"Self-regulation is at best a vulnerable strategy in any human concern involving trust, but is absolute folly in an industry where the emphasis and incentives are based on the ruthless pursuit of performance at any cost, and where such behaviour is lauded.

There is little doubt that strong personality types such as even marginal psychopaths can hijack an organization, a [political] party, or even a sub-culture given the right environment of moral relativism and complacency. And if successful, they bring more of the morally ambivalent and weak-willed along with them.

The efficient market hypothesis is more a clever cover story than a legitimate scientific observation worthy of consideration in public policy discussions. Transparency and oversight are absolutely essential in all financial matters. The financial system, and their amoral enablers in politics and the media, have done enough damage to the world. It is time to stop."

Jesse, Psychopaths on Wall Street, 17 March 2012

"The suspicions that the system is rigged in favor of the largest banks and their elites, so they play by their own set of rules to the disfavor of the taxpayers who funded their bailout, are true. It really happened. These suspicions are valid.”

Neil Barofsky, TARP Inspector General

"A lot of white-collar criminals are psychopaths. But they flourish because the characteristics that define the disorder are actually valued. When they get caught, what happens? A slap on the wrist, a six-month ban from trading, and don't give us the $100 million back. I've always looked at white-collar crime as being as bad or worse than some of the physically violent crimes that are committed."

Robert Hare

"Three dark personalities, narcissism, Machiavellianism, and psychopathy have been studied in

businesses. Although the first two share similar traits with psychopathy, such as superficial

charm, lying and manipulation, the inability to accept responsibility for their actions, and the

complete lack of empathy, guilt and humility, a large body of research has demonstrated that

psychopathic individuals are more dishonest, treacherous and destructive than the others. While

all three dark personalities can be bad-news for a company, corporate psychopathy is the most

dangerous.

If success is defined by the

accomplishment of one’s goal, then I would say psychopathic individuals, by definition, are

often successful. That is, they are successful at manipulating others into getting what they want,

whatever the cost might be to others. Their ability to charm, manipulate and lie to others,

coupled with the fact that their lack of empathy and guilt and failure to accept responsibility for

their actions, gives psychopathic individuals the upper hand to attain their goals, by any means

possible.

There is a difference between being confident and not being capable of humility or

modesty. Good leaders will back their realization and success stories with verifiable facts and will do it with a certain dose of humility, occasionally giving credit to others. Moreover, good

leaders will take some credit but will also give credit to their team members while psychopathic

individuals are likely to take all the credit for previous achievements."

Cynthia Mathieu, The Devil Lurks In the Suit

"I wonder whether people who ask God to intervene openly and directly in our world quite realise what it will be like when He does. Then it will be God without disguise; something so overwhelming that it will strike either irresistible love or irresistible horror into every creature. It will be too late then to choose your side. That will not be the time for choosing: it will be the time when we discover which side we really have chosen, whether we realised it before or not."

C. S. Lewis, Mere Christianity, 1944

Stocks did their yo-yo routine again today, but nevertheless rallied back from their flighty drop of yesterday.

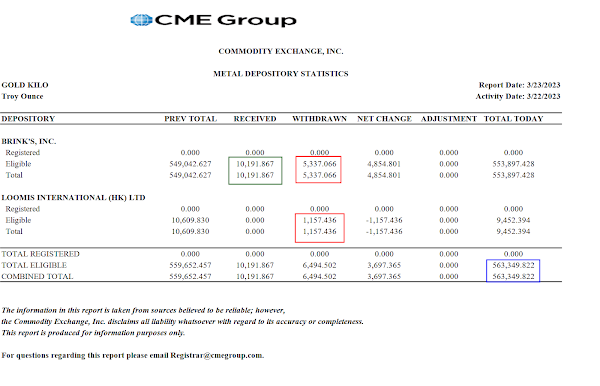

Gold and silver moved higher. Both are within range of breaking out.

They may be tested by the Comex metals option expiration of next week.

VIX chopped sideways in familiar volatility.

The Dollar climbed back a little.

Have a pleasant evening.