The Fed has a two day meeting and will report their decision and outlook on Wednesday.

The US will report the Advanced GDP number for Q1 on Friday.

"In the Incarnation the whole human race recovers the dignity of the image of God. Thereafter, any attack, even on the least of men, is an attack on Christ, who took on the form of man, and in his own Person restored the image of God in all. Through our relationship with the Incarnation, we recover our true humanity, and at the same time are delivered from that perverse individualism which is the consequence of sin, and recover our solidarity with all mankind."

Dietrich Bonhoeffer

"The seasonally-adjusted SGS Alternate Unemployment Rate reflects current unemployment reporting methodology adjusted for SGS-estimated long-term discouraged workers, who were defined out of official existence in 1994. That estimate is added to the BLS estimate of U-6 unemployment, which includes short-term discouraged workers.

The U-3 unemployment rate is the monthly headline number. The U-6 unemployment rate is the Bureau of Labor Statistics’ (BLS) broadest unemployment measure, including short-term discouraged and other marginally-attached workers as well as those forced to work part-time because they cannot find full-time employment."

Note: The spokemodels and the uninformed parrots quite predictably are tut-tutting this using misdirection by saying that the most recent drop for January alone is attributable to a revision in the Labor Force, the denominator in this case, by the Census Bureau. And I accept that. No problem. But my point again is not to look at a single month, but at the trend, even for this. And from a technical standpoint, the trend here undeniably 'blows.'If the Fed can target a Nominal GDP, that is, economic growth targets that do not care how much is real and how much is paper manipulation, then I am sure it is only fair for the government to target a Nominal Work Force.

"The pace of consumer inflation is accelerating rapidly, with annual CPI-U at 2.7% and CPI-W at 3.0%, while the annualized quarterly, seasonally-adjusted inflation rates have hit 5.2% for the CPI-U and 6.0% for the CPI-W.

These higher inflation numbers are tied directly to the Federal Reserve's successful and ongoing efforts to debase the U.S. dollar, which in turn have boosted dollar-denominated commodity prices such as oil. The inflation pace here normally would be of concern to the Fed, except the U.S. central bank officially ignores inflation tied to food and energy prices, even though, again, those debilitating price increases for consumers are a direct result of Fed policy.

Of particular discomfort to consumers, this inflation has not resulted from booming economic activity and wages, but rather from Fed monetary policy in the context of stagnant/declining broad economic activity.

Inflation has gained the upper hand in retail sales, with sales gains now more than accounted for by rising prices. A pending benchmark revision (April 29th) should show a much weaker recent history for retail sales activity, as the just-published benchmark revision to industrial production did for that series...

Inflation Above 3% Tends to Rattle Consumers. Where consumers look at inflation in terms of out-of-pocket expenses, the threshold of pain has been crossed, with popularly used consumer price indices at or within one month of topping 3% annual inflation. Further, for those who do not get paid in seasonally-adjusted dollars, the 0.5% adjusted CPI-U monthly gain felt more like the 1.0% unadjusted gain."

"I want a trained professional to analyze this. It is not unusual for the series to do something odd around Christmastide. It is not unusual for the series to diverge. Not this much."And Brad is not the overly fussy sort, because a few years ago he said that Alan Greenspan had never made a policy decision with which he disagreed.

"Now it is fairly well known that the unemployment rate is a less important metric, since people stop being counted as unemployed when no longer receiving unemployment benefits, or when they take a menial low paying job. And in a prolonged downturn you can therefore have improvements in the unemployment rate without any real improvement in overall unemployment like the labor participation rate and the median wage, which are the key indicators of a sustainable recovery.

So it makes me wonder what antics the government and the pigmen might have up their sleeve to rattle the swill bucket for mom and pop to get back into stocks, and most likely once again at a top."

"...there must be an end to a conduct in banking and in business which too often has given to a sacred trust the likeness of callous and selfish wrongdoing. Small wonder that confidence languishes, for it thrives only on honesty, on honor, on the sacredness of obligations, on faithful protection, and on unselfish performance; without them it cannot live. Restoration calls, however, not for changes in ethics alone. This nation is asking for action, and action now."

