“Never was the victory of patience more complete than in the early church. The anvil broke the hammer by bearing all the blows that the hammer could place upon it. The patience of the saints was stronger than the cruelty of tyrants.”

Charles H. Spurgeon

“The limits of tyrants are prescribed by the endurance of those whom they oppose.”

Fredrick Douglas

"This is the Golden Age of fraud, an era of general willingness to ignore and justify the wrongdoings of the rich and powerful, which makes every lie bigger and widens its destructive path.”

Reed Albergotti

"Things fall apart; the centre cannot hold;

Mere anarchy is loosed upon the world,

The blood-dimmed tide is loosed, and everywhere

The ceremony of innocence is drowned;

The best lack all conviction, while the worst

Are full of passionate intensity...

And what rough Beast, its hour come 'round at last,

Slouches towards Bethlehem to be born?"

W. B. Yeats, The Second Coming, 1919

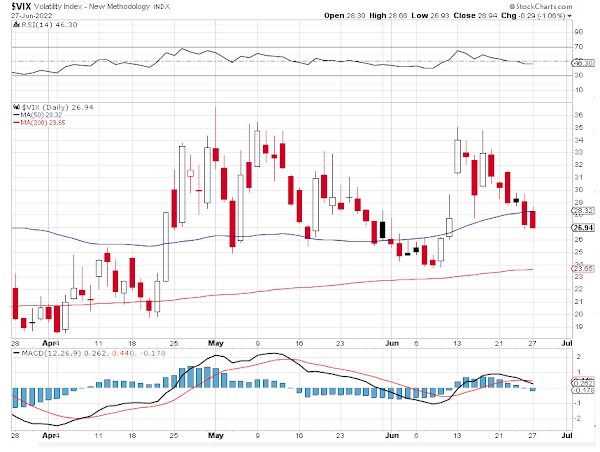

Stocks had another ranging day but managed to finish mostly unchanged.

Gold and silver took early hits, but drifted back during the day to mostly unchanged.

I suspect this is the tail end of the expiration shenanigans.

We may have a bit of a breather until the Non-Farm Payrolls next Friday.

The Dollar soared higher back on to the 105 handle.

Until sound regulation in the public interest is restored there will be no sustainable recovery for the real economy and irregular plunges and peaks in financial assets.

Don't hold your breath for this to happen.

Have a pleasant evening.