"No amount of observations of white swans can allow the inference that all swans are white, but the observation of a single black swan is sufficient to refute that conclusion."

David Hume

“It has been more profitable for us to bind together in the wrong direction than to be alone in the right one. Those who have followed the assertive idiot rather than the introspective wise person have passed us some of their genes. This is apparent from a social pathology: psychopaths rally followers.”

Nassim Nicholas Taleb, The Black Swan

"Definite signs that business and industry have turned the corner from the temporary period of emergency that followed deflation of the speculative market were seen today by President Hoover. The President said the reports to the Cabinet showed the tide of employment had changed in the right direction." -

News dispatch from Washington, January 21, 1930

“The narcissist devours people, consumes their output, and casts the empty, writhing shells aside.”

Sam Vaknin

Stocks were soaring higher as Alphabet, the stock formerly known as Google, put in some good results, sending the FANGs soaring.

But tech faded and turned around, just managing to finish unchanged.

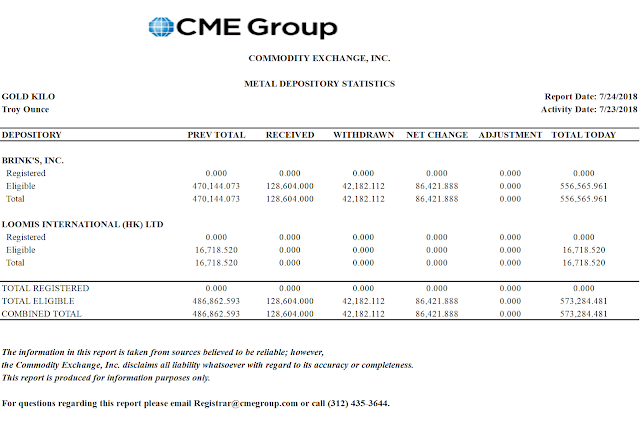

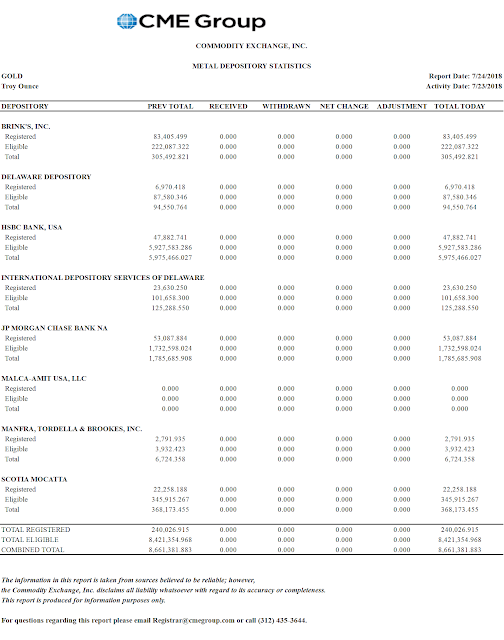

There will be a Comex gold option expiration on Thursday the 26th.

We are in the thick of earnings season now, and individual result are sending some stocks soaring or plunging.

The IMF estimates that the US Dollar is overvalued from 8 to 16 percent.

I think gold expressed in dollars is undervalued by from 60 to 100 percent.

Let's how all the reversions to the mean go.

There was intraday commentary regarding the dangers of the derivatives markets to the Too-Big-To-Fail boys here.

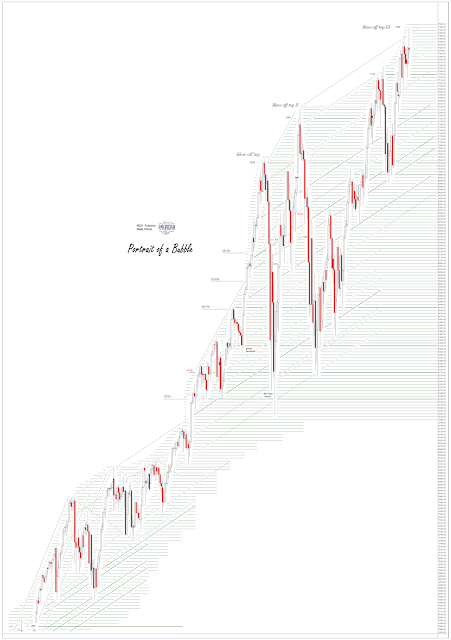

It's probably early days, but now might be the time to start taking precautions against a 2008 class event in the financial markets. I would suggest it might arrive anytime between now and July 2020.

These sorts of things depend on the magnitude of any 'trigger event,' which is why it is so difficult to forecast with regard to specific dates.

As time goes on the required force for a market moving event decreases until it takes very little to set that ball in motion.

Need little, want less, love more. For those who abide in love abide in God, and God in them.

Have a pleasant evening.