"Those who directed the state in the time of Solon and Cleisthenes did not establish a polity which trained the citizens in such fashion that they looked upon insolence as democracy, lawlessness as liberty, impudence of speech as equality, and licence to do what they pleased as happiness, but rather a polity which detested and punished such men, and by so doing made all the citizens better and wiser."

Isocrates

"With the tools of democracy, democracy was murdered and lawlessness made ‘legal.’ Raw power ruled, and its only real goal was to destroy all other powers besides itself.”

Eric Metaxas, Bonhoeffer

"I know that my retirement will make no difference in its [my newspaper's] cardinal principles, that it will always fight for progress and reform, never tolerate injustice or corruption, always fight demagogues of all parties, never belong to any party, always oppose privileged classes and public plunderers, never lack sympathy with the poor, always remain devoted to the public welfare, never be satisfied with merely printing news, always be drastically independent, never be afraid to attack wrong, whether by predatory plutocracy or predatory poverty."

Joseph Pulitzer

"It’s not that the former Fed boss Greenspan was incompetent

that is remarkable. Incompetence is common enough after

all, even in important jobs. What’s remarkable is that so

many people don’t seem, even now, to get it. Do people

just believe high-quality self-justifying blarney? Or is

it just that they apparently want to believe that critical

jobs in a great country attract great talent by divine right."

Jeremy Grantham, Immoral Hazard, May 22, 2008

"The truth is most of the individual mistakes boil down to just one: a belief that markets are self-adjusting and that the role of government should be minimal. Looking back at that belief during hearings this fall on Capitol Hill, Alan Greenspan said out loud, 'I have found a flaw.' Congressman Henry Waxman pushed him, responding, 'In other words, you found that your view of the world, your ideology, was not right; it was not working.' 'Absolutely, precisely,' Greenspan said. The embrace by America—and much of the rest of the world—of this flawed economic philosophy made it inevitable that we would eventually arrive at the place we are today."

Joseph Stiglitz, Capitalist Fools, January 2009

Stocks continued to rally higher into seriously overbought territory ahead of the FOMC decision tomorrow.

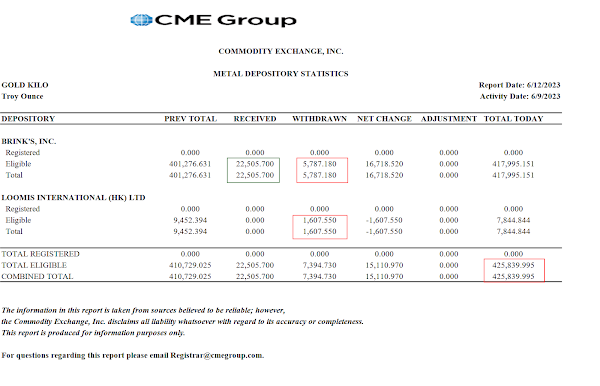

Gold, silver, and the Dollar fell.

VIX declined.

It's really all about how the Fed approaches its expected 'pause' tomorrow and the words that are used to shape the expectations around it.

The Fed has, through a series of overreaching policy errors and regulatory missteps, become the market.

The sweeping under the rug of their most recent insider trading scandal and the abuse of confidential information is appalling.

This will not end well.

Quad witch option expiration on Friday.

Have a pleasant evening.