"These violent delights have violent ends.

And in their triumph die, like fire and powder."

William Shakespeare, Romeo and Juliet

“The disposition to admire, and almost to worship, the rich and the powerful, and to despise, or, at least to neglect, persons of poor and mean condition is the great and most universal cause of the corruption of our moral sentiments.”

Adam Smith

"The heart of the problem is that because of the credibility trap, we have never had a proper public discussion on what went wrong with the policies of the US. The apathy of the people enables this. There are plenty of staged discussions in the media, where two paid talking heads and a moderator who carefully stages the parameters and definition of the 'discussion' shout slogans past one another that play to the emotions of their deeply polarized and propagandized constituencies.

Since we have not yet been able to speak frankly and openly about the massive fraud and abundant soft and overt corruption of the political and professional class, there can be no meaningful reform. Until one admits they have a problem and are able to face it, they cannot begin to address it.

So like any other type of hopeless addict, the US and much of its client states in the West will most likely have to finally hit rock bottom before they can begin to face their addiction to deceit and corruption, money and power. This will be difficult because so many of those who control the platforms for the conversation about corruption are also those hands are dirty with it, either by participation or acquiescence. It is the same phenomenon that compels a country to remain in protracted, winless wars long beyond any rational expectation of 'victory.'

Jesse, Moving Beyond Corporatism and Corruption, 10 April 2015

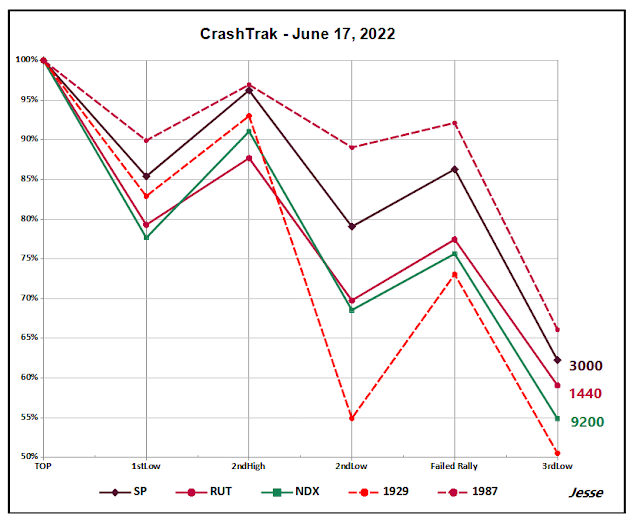

Bear market rally or bull trap?

And for the eternal optimists and market strategists a bottom followed by a long recovery rally. LOL

I'd guess a bull trap because the pundits were out talking about time to put your cash to work again.

Have a pleasant evening.