The paper money munchkins and metal bears are making their stand for gold at $1650 and silver at 32. That seems fairly obvious. They will hold it until they cannot, and then will fall back to defend a slightly higher price level. I like to think of it in American football terms. The bulls are going for a first down, and the bears are trying to hold them back.

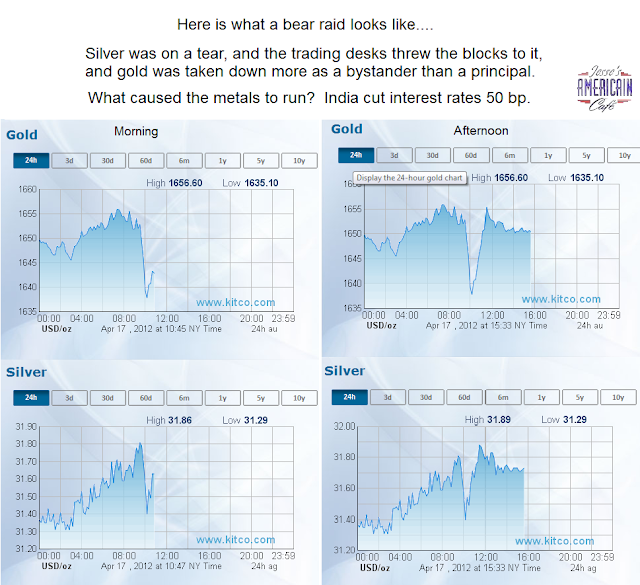

Silver came in this morning with some serious momentum, and so we saw a fairly quick and sharp bear raid. See the first chart. Yes, the bear raid 'failed' but it broke the upward momentum which was the point.

Silver registed for delivery at the Comex is down to historically low levels again. They will have to be replenished before the next big delivery month.

Some of the commentators are remarking on the unusually low open interest in gold at Comex. While that could be a bullish or bearish indicator depending on how you wish to twist it, it could also very well indicate that the players are shunning the US futures market and so volume is down. Before these scandals work themselves out I expect it to fall much lower.

India cut its interest rate by 50 basis point, and this was most likely the fundamental reason for the rally in commodities and stocks.

It looks like the metals and stocks are moving together again, so one might put the long metal short stocks hedge back on again.