"ONE great puzzle about the recent housing bubble is why even most experts didn’t recognize the bubble as it was forming. Alan Greenspan, a very serious student of the markets, didn’t see it, and, moreover, he didn’t see the stock market bubble of the 1990s, either." Robert Shiller, How a Bubble Stayed Under the Radar, NY Times, March 2, 2008

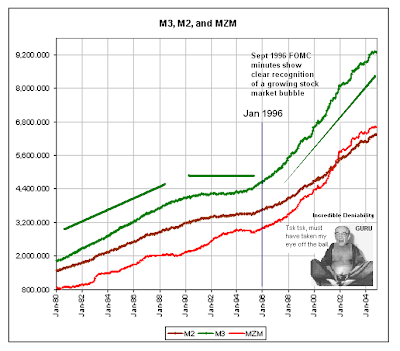

“I recognise that there is a stock market bubble problem at this point, and I agree with Governor Lindsey that this is a problem that we should keep an eye on....We do have the possibility of raising major concerns by increasing margin requirements. I guarantee that if you want to get rid of the bubble, whatever it is, that will do it.” Alan Greenspan, September 24, 1996 FOMC Minutes

"While everyone enjoys an economic party the long-term costs of a bubble to the economy and society are potentially great. They include a reduction in the long-term saving rate, a seemingly random distribution of wealth, and the diversion of financial human capital into the acquisition of wealth. As in the United States in the late 1920s and Japan in the late 1980s, the case for a central bank ultimately to burst that bubble becomes overwhelming. I think it is far better that we do so while the bubble still resembles surface froth and before the bubble carries the economy to stratospheric heights. Whenever we do it, it is going to be painful, however.” Larry Lindsey, Federal Reserve Governor, September 24, 1996 FOMC Minutes (the same Larry Lindsey who was later fired by G. W. Bush for stating that the Iraq War could cost as much as 200 Billion dollars when Rumsfeld estimated less than 50 billion).

"As societies grow decadent, the language grows decadent, too. Words are used to disguise, not to illuminate, action...Words are used to confuse, so that at election time people will solemnly vote against their own interests." Gore Vidal, Imperial America, 2004

His primary rules were: never allow the public to cool off; never admit a fault or wrong; never concede that there may be some good in your enemy; never leave room for alternatives; never accept blame; concentrate on one enemy at a time and blame him for everything that goes wrong; people will believe a big lie sooner than a little one; and if you repeat it frequently enough people will sooner or later believe it." United States Office of Strategic Services, Adolf Hitler, p.51

"...when one lies, one should lie big, and stick to it. They keep up their lies, even at the risk of looking ridiculous...If you tell a lie big enough and keep repeating it, people will eventually come to believe it. The lie can be maintained only for such time as the State can shield the people from the political, economic and/or military consequences of the lie. It thus becomes vitally important for the State to use all of its powers to repress dissent, for the truth is the mortal enemy of the lie, and thus by extension, the truth is the greatest enemy of the State.”

" Joseph Goebbels

"All this was inspired by the principle...that in the big lie there is always a certain force of credibility, because the broad masses of a nation...often tell small lies in little matters but would be ashamed to resort to large-scale falsehoods. It would never come into their heads to fabricate colossal untruths, and they would not believe that others could have the impudence to distort the truth so infamously. Even though the facts which prove this may be brought clearly to their minds, they will still doubt and waver and will continue to think that there may be some other explanation." Adolph Hitler, Mein Kampf

"Through clever and constant application of propaganda, people can be made to see paradise as hell, and also the other way round, to consider the most wretched sort of life as paradise." Adolf Hitler

"...we're going to redesign the current system...you don't have anything to worry about -- third time I've said that. (Laughter.) I'll probably say it three more times. See, in my line of work you got to keep repeating things over and over and over again for the truth to sink in, to kind of catapult the propaganda. (Applause.)" George W. Bush, May 24, 2005

"...the problem at its root is a flawed business model, and that business model is the product of a government regulatory decision to repeal Glass-Steagall administratively and legislatively, and to seek this tremendous concentration of power; and then the abuse of that power by the investment houses...What we want to do is clean up the system and hold the individuals accountable, and that is what we have tried to do...But there was an understanding that if we were to seek criminal sanctions against either the institution or the most senior people of the institution, the practical impact in our regulatory environment would have been to destroy those institutions, and then structural reform would be meaningless...because the harm to our economy that would result from eliminating a Citigroup or a Merrill Lynch is enormous, and it's disproportionate to the remedy that we want.....It was incredible. It was distressing to me how simple and outrageous it was. It wasn't so complicated that you said, "Wow, at least they're smart in the way they're doing it." It was simple. It was brazen. The evidence of it was overwhelming. It's just that it hadn't been revealed to the public, and that's why could get away with it...Right, we have seen a failure of accountability -- what I call a crisis of accountability -- over the past decade, in many institutions...Over the past decade we've wanted to deregulate, and we've said, "Let's get government out of the business of looking at these issues, and permit industry to control itself, because we can trust them." Maybe that's been a very good thing in some ways. One of the things that is eminently clear from our investigation is that all the compliance departments, all the self-regulation is nothing. They watched it, but they did nothing. So we've got to think this through, and it's not only the financial community. There are a lot of sectors where we have said self-regulation is the answer. We've got to think about it." Eliot Spitzer, The Wall Street Fix, March 16, 2003