“To understand reality is not the same as to know about outward events. It is to perceive the essential nature of things.

The best-informed man is not necessarily the wisest. Indeed there is a danger that precisely in the multiplicity of his knowledge he will lose sight of what is essential. But on the other hand, knowledge of an apparently trivial detail quite often makes it possible to see into the depths of things.

And so the wise man will seek to acquire the best possible knowledge about events, but always without becoming dependent upon this knowledge.

To recognize the significant in the factual is wisdom.”

Dietrich Bonhoeffer

The bullion supply lines for this recent market operation seem a bit overextended and ill equipped for the ferocious waves of physical buying that have been reported, especially in Asia.

This from UBS:

"On the physical front, strong appetite out of Asia continues. Our index of physical flows to India continues to indicate very strong demand coming in, at least five times the average over the last 12 months.

Premiums in India are now quite high, particularly for the 0.9995 purity kilo bar, the more popular product, amid extremely limited supplies at the moment."

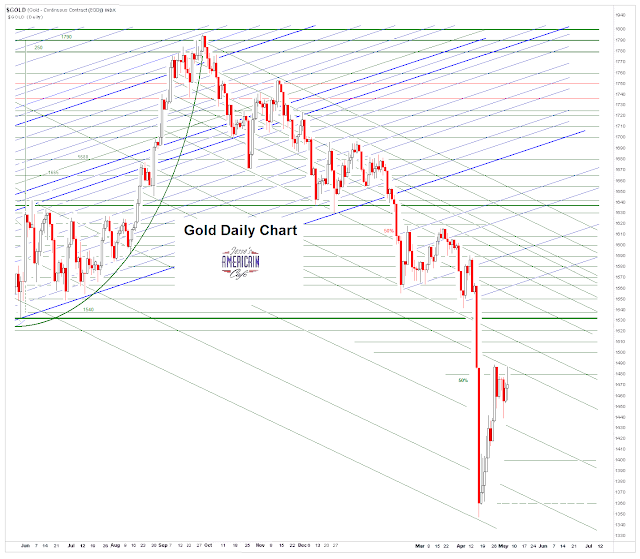

The bullion bears are drawing a line in the sand for gold at 1480. The physical drawdowns are going to eat them alive if they try to hold the easy ground they gained by heavy selling in quiet market periods.

And so I think that level will fall, and they will fall back to the real test which will be in the area of 1580 when gold takes on the longer term downtrend. And they will continue to have their easy victories, while sowing the seeds of their own downfall.

And for our modern financial speculators, who think that price is the value, rather than the other way around, welcome to the winter of your discontent. There are going to be some very punishing lessons in the fundamentals of supply and demand given out, and of the limits of the will to power and fraud. And given time they will be haunted and hunted, and reviled beyond their ability to conceive it.

That is the underlying story of the last financial crisis, and sadly, little has changed. One thing I will give the financiers, they often persevere in their greed and folly until achieving, at last, their own shame and remarkable self-destruction. That is the heroic commitment of the mad to a foolish and unworthy end. It is a sickness unto death. We have seen such downfalls in our day, again and again and again. They would be as gods; and in their madness they never learn to avoid plunging into the abyss.

Think about those who have shown this tendency. Bernie Madoff, the Enron Boys, the London Whale. How can one explain such unaccountable madness, and yet account for it in their economic models?

And in truth, there are times when a sector that promises power becomes the playground of the psychopaths and the morally ambivalent. And there would be tragedy, except that they fall not from heights of greatness, but from monumental and foolish pride. And so they lie, scorned and unpitied.

How are the mighty fallen, stripped of the accoutrements of their war. And there are many more, and greater yet, to come. And they scorn the simple prescription that would save them: need little, want less, and love more.

But let's not get ahead of ourselves, and let the markets show us what is really happening. The biggest changes are not events but processes, with many twists, and the turning of the tide is only knowable in retrospect.

Here is a recent chart linked to below that purportedly compares housing and gold as a hedge against inflation.

Gold Versus Housing As An Inflation Hedge

The scales are utterly misleading. If you wish to compare two things over the same period of time a percentage increase is much more effective than splitting it across two unrelated nominal scales on opposite sides of the chart.

Housing on the left scale went up on the chart 2x, and gold on the right has gone up 6x at least.

The chartist *could* be trying to show that housing, as the major measure of inflation, was not closely followed by gold. But that does not come out in the commentary, and is a bit off the wall, since housing was not a major measure of general inflation. Housing was a secular phenomenon, a flat out bubble marked by significant fraud and highly leveraged mispricing of risks.

The central banks were net selling gold into the first part of the chart. As you may recall the period of 1999 to 2002 was the infamous "Brown's Bottom." They turned to net purchasing around 2006, and now there are shortages of bullion.

And I don't see the government subsidizing and promoting the purchase of gold as they had been doing with housing, at least not directly. However, the US financial system is doing a pretty good job of incenting the world to buy gold by creating negative real interest rates of return on the dollar, and allowing the bullion banks to game the metals markets. But I think that has hardly run its course.

As you may have heard today, JP Morgan and their derivatives diva Blythe Masters are under scrutiny for gaming the energy markets, among other things. I am convinced that the scandals that keep coming out are still just the tip of the iceberg. As Jeffery Sachs said, Wall Street has become a pathological environment, and it is so 'in your face' that is hard to miss. Unless your paycheck depends upon not seeing it.

The G20 has its conference on Reinventing Bretton Woods next week. I do not expect anything dramatic to come out of it. This process of change is going to move slowly.

See you Sunday evening.

This is what quite a bit of the non-English speaking world thinks is happening. And they are getting mad as hell about it.

There is change in the wind, and before it's over, it may be blowing a hurricane.