If you had a calm trading day today then you probably were not trading.

Gold and silver were smacked down fairly hard in a two step operation around the NY open this morning in a blatantly obvious bear raid. Stocks also sold off quite sharply.

But then the markets started to recover, if one knows what to look for. I responded by taking down my short stock positions, and added substantially to my bullion position a little after 10 AM.

Something in the selloff did not seem right. Volumes became almost non-existent and prices drifted higher for the rest of the day.

Then this story hit the wires in the afternoon about 3 PM NY time.

The Guardian UK

France and Germany Agree to €2 Trillion Euro Rescue Fund

By David Gow in Brussels

France and Germany have reached agreement to boost the eurozone's rescue fund to €2tn (£1.75tn) as part of a "comprehensive plan" to resolve the sovereign debt crisis, which this weekend's summit should endorse, EU diplomats said."

Was this known in advance by some market participants? It certainly could be thought so. It proved to be a decent opportunity to add back to my metals positions and I was glad I took off the short stock hedges.

So what next? It is hard to say, because this is a very light volume, headline driven market, and the fundamentals are taking a back seat to the events of the day at least for now, with the events dominated by European debt concerns.

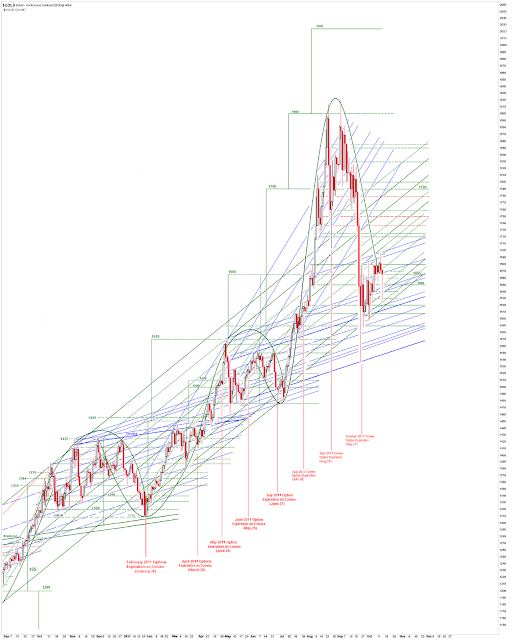

Gold is locked into a trading channel, and I have been buying weakness and selling strength at extremes while it remains therein. How and where it might break out or down I cannot say. But the trend looks up barring a liquidation event.

Speaking of bank chicanery, I see where Bank of America is shifting Merrill Lynch derivates to the books of a bank subsidiary that is fat with FDIC insured deposits.

Apparently the FDIC and Federal Reserve have differing views of this maneuver.

But it should help to clarify why Glass-Steagall needs to be reinstated. And why the Fed may be a poor choice as bank regulator, itself being a private institution owned by the banks.