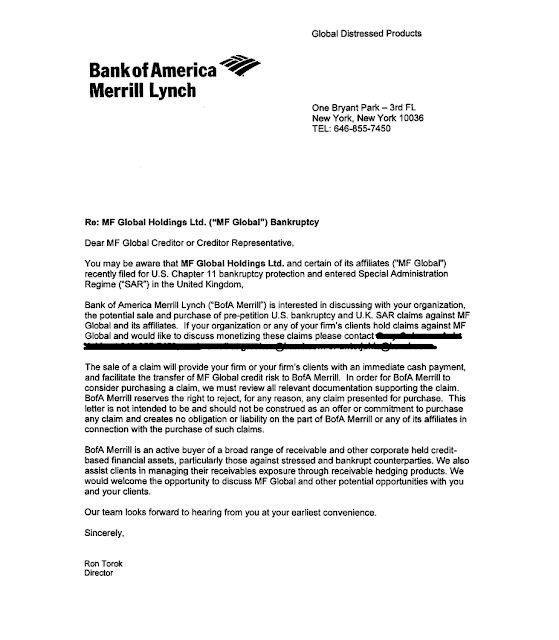

Bank of America's Merrill Lynch unit is soliciting for the purchase of claims against MF Global.

As you may recall, Bank of America is one of the major creditors of MF Global with JPM, and is reported to be one of the Debtors, along with JP Morgan, involved in the litigation trying to obtain superiority of their claims over customers whose money was taken/lost/stolen by parties unknown for now.

I have nothing against vulture funds per se, although what I hear a few of them have done with two of the failed Icelandic Banks and their former directors proves Rule Four of ZombieBankingland: Always Use the Double Tap.

But doesn't this seem like a bit of an impropriety, if Bank of America is one of the holders of assets, or affiliated in a court action with such a holder of contested assets, that would ultimately make customers whole? Is it conceivable that this is a conflict of interest?

I mean, it does seem that BofA with one hand is acting with others to give its own claims superiority in the Trustee liquidation, and on the other hand it is offering to buy up the claims it has weakened by these legal actions.

MF Global has the wafting odour of scandal that keeps on intensifying.

I cannot wait to find out the whole truth. But that might have to wait for kingdom come, if it is in the same justice delivery system as the silver manipulation inquiry.

But for now the pampered princesses of the NY financial media are bubbling with excitement over the clubbing and gassing of peaceful protesters under cover of darkness.

It appears that MF Global is phase two: the clubbing and looting of unsuspecting customers and clients.

When in doubt, get out.