"We looked into the abyss if the gold price rose further. A further rise would have taken down one or several trading houses, which might have taken down all the rest in their wake. Therefore at any price, at any cost, the central banks had to quell the gold price, manage it."

Sir Eddie George, Bank of England, reported in private conversation, September 1999

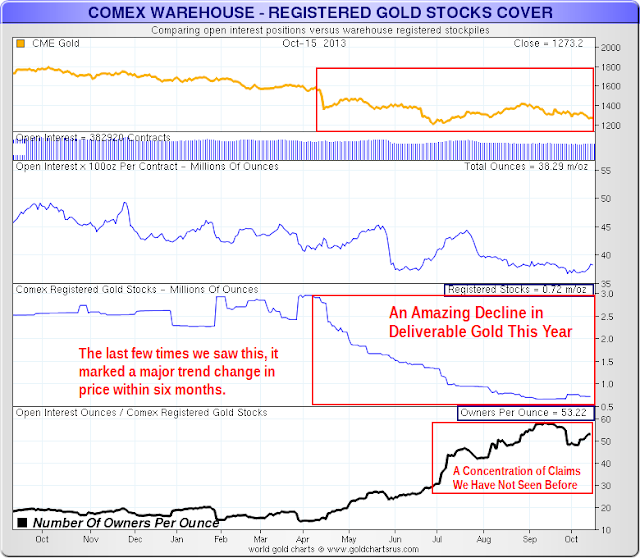

We saw more significant action in the Comex warehouse complex yesterday.

A total of almost 4,000 ounces left the greatly diminished deliverable category, bringing it down to 717,666 ounces. The ownership per ounce for each of those deliverable ounces is back up to 53.

Over 50,000 ounces left the Comex complex overall, taking the total amount of gold bullion there to 6,859,476 ounces.

As you know the gold bullion has been coming out of the ETFs in particular, and it is not showing up in the Comex warehouses. There is widespread speculation and anecdotal evidence that this gold is being used to fulfill deliveries in Asia, after being refined into 400 ounce bars. I do not think that it is likely to come back anytime soon.

There was a great deal made today of a letter that was sent out by JPM, limiting cash withdrawals by customers significantly and eliminating overseas wire transfers completely. I have heard from some well-heeled individuals who are pulling their cash out in response to this.

I do not think this is a sign of government capital controls. It is more likely involved with the trouble that JPM had gotten into with the OCC over their lack of compliance with regard to anti-money laundering measures. As you may recall they received a 'cease and desist' order in January over this and have been under stricter surveillance since then.

Sometimes Banks engage in campaigns to migrate customers out of old platforms and less desirable accounts into more profitable account programs. I did not see a message in their indicating that, but it is a possibility.

It could also be a short term cash problem at the bank. Perhaps there is some perceived risk there that the general public is not yet aware. I find that a little hard to believe, but it seems more likely than a move to more general capital controls by the government. If another big bank or two institute similar rules then maybe there is a little heat there worth our notice.

When it comes to metals, this market is just a mess. I am appalled at the manner in which the CFTC and the CME have been conducting their roles as overseers. These big market sells in quiet periods are almost unbelievable in their frequency and brazen effect on price.

Are some bullion