Franklin Delano Roosevelt, First Inaugural Address, 1933

Mike McDermott to Teddy KGB: "Well you feelin' satisfied now Teddy? Because I can go on bustin' you up all night."Caution: language

Oh by the way, JPM Hid Doubts On Madoff Fraud - NYTAnd there will be more.

GDP Estimate Was of Unusually Poor Quality.And some practitioner of economic auterism will snarkily say, "But har har and tut tut. You obviously do not understand that the deflator has nothing to do with inflation, although it purports to perform the function of taking out the inflationary effect. The deflator is merely what we say it is."

This morning’s "advance" estimate of annualized 3.17% real (inflation-adjusted) GDP growth was nonsensical, even though it was somewhat shy of consensus. Most of the reporting was based on guesses; hard data simply are not available this early. Consider that more than the total reported fourth-quarter growth was accounted for by a narrowing of the trade deficit. The Bureau of Economic Analysis (BEA) indicated that 3.44 percentage points of growth was generated by an improved net export account. That estimate, however, was based on just the two months of available data (October and November) for the quarter. December’s data will not be available until February.

As noted in Commentary No. 345, the relative improvement suggested in the trade deficit for the fourth-quarter (based on the October and November reporting) could have added 1.3 annualized (0.3 quarterly) percentage points to fourth-quarter real GDP growth, but not 3.44 percentage points. That differential required extremely optimistic assumptions on the part of the BEA as to the December trade results. Accordingly, the upcoming trade release will be particularly interesting in terms of its implications for GDP revisions.

Separately, after quarters of a significant inventory build-up, a reduced pace of relative inventory increase reduced the reported real fourth-quarter GDP growth rate by 3.70 percentage points. Inventories at this point in time are even less reliable than the trade data. Nonetheless, inventory build-up still accounted for half the annual average GDP growth in 2010.

Also, despite the 30% annualized (8% quarterly) quarter-to-quarter contraction in housing starts, residential investment rose at a 3.4% annualized pace.

The point here is that reported 3.17% annualized growth, with the regular +/- 3.0% 95% confidence interval, along with such unusually large swings in unreliable components, should not be taken as a serious or meaningful measure of quarterly economic growth. I believe that realistic growth would have been flat-to-minus and eventually that should prove out in long-range revisions.

Where early GDP reporting generally is of extremely poor quality, some catch-up should be seen in the annual benchmark revisions due for release on July 29th. At that time — as will be seen with the payroll employment reporting due for revision a week from now — the revisions to prior economic growth generally will be to the downside, showing a more-protracted and deeper economic contraction in place than officially is recognized at present.

With quarterly weakness in the housing starts and in new orders for durable goods, the indications remain in place for a re-intensifying economic downturn, as discussed inSpecial Commentary No. 342.

"Advance" Guesstimate on Fourth-Quarter 2010 GDP Was Unusually Flimsy.

The opening comments covered several unusual issues with the current GDP report. A more traditional problem lies in how inflation was handled. On a one-to-one basis, the lower the inflation rate used to deflate the GDP, the higher will be the real or inflation-adjusted GDP growth rate. Annualized GDP inflation — the GDP Implicit Price Deflator — was reported showing annualized inflation of 0.3% in the fourth-quarter, down from 2.0% in the third, while annualized CPI inflation rose to 2.6% in the fourth-quarter, up from 1.5% in the third.

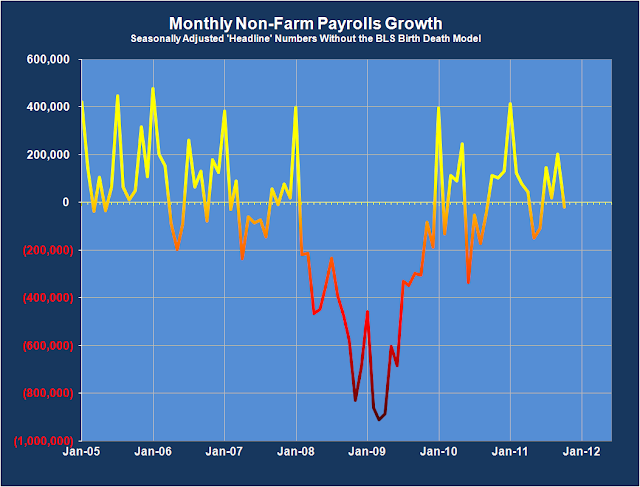

When the US government announced a 'better than expected' headline growth number in its non farm payrolls report for August, a loss of 'only' 54,000 jobs versus a forecasted loss of 120,000 jobs, people had to wonder, 'How do they do it? We do not see any of this growth and recovery in our day to day activity.'

