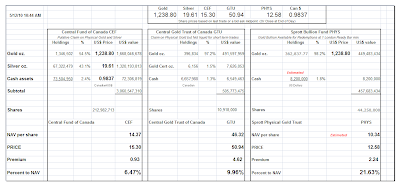

The premiums on PHYS and PSLV are back more to 'normal' levels now, although still hardly exuberant. PSLV is at a slight premium, and PHYS is almost flat.

The deeper discounts on CEF and GTU are still there, but a bit thinner that they have been.

Since the last time I put out this chart, another 91,680 ounces of gold bullion have been redeemed from the Sprott Physical Gold Trust.

I can imagine someone rationalizing this redemption as an arbitrage deal because PHYS is selling at a slight discount to its NAV. However, given the 'friction' of the transaction, and the necessity of storing this amount of gold, it seems like a fairly small amount to be tempting for a mere arbitrage against the NAV discount, given the volumes of gold that are being taken out.

Although it is possible that PHYS has priced its redemption process too cheaply. And there is no allowing for the desperation of a hedge fund that is willing to scrape for thin returns. This assumes they are not taking delivery to ship the gold to Asia for the premiums for physical paid there. If so, then it is not really arbitrage as I am using the term with regard to the discount to NAV, but the discount of paper to bullion. And that is a general trend that is hard to miss. But some do.

But one would think that playing the spread with paper and leverage, and betting that there would be a reversion to norms if the premiums fall to historically low discounts, would be a smoother and more scalable wager for any fund truly interested in paper profits. Here is a link to the distribution of PHYS premiums historically.

But this seems to be viewing a phenomenon in isolation that I think it is more correctly seen as part of a general trend, that one is foolish to ignore.

As I have shown here repeatedly, there is a general scouring of enormous proportions of the physical gold bullion from most if not all of the Western trusts and funds at these prices as set by the Comex, which unfortunately is still a price maker for the physical trade despite its own shrinking physical basis. That is the inconvenient reality that gold imposes on the financiers: they cannot print it into existence, except as an apparition of paper, without genuine substance.

And there are none so blind as those whose paychecks depend on their willing ignorance. It is unfortunate, but a fact of life.

So, let's see where this grand experiment goes. I have not been keeping an eye on the short interest in the PHYS, but I think the greater problem is the price of gold overall, which does not seem to be a market clearing price in terms of the actual commodity. And as a result, the physical bullion is flowing towards markets paying fairer prices, and finding ownership in stronger hands.

But why argue about it, especially with those whose mindset is clearly fixed in one direction? Let the tide go out, and we will see what allocated and unallocated funds are naked. And who, at the end of the day, is actually holding what gold, and with what encumbrances, cross claims, and counterparty risks.

So in summary, some might say that gold is flowing out of Sprott because of its discount to NAV, which I point out is miniscule, and much more adeptly gamed through the usual paper games.

Rather, gold is flowing from financialised markets to cash basis markets, from highly leveraged schemes to the vaults of stronger hands flush with paper of less confident value, and put even more simply, from West to East.

This is what happens when once again we begin to see 'peak paper.' Yes it certainly has not failed yet, and yes, the official measures may show little devaluation from inflation and mask the enormous leverage and undisclosed counterparty risk that is still in the system, après Crash.

And to this I say, 'in time.'

Not everyone is investing with a two month time horizon, as is de rigueur in the City and on the Wall Street these days, and passing around their hot potatoes of dodgy paper from hand to hand as quickly as possible, before the next bell rings.