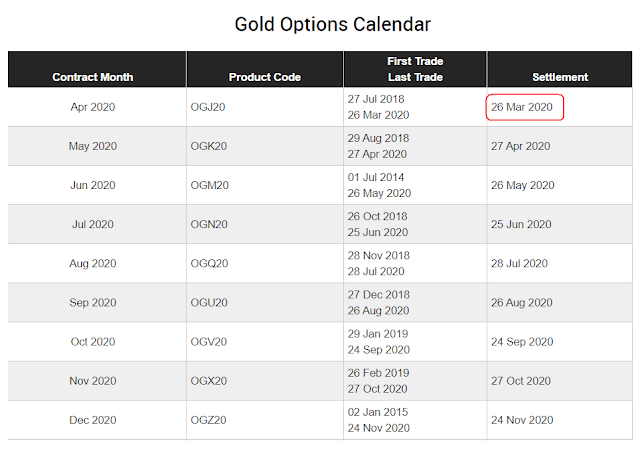

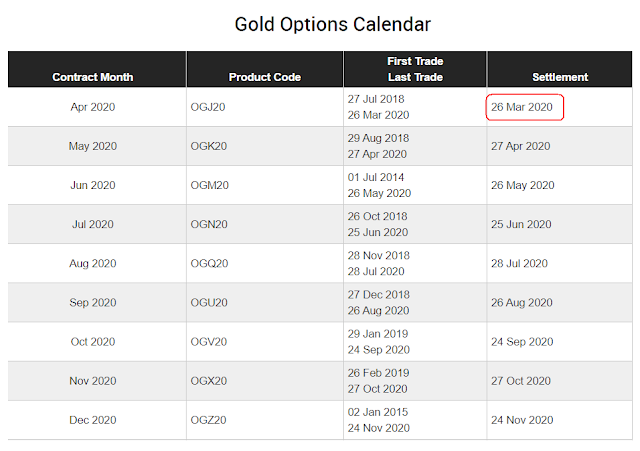

But this is also the lead up to the quad stock witch, and the Banks are keen to maximize their short position returns on the miners.

And certain financial bigwigs and their compadres in government and the Fed view gold as a dangerous competitor to their monetary fraud. Especially now that the frauds have worn so thin.

Try not to listen to the usual suspects, with their goofy theories about how this coronavirus is all just a hoax, and some quirk of human nature, or the Deep State. Try not to become a statistic.

There seems to be some perverse version of Gresham's Law going on. People readily pass around bad information and awful advice, sometimes truly outrageous nonsense. But realistic advice and sound information are not to be found except in a few neglected places. Chaos is exciting. And so chaos multiplies.

Have a pleasant evening.