Here's one way that those reporting the numbers can 'tinker' with them to produce the desired results.

As you may recall, there is often a very large difference between the raw, unadjusted payroll number and the adjusted number. Seasonality plays the largest role, although there can occasionally be special circumstances. Since this is designed to be a simple example I am going to lump all the various adjustments that could be and call them the 'seasonality factor' since it is most usual and signficant.

Here is a chart showing the unadjusted and the adjusted numbers. As you can see, a seasonal adjustment can legitimately normalize the numbers for the use of planners and forecasters. This is a common function in businesses affected by seasonal changes. Year over year growth rates, rather than linear, comparisons, can also serve a similar function.

Quite a variance in numbers that are very large.

Since it probably is in the back of your mind, let's address the infamous "Birth Deal Model" now, which I have advised may not be such a significant factor as you might imagine. This is an 'estimate' of new jobs created by small businesses. A comparison of the last few years demonstrates rather easily that this number is what is called 'a plug.'

How can the growth of jobs from small business not been significantly impacted by one of the greatest financial collapses in modern economic history?

Certainly the Birth Death model offers room for statistical mischief. It is important to remember that it is added to the RAW number before seasonal adjustment, and that number has huge variances. So the effect of Birth Death is mitigated by the adjustment for seasonality. If it were added to the Seasonal number from which 'headline growth' is derived it would be a huge factor. But it is not the case, although the timing of the significant annual adjustments and additions is highly cynical, and supportive of number inflation. Perhaps calling it a 'plug' is too kind, and 'fudge factor' would be more accurate.

From my own analysis of each month's data, and especially looking at the changes made to the numbers over time, the two biggest factors are the restatements of prior months, and sometimes years, and the monthly changes in seasonality factor.

Let's take a closer look at the seasonality adjustment.

The raw unadjusted number for US non-farm payrolls is very large, on the order of 130+ million in the most recent month.

The 'headline growth number' these days is generally around a hundred thousand jobs or so, which is several orders of magnitude difference smaller than the unadjusted number from which it starts to be derived. Even the month over month fluctuations in the unadjusted number are quite large, and added to that are the Birth Death adjustments, which are often as large or larger than the 'headline number.'

Do you think the Government uses the same seasonality adjustment factor profile each year? Let's take a look at just the month of June, and how the adjustments were made since 2003. It is important to point at here that the seasonality factor is subject to backward revisions. What is used in the current month can and often does change substantially as it becomes 'history' and is no longer in the public eye.

As it turns out the seasonality factor varies over time, as determined by year over year. Here is a chart that shows the adjustment factor by year. It does not seem that great does it, but the variance is there.

How significant are these variances? Let's take a look at a specific example.

Here is the use of seasonal adjustment in June of 2010, compared to June of 2009. The takeaway from this chart is that even a slight change in seasonal adjustment can result in a large impact to the 'headline number' that Wall Street and the political commentators watch and expound upon.

Quite a difference isn't it? Plus 43,000 jobs can be a big difference from no growth, especially if a flat growth was forecast by the economists.

Let's take a look further into the past to see how much variability there can be in adjustments for the SAME month over time.

What is important is not the result for a specific year per se, but the huge variance in results for the same month each year with little or no justification. Further, these results can be restated, and significantly, going forward in benchmark revisions. Whether they are 'correct' or not is not the point. The point is that this variability renders the current headline number as data highly suspect, vulnerable to manipulation by special interests and short term agendas.

Given the degrees of freedom in setting the seasonality, and adjusting prior months to add and subtract jobs once they have served their purpose in supporting the headlines, I think it is safe to say that if you give me a spreadsheet of jobs data, and you are my politically appointed supervisor, I can make the numbers come out pretty close to whatever you want within reason to support whatever messaging you may wish to put forward. As the errors start to add up over time, I can 'restate' the past numbers in a wholesale change to bring them into line with reality.

