“Every time I hear a political speech or I read those of our leaders, I am horrified at having, for years, heard nothing which sounded human.

It is always the same words telling the same lies."

Albert Camus, Carnets

“It was miraculous. It was almost no trick at all, he saw, to turn vice into virtue and slander into truth, impotence into abstinence, arrogance into humility, plunder into philanthropy, thievery into honor, blasphemy into wisdom, brutality into patriotism, and sadism into justice. Anybody could do it; it required no brains at all. It merely required no character.”

Joseph Heller, Catch-22

“And on the subject of burning books: I want to congratulate librarians, not famous for their physical strength or their powerful political connections or their great wealth, who, all over this country, have staunchly resisted anti-democratic bullies who have tried to remove certain books from their shelves, and have refused to reveal to thought police the names of persons who have checked out those titles.

So the America I loved still exists, if not in the White House or the Supreme Court or the Senate or the House of Representatives or the media. The America I love still exists at the front desks of our public libraries.”

Kurt Vonnegut, A Man Without a Country

The 'saves' of the troubled banks did not quite stick, in particular with respect to Credit Suisse.

And so it was 'risk off' once again.

Stocks dumped, led south by the banks, particularly the regional and smaller banks which tend to populate the Russell 5000.

The VIX took back its decline from the day before.

Gold and silver rallied higher, breaking out of their restraints.

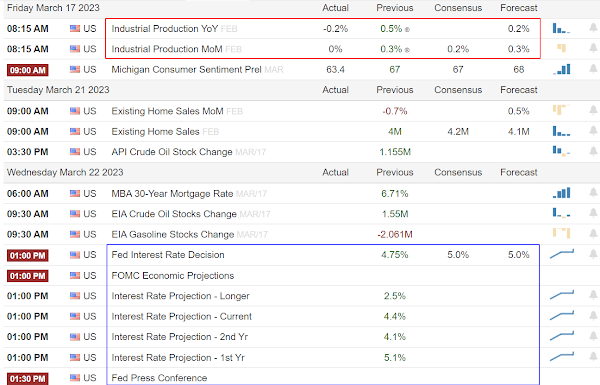

They may face a challenge next week with an FOMC rate decision on Wednesday.

There will be a key precious metal option expiration on the Comex on the 28th.

The cavalier attitude towards banking policy taken by the Fed and Yellen's Treasury can be added to the extraordinary things which we have been experiencing.

The oligarchy is audacious.

Have a pleasant weekend.