When the US government announced a 'better than expected' headline growth number in its non farm payrolls report for August, a loss of 'only' 54,000 jobs versus a forecasted loss of 120,000 jobs, people had to wonder, 'How do they do it? We do not see any of this growth and recovery in our day to day activity.'

Here's one way that those reporting the numbers can 'tinker' with them to produce the desired results.

As you may recall, there is often a very large difference between the raw, unadjusted payroll number and the adjusted number. Seasonality plays the largest role, although there can occasionally be special circumstances. Since this is designed to be a simple example I am going to lump all the various adjustments that could be and call them the 'seasonality factor' since it is most usual and signficant.

Here is a chart showing the unadjusted and the adjusted numbers. As you can see, a seasonal adjustment can legitimately normalize the numbers for the use of planners and forecasters. This is a common function in businesses affected by seasonal changes. Year over year growth rates, rather than linear, comparisons, can also serve a similar function.

Quite a variance in numbers that are very large.

Since it probably is in the back of your mind, let's address the infamous "Birth Deal Model" now, which I have advised may not be such a significant factor as you might imagine. This is an 'estimate' of new jobs created by small businesses. A comparison of the last few years demonstrates rather easily that this number is what is called 'a plug.'

How can the growth of jobs from small business not been significantly impacted by one of the greatest financial collapses in modern economic history?

Certainly the Birth Death model offers room for statistical mischief. It is important to remember that it is added to the RAW number before seasonal adjustment, and that number has huge variances. So the effect of Birth Death is mitigated by the adjustment for seasonality. If it were added to the Seasonal number from which 'headline growth' is derived it would be a huge factor. But it is not the case, although the timing of the significant annual adjustments and additions is highly cynical, and supportive of number inflation. Perhaps calling it a 'plug' is too kind, and 'fudge factor' would be more accurate.

From my own analysis of each month's data, and especially looking at the changes made to the numbers over time, the two biggest factors are the restatements of prior months, and sometimes years, and the monthly changes in seasonality factor.

Let's take a closer look at the seasonality adjustment.

The raw unadjusted number for US non-farm payrolls is very large, on the order of 130+ million in the most recent month.

The 'headline growth number' these days is generally around a hundred thousand jobs or so, which is several orders of magnitude difference smaller than the unadjusted number from which it starts to be derived. Even the month over month fluctuations in the unadjusted number are quite large, and added to that are the Birth Death adjustments, which are often as large or larger than the 'headline number.'

Do you think the Government uses the same seasonality adjustment factor profile each year? Let's take a look at just the month of June, and how the adjustments were made since 2003. It is important to point at here that the seasonality factor is subject to backward revisions. What is used in the current month can and often does change substantially as it becomes 'history' and is no longer in the public eye.

As it turns out the seasonality factor varies over time, as determined by year over year. Here is a chart that shows the adjustment factor by year. It does not seem that great does it, but the variance is there.

How significant are these variances? Let's take a look at a specific example.

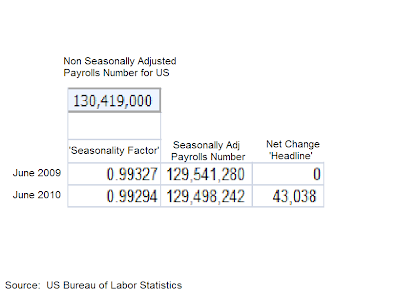

Here is the use of seasonal adjustment in June of 2010, compared to June of 2009. The takeaway from this chart is that even a slight change in seasonal adjustment can result in a large impact to the 'headline number' that Wall Street and the political commentators watch and expound upon.

Quite a difference isn't it? Plus 43,000 jobs can be a big difference from no growth, especially if a flat growth was forecast by the economists.

Let's take a look further into the past to see how much variability there can be in adjustments for the SAME month over time.

What is important is not the result for a specific year per se, but the huge variance in results for the same month each year with little or no justification. Further, these results can be restated, and significantly, going forward in benchmark revisions. Whether they are 'correct' or not is not the point. The point is that this variability renders the current headline number as data highly suspect, vulnerable to manipulation by special interests and short term agendas.

Given the degrees of freedom in setting the seasonality, and adjusting prior months to add and subtract jobs once they have served their purpose in supporting the headlines, I think it is safe to say that if you give me a spreadsheet of jobs data, and you are my politically appointed supervisor, I can make the numbers come out pretty close to whatever you want within reason to support whatever messaging you may wish to put forward. As the errors start to add up over time, I can 'restate' the past numbers in a wholesale change to bring them into line with reality.

So what is the point of this discussion. First, and foremost, judging the health of the economy over a monthly headline number like this is more artifice than substance. At worst it is leaked to Wall Street cronies to help them skin the public from their money, and provide a few sound bytes to support whatever political message the government wishes to promote that month to 'restore confidence.'

At best and most properly it can be included in a series of numbers, a moving average preferably that shows the trend in employment, which along with other factors can help economists determine the actual growth and health of the economy.

The government was able to turn around a tremendous loss of jobs, which is good news. The bad news is that they accomplished this by essentially throwing trillions of dollars at the problem, and in particular a corrupt and oversized financialization industry, in order to bring the trend back to zero. Without a change one cannot return to a bubble economy and hope it to be sustainable without a growing asset bubble. This implies organic growth and a return to a growth in the median wage which has been declining or stagnant in a long term structural trend. Has anything been done to promote this? No. And in this sense of over cautious lack of reform Obama is more a Hoover than a Roosevelt.

But this cult of 'headline numbers' as used by the mainstream media, the government, and Wall Street is a sad commentary on the frivolous nature of US leadership. This childishness should not be surprising given that they think they can hide their monetary inflation by leasing gold into the bullion markets and buying Treasuries to hold down the long term rates while a private banking cartel prints money and provides it to their friends. And the primary capital allocation mechanism of the nation is riddled with false trades, naked short positions, and accounting fraud, schemes and subterfuges, that go largely unaddressed by the financial authority charged with enforcement of the integrity of the system even when they become so blatant as to cause a flash crash collapse of the system.

The only thing that is surprising about Wall Street and the US financial frauds is, as Eliot Spitzer famously observed, their scams and schemes are so simple and so obvious when one can pry back the veil of secrecy and see what is actually being done.

Sadly it will likely continue because 'it works' for the short term, and the US is preoccupied with the short term, instant analysis and results over substance and solid progress built on strong foundations, every time.