So what is the point of this discussion. First, and foremost, judging the health of the economy over a monthly headline number like this is more artifice than substance. At worst it is leaked to Wall Street cronies to help them skin the public from their money, and provide a few sound bytes to support whatever political message the government wishes to promote that month to 'restore confidence.'

At best and most properly it can be included in a series of numbers, a moving average preferably that shows the trend in employment, which along with other factors can help economists determine the actual growth and health of the economy.

The government was able to turn around a tremendous loss of jobs, which is good news. The bad news is that they accomplished this by essentially throwing trillions of dollars at the problem, and in particular a corrupt and oversized financialization industry, in order to bring the trend back to zero. Without a change one cannot return to a bubble economy and hope it to be sustainable without a growing asset bubble. This implies organic growth and a return to a growth in the median wage which has been declining or stagnant in a long term structural trend. Has anything been done to promote this? No. And in this sense of over cautious lack of reform Obama is more a Hoover than a Roosevelt.

But this cult of 'headline numbers' as used by the mainstream media, the government, and Wall Street is a sad commentary on the frivolous nature of US leadership. This childishness should not be surprising given that they think they can hide their monetary inflation by leasing gold into the bullion markets and buying Treasuries to hold down the long term rates while a private banking cartel prints money and provides it to their friends. And the primary capital allocation mechanism of the nation is riddled with false trades, naked short positions, and accounting fraud, schemes and subterfuges, that go largely unaddressed by the financial authority charged with enforcement of the integrity of the system even when they become so blatant as to cause a flash crash collapse of the system.

The only thing that is surprising about Wall Street and the US financial frauds is, as Eliot Spitzer famously observed, their scams and schemes are so simple and so obvious when one can pry back the veil of secrecy and see what is actually being done.

Sadly it will likely continue because 'it works' for the short term, and the US is preoccupied with the short term, instant analysis and results over substance and solid progress built on strong foundations, every time.

John Williams' comments on the GDP number were short and to the point. I am still not on board with his hyperinflation forecast preferring to stick with a pernicious stagflation, although what he sees is certainly possible, as is a Japan style deflation. That is what 'fiat' is all about.

The correlation in stocks across the various indices today is remarkably uniform. Do you need to buy a vowel?

John Williams of ShadowStats

Economic Data Will Get Much Worse.

The kindest thing I can say about a stock market that rallies on the "stronger than expected" news that annualized growth in second-quarter GDP was revised from 2.4% to just 1.6%, instead of to the expected 1.4% (keep in mind those numbers are quarterly growth rates raised to the fourth power), or that gyrates over meaningless swings in seasonally-distorted weekly new unemployment claims, is that it is irrational, unstable and terribly dangerous.

As the renewed tumbling in the U.S. economy throws off statistics suggestive of a continuing collapse in business activity, as a looming contraction in third-quarter GDP becomes increasingly evident to all except Wall Street and Administration hypesters, who professionally never admit to such news, it would be quite surprising if the financial markets did not react violently, with a massive sell-off in the U.S. dollar contributing to and coincident with massive sell-declines in both the U.S. equity and credit markets.

Recognition is growing rapidly of the re-intensifying economic downturn. Yet, little analysis so far has been put forth to public as to some of the unfortunate systemic implications of this circumstance. The problems range from extreme growth in the federal government's operating deficit, tied to reduced tax revenues and to bailout expenditures for the unemployed, bankrupt states and continuing banking industry solvency issues, to U.S. Treasury funding needs to pay for same. The latter issue promises eventual heavy Federal Reserve monetization of Treasury debt, with resulting inflation problems and eventual hyperinflation (see the Hyperinflation Special Report).

This situation is an analogue to the US economy, where increasingly larger portions of the financial markets in the US are being ceded to white collar fraud and manipulation by the gangs of New York. The problem is not with law enforcement per se, but that the basic functions of government are being overwhelmed by inept and corrupt lawmakers and regulators, the powerful rule of special interests, and a general lack of concern and disdain for the needs of the ordinary citizens. These are the root cause of the failures of government in the US.

