I think that the explanation for the negative premium on the Central Gold Trust lies in its thinner liquidity.

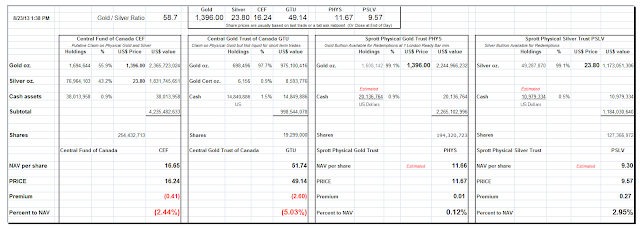

For example so far today it has traded 90,000 units in the US, against 861,000 units for the Sprott Physical Gold Trust. A seller at 49.14 distorted the price a bit as the market slowly chipped away at the offer.

The Central Fund is more responsive to market changes, with units traded today at 734,000.

But I do think that the redemption feature at Sprott, though lightly used, makes a difference in value perception for whatever that is worth.

With the gold/silver ratio having fallen to 58 so far, it is obvious that silver's high beta has caused it to rally harder than gold at this point. That is normal and healthy for the metals overall.