Management does makes a difference.

The Central Fund's offering led by CIBC is allowing the underwriters and others given access to this offering to obtain a windfall, being given the right to purchase additional shares at 14.85.

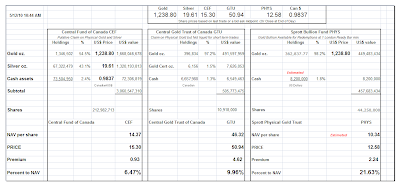

Presumably this will create a weight holding down the premium to NAV of this fund until they have taken their profits by selling those units which they have obtained at discount prices. Perhaps this is not the case, and the news is misleading. But it would certainly explain the contraction in the premium when gold and silver are hitting new highs.

This looks to me like the habit of using an old, familiar method of obtaining funds that may be more suited to other times and different markets. Old habits die hard, and sometimes even harder when new competition enters the markets and changes are not made with the times.

Since CEF will be in the market buying gold and silver bullion, it drives up prices at the very time it is giving its bank underwriters a discount price on their stock.

Yes I understand the difficulty of selling a large tranche like that in the marketplace. But I would contrast this approach with that of PHYS and Sprott Asset Management, which managed to sell an equally large amount of units and buy bullion while continually providing the benefits to shareholders, and not to the banks with whom they are doing business.

To say I am not impressed by the CEF management would be about right. While I do not doubt they have the bullion they represent, I am disappointed by their method of obtaining the greatest value and consideration for shareholders.

I will flip their shares for a trade, but if I want to buy and hold something besides bullion when the metals are running I think there are better ways to play that trade. Some of the miners have higher beta and a better index to the metal moves. PHYS had been a great play but its premium now is a bit prohibitive for my taste. SLW is da bomb when silver runs but it too can get ahead of itself.

Still, you have to have something to hang onto when gold and silver are on a run like this. There is a huge surge of bullion and coin purchases in Europe because of worries about their currencies. When the currency concerns eventually spread to the dollar, which they almost certainly will, the buying will make what we are seeing now seem like a bump on the charts.

12 May 2010

Net Asset Value of Certain Precious Metal Funds and Trusts: Comments on CEF

Category:

CEF,

NAV of precious metal funds,

PHYS