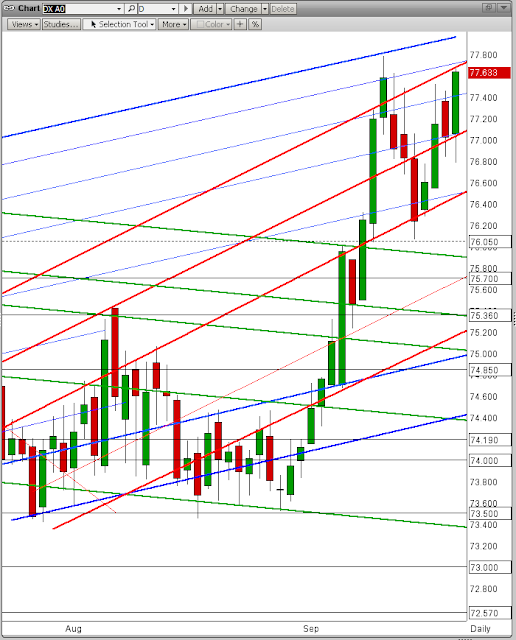

The Fed did what was expected, announcing Operation Twist which will buy Treasuries in the 6 to 30 year range to pull down rates. They will also continue to roll over their balance sheet assets.

The unexpected perhaps was the strong language in describing the economy in terms of 'significant downside risk.' This language, coupled with the bank downgrades in Italy and the US, had trading flying to buy Treasuries and sell stocks.

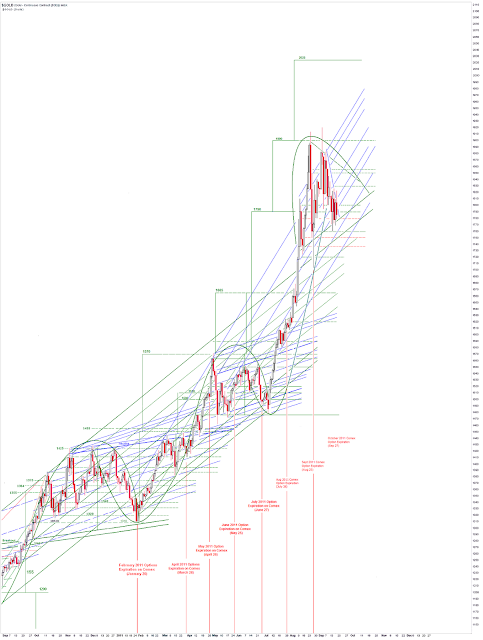

Gold and silver retreated off their highs and closed lower for the day, perhaps on the stronger dollar which rallied as additional capital fled Europe and emerging markets. So we had no resolution of this chart pattern, how disappointing was that!

Typically the day after the Fed takes a policy action, if the stock market sells off it rallies the next day. Let's see if that pattern holds.

I think the support gold has here is important, and many have cited the strong physical buying support that gold is finding in the 1700's.

Option expiration next week, and so no peace for the metals bulls perhaps.

JPM stages major bear raid, encounters determined resistance. Bravo Masters, shall we dance?