"In particular, over a protracted period of good times, capitalist economies tend to move from a financial structure dominated by hedge finance units to a structure in which there is large weight to units engaged in speculative and Ponzi finance."

Hyman Minsky, The Financial Instability Hypothesis

"Twenty-five years ago, when most economists were extolling the virtues of financial deregulation and innovation, a maverick named Hyman P. Minsky maintained a more negative view of Wall Street; in fact, he noted that bankers, traders, and other financiers periodically played the role of arsonists, setting the entire economy ablaze. Wall Street encouraged businesses and individuals to take on too much risk, he believed, generating ruinous boom-and-bust cycles. The only way to break this pattern was for the government to step in and regulate the moneymen.

Many of Minsky’s colleagues regarded his 'financial-instability hypothesis,' which he first developed in the nineteen-sixties, as radical, if not crackpot. Today, with the subprime crisis seemingly on the verge of metamorphosing into a recession, references to it have become commonplace on financial web sites and in the reports of Wall Street analysts. Minsky’s hypothesis is well worth revisiting."

John Cassidy, The Minsky Moment, The New Yorker, 4 February 2008.

Charles Kindelberger, Manias, Panics, and Crashes: A History of Financial Crises

"Bubbles most often resolve their imbalances irresponsibly and jarringly, with a correction that is sharp and destructive. It is often triggered by some seemingly trivial event, especially if its predatory mispricing of risk has been allowed to fester for an extended period of time.. How can this be?

Credit cycles explain bubbles in modern finance, but the elite protect themselves and their banks from the effects. Hence, only the middle and working class loses. And this has been the case for many years now. Hence the growing unrest abroad, and the decisions by the electorate at home that seem to puzzle and provoke the very comfortable 'credentialed' class.

The reason for this is quite easy to understand. Those who benefit the most from the bubble both actively and passively help sustain it. They are reluctant to surrender any potion of their enormous advantage and personal gains, even if it might be better for them in the long term."

Jesse, Who Could Have Seen It Coming?, 17 January 2019

Stocks continued moving higher in a relief rally from a short term oversold condition.

Without a fresh fundamental reason to continue to rise higher, the correction in the market is probably coming quickly to an end.

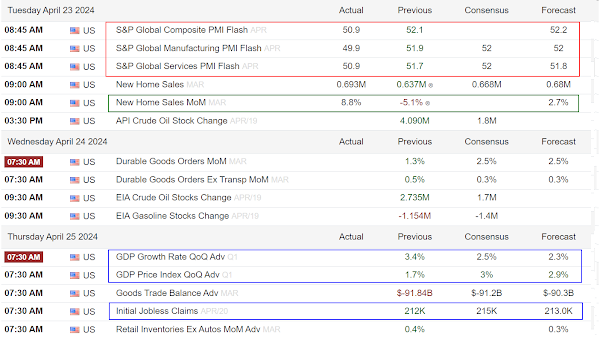

Non-Farm Payrolls report for April on next Friday May 3rd will likely affect the markets.

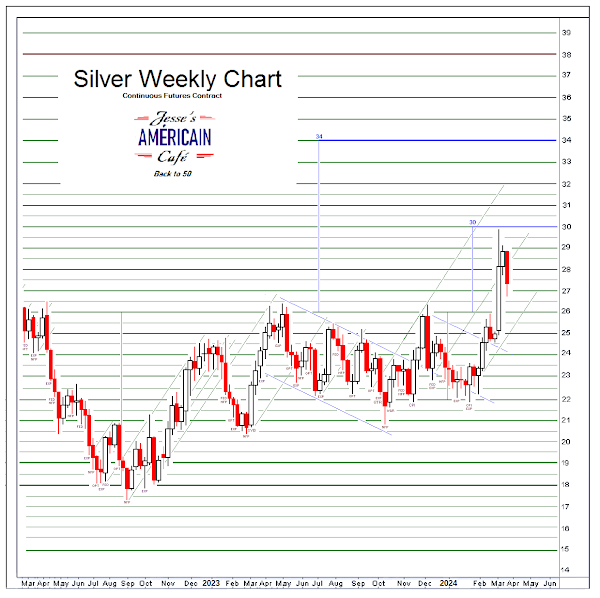

Gold and silver were hit hard early on, as part of the Comex option expiration boogie woogie.

That also may be quickly passing. Gold achieved a 38.2 Fibonacci retracement early today, and then bounced back to almost unchanged by the close.

Silver actually posted a gain for the day.

A big chunk of gold took a walk out of the Hong Kong Comex warehouses. More expected to follow.

How did the governments of the US, UK, Germany and France become so indifferent to the good of the people who elect them?

It's quite the fashion these days.

Follow the money.

Have a pleasant evening.