This situation is an analogue to the US economy, where increasingly larger portions of the financial markets in the US are being ceded to white collar fraud and manipulation by the gangs of New York. The problem is not with law enforcement per se, but that the basic functions of government are being overwhelmed by inept and corrupt lawmakers and regulators, the powerful rule of special interests, and a general lack of concern and disdain for the needs of the ordinary citizens. These are the root cause of the failures of government in the US.

This is not a problem of Republicans versus the Democrats. It is the age old problem of the avarice of an oligarchy of the self-proclaimed elites against the rights of the private individual, and the common people.

"From whence shall we expect the approach of danger? Shall some trans-Atlantic military giant step the earth and crush us at a blow? Never. All the armies of Europe and Asia...could not by force take a drink from the Ohio River or make a track on the Blue Ridge in the trial of a thousand years. No, if destruction be our lot we must ourselves be its author and finisher. As a nation of free men we will live forever or die by suicide.""In a press conference ignored by the American national media, the sheriff described how his deputies were outmanned and outgunned by the cartel smugglers who increasingly operate using military tactics and weapons. The result, said Sheriff Babeu, was that a wide corridor of Arizona from the border North to the outskirts of Phoenix is effectively controlled by the cartels. "We do not have control of this area," the sheriff said.

Abraham Lincoln

Here's a postcard from off-balance-sheet country.

This includes only current debt and not future unfunded obligations.

I like to call this US debt chart "The Last Bubble," but it could equally apply to a chart showing the representation of this debt - the US bonds, notes, bills and of course dollars, which are really nothing more than Federal Reserve Notes of zero duration in the modern fiatopia.

It all adds up, eventually, and must be reconciled. It is easier to print money and accumulate debt when you own the world's reserve currency. For a while the dollar might even flourish, despite the printing, as the international savers flee ahead of the economic hitmen, from country to country, and crisis to crisis.

Chart compliments of the Contrary Investor.

Posted by Keith Hazelton, Anecdotal Economics

“In these sentiments, Sir, I agree to this Constitution with all its faults, if they are such; because I think a general Government necessary for us, and there is no form of Government but what may be a blessing to the people if well administered, and believe farther that this is likely to be well administered for a course of years, (but) can only end in Despotism, as other forms have done before it, when the people shall become so corrupted as to need despotic Government, being incapable of any other.” (Emphasis mine.)And the question we keep pondering is, “Are we there yet?” Are we merely slouching toward despotism, or have we arrived? Are we already so corrupt so as to need despotic government, what with Vampire Squids and corporate/union-bought elections and Congressional bystanders and regulatory capture and Systemically Important Too Big To Fail and Gulf of Mexico oil well disasters?

What a heavy burden God has laid on men! I have seen all the things that are done under the sun; all of them are meaningless, a chasing after the wind. What is twisted cannot be straightened; what is lacking cannot be counted. I thought to myself, "Look, I have grown and increased in wisdom more than anyone who has ruled over Jerusalem before me; I have experienced much of wisdom and knowledge." Then I applied myself to the understanding of wisdom, and also of madness and folly, but I learned that this, too, is a chasing after the wind. For with much wisdom comes much sorrow; the more knowledge, the more grief. (Emphasis added.)Indeed, with wisdom comes sorrow, and from more knowledge, more grief. Would, sometimes, that we could empty so much of it from the mush of our remaining gray matter and then we wouldn't have to pretend it's all good, when, in fact, it’s anything but good, as soon, perhaps in a matter of a few short years, we shall see.

The transition from unitary executive to dictator – conservative, benevolent or otherwise – will not happen in the waning months of the current administration, so uniquely manifested by America's First Triumvirate of George Bush, Dick Cheney and, until recently, Karl Rove, but succeeding chief executives may choose overtly to expand further the envelope-pushing and Constitution-trampling of the 43rd President and his neo-conservative command-and-control cabal as the American oligarchy, and the nation, slouches slowly toward despotism.Are we there yet?

As such, we will one day awake from our debt-financed, pleasure-induced stupors to find one person or group firmly in charge, answering to no one, especially not Congress, and in complete grasp of the military, the intelligence agencies, the treasury, the Federal Reserve and the financial and judicial systems. It will happen – it is happening – an inch at a time, until the day comes when not only will we, the fun-loving, celebrity-worshipping, civic-duty-abhoring citizens of America, so embrace the notion of despotism, we will think it entirely our own idea.

I have been looking for a commentary to share with you all regarding the most recent US GDP report. I wanted something that went beyond the obvious inventory buildup that boosted the number by almost double, and the shockingly low deflator that was used.

Here is a commentary that seems to capture the big picture of where the US economy stands today, and is able to express it simply and clearly.

Richard Davis of the Consumer Metrics Institute does excellent work, and is available for interviews.

Enjoy.

"The April 30th GDP report issued by the Bureau of Economic Analysis ("BEA") of the U. S. Department of Commerce was a freeze-frame quarterly snapshot of a highly dynamic economy -- an economy that another source indicates was in significant transition while the snapshot was being taken.

Compared to the 4th quarter of 2009, the annualized growth rate of the GDP had dropped by 43%. Depending on your point of view this could be interpreted either as a glass that is "half-full" or a glass that is "half-empty":

1) The "half-full" reading would mean that the GDP numbers confirm that the recovery had at least moderated to a historically normal growth rate. In this scenario the good news would have been that "the economy is still growing," albeit at a historically normal rate. The bad news would have been that a normal growth rate would only warrant normal P/E ratios in the equity markets.

2) The "half-empty" reading would have meant that the near halving of the GDP's growth rate confirmed that (at the factory level) the economy had finally begun to "roll over". If so, the BEA's announcement portends even lower readings in the quarters to follow.

What was clearly missing in the "half-full/half-empty" debate was a feel for whether the level seen in the snapshot's glass was stable or still dropping. At the Consumer Metrics Institute our measurements of the web-based consumer "demand" side economy support the "half-empty" reading of the new GDP data. The new GDP numbers (which are subject to at least two revisions) agree with where our "Daily Growth Index" was on November 24th, 2009, 18 weeks prior to the end of 2010's first calendar quarter -- and when that index was in precipitous decline.

A look at our "Daily Growth Index" also shows that towards the end of November 2009 the "demand" side economic activity was dropping so quickly that a two week change in the sampling period would make a huge difference in the numbers being reported. If the sampling period had shifted to two weeks earlier, the reported GDP number would have been 4.4%, substantially higher. However, if the sampling period had shifted to two weeks later, the GDP growth rate would have been only 2.0%, less than half the reading from only 4 weeks earlier. This is the sign of an economy in rapid transition.

The methodologies used by the BEA when measuring factory production are ill suited to capturing an economy in such rapid transition. In the 4th quarter of 2009 the production side of the economy was topping (reflecting the topping of our measurements on the demand side in August 2009). The first quarter's production environment was at a much more dynamic spot in this particular economic cycle, and the subsequent monthly revisions by the BEA may be significant.

From our perspective the GDP is only confirming where our numbers were in November -- which is, relatively speaking, ancient history. Since then we have seen our "demand" side numbers slip into contraction (on January 15th), and they have recently lingered in the -1.5% "growth" range (see charts below). We have long since recorded the "demand" side activity that has been flowing downstream to the factories during the second quarter of 2010. If the GDP lags our "Daily Growth Index" by 18 weeks again we should see the consumer portion of the 2nd quarter 2010 GDP contracting at a 1.5% clip, less inventory adjustments."

"As you can see from the above chart the current consumer "demand" contraction event is unique: if there is a "second dip" it may very well be unlike anything we have seen recently. Instead of a "call-911" type of event in 2008 or the "hiccup" witnessed in 2006, we may be seeing a "walking pneumonia" type of contraction that has legs.Charts and commentary courtesy of Richard Davis at the Consumer Metrics Institute.

Our data is significantly upstream economically from the factories and the products measured by the GDP, putting us far ahead of the traditional economic reports. Perhaps our data is too timely; we are so far ahead of conventional economic measures that our story generally differs (either positively or negatively) from the stories being simultaneously reported by more traditional sources."