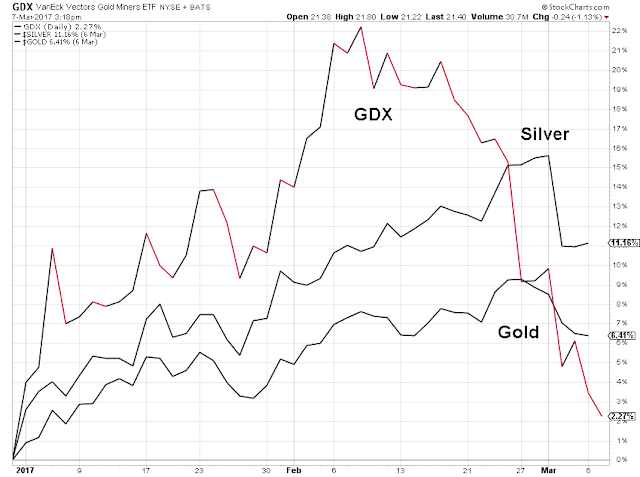

There is a 'risk off' flight to safety in the markets today.

The unusually high gold to silver ratio seems to reflect this undercurrent.

Gold is somewhat preferred to silver in a 'flight to safety scenario.'

I ascribe this to silver's 'industrial component' which represents about one half its valuation.

But with its much higher than normal volatility, the beta of silver will often prompt silver to 'catch up' and pull forward rather quickly.

Today, for example, both metals are up by the same percentage, for example. Silver may start rising more quickly if the 'inflation' component of the market risk starts advancing more quickly than the geopolitical risks.

Note that Sprott has acquired the Central Fund CEF and changed the manner of reporting its NAV to conform to the Sprott asset funds model.

Wall Street may be propping the stock indices a bit into the European close, as is sometimes their custom. Let's see how things go into the close today.

Trumpolini has the markets on edge with his taunting of Russia over missiles and Syria.