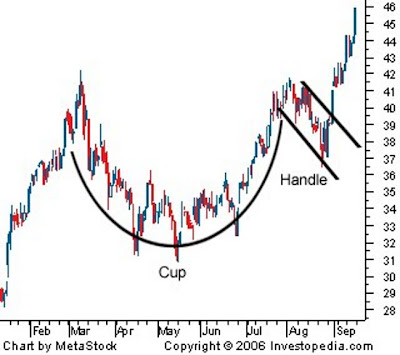

With regard to the cup and handle formation on the gold chart, a reader from Italy asks, 'Are you so sure?'

The short answer is jamais, 'never.' Only saints and fools approach certainty with reckless disdain; the experienced hedge with caution.

All charting is based on probabilities. Only fools are certain of what will happen next, and the market soon separates them from their money. In fact, 'knowing what will happen next' is the greatest single indicator of failure in trading that I have seen. All charts, all data, are selectively twisted and formed to support the outcome that one believes in. And when the like-minded collect, groupthink soon follows.

At the feast of ego, all leave hungry.

Right now this formation is indicative, a 'potential' thing that will be confirmed IF gold can break out higher. I would put the probability at about 65%, so it is a decent wager, but not more than that. As the price approaches a breakout point, the odds improve substantially.

The greatest negative is the possibility of a market meltdown in which everything is sold, at least temporarily.

This same reader from Italy suggests that gold is a Ponzi scheme. That is hardly probable since a Ponzi scheme requires a person, or small group of people, to concentrate and promote it. In the case of gold it is quite the opposite case, that the shorts hold concentrated power. I think he meant to suggest that it was a bubble, and was being a bit provocative. Although you could make the case that it is an 'anti-Ponzi' phenomenon, to the except that a fiat currency that was based in a debt Ponzi scheme is collapsing.

Well, is gold in a bubble? Gold is the 'mirror' of fiat currencies. Are governments and central banks doing a good job of protecting and maintaining the value of their currencies. Is spending well in balance with taxation? Gold is the barometer of profligacy and corruption. This is why corrupt statists fear and despise it.

Here is an interesting interview with Felix Zulauf on the global currency crisis and the gold bull market which is worth listening to carefully.

If people look back to the last great credit collapse worldwide which was the 1930's, and sees what happened to currencies and gold, they will obtain some knowledge that could very useful to them now. Stubborn ignorance can rationalize amost anything, and there is a peculiar tendency among people to resist the data that does not support their assumptions, until they are overwhelmed. They still have some hope due to the somewhat arbitrary nature of fiat currencies today, but increasingly less so for the very good reasons that Mr. Zulauf outlines in his interview.

Gold has no liabilities if you own it, it is sufficient in itself. It is also relatively stable in supply, and cannot be increased at will, as a fiat currency can be printed almost at will by a central bank but with increasingly lower marginal value in a free and transparent market.

Pierre Lassonde offers another interesting, although less rigorous viewpoint in this interview.

As a reminder I do not subscribe to the pure hyperinflationary outcome yet, which I think is not likely in the US at least. For my way of thinking, organic hyperinflation is a function of a currency with an external reference point. At the moment, the US dollar has no legitimate external standard as a reference point, except something soft, indicative, like gold. This is a truly fascinating and almost unprecedented historical development. I cannot think of a comparable economic example.

I suspect we will see powerful deflationary forces that will be countered by monetary inflation and devaluation that is not quite sufficient to break it, because quite frankly Bernanke is no Volcker, and the monied interests will resist a deterioration of their inordinate share of the dollar wealth of the world. That is not to say that various countries and even regions will not be economically 'trashed' in the process by a predatory financial sector based largely in New York, Zurich, and London.

Within eight years I would see the US dollar financial system resolving into a currency collapse and the issuance of a new dollar with a few zeros, two or three, knocked off as was seen with the rouble. It will look somewhat similar to the collapse of the former Soviet Union, not with a bang, but a whimper.

Here is a closer look of the current 'handle' being formed, and next to it the idealized example from an illustration of a classic cup and handle formation.

I would have preferred to have seen that lower bound set with at least one more test. Obviously at this point a retest would certainly try the longs. This would most likely occur if there was a major selloff in equities. Otherwise it appears that the orchestrated selling around Comex option expiration was the near term low.

Classic Cup and Handle Illustration

Gold to $1800-$2000 this year, and $30 Silver - James Turk

There are many more skeptical holdouts and the merely unaware with regard to the unraveling of the global fiat currency regime that has been in place since Bretton Woods.

As the dollar reserve currency and the euro recede into history, the pricing of gold in these currencies will become quite high, as the price of gold in old roubles had been during the collapse of the former Soviet Union. One thing that puzzles me is to speculate on which, if any, currencies will remain standing and be the big winners. Few have any backing in specie.

As the dollar reserve currency and the euro recede into history, the pricing of gold in these currencies will become quite high, as the price of gold in old roubles had been during the collapse of the former Soviet Union. One thing that puzzles me is to speculate on which, if any, currencies will remain standing and be the big winners. Few have any backing in specie.

Moscow Memories of 1997

As you will recall, the world did not collapse with the Russian Empire. Goods flowed around and out of that region to other parts of the world, creating severe shortages. Many were out of work, or not being paid as official payrolls were in default due to lack of funds. Debts were wiped out en masse. Where was the deflation?

The US may have the option to go the Japanese route of slow death rather than a purging. A decade of stagflation may be deemed preferable to an all out bust.

Few understand the difference between a recession and a currency crisis. And they tend to forget even the wisdom of their own cultural heritage, embodied in the little sayings that we so often repeat, but genuinely understand only at those rare moments in our own personal experience.

"...the harder they fall."

Indeed.

29 May 2010

Gold Daily Chart: The Handle Forms, a Reader's Questions, and Felix Zulauf on Gold

Category:

cup and handle formation,

gold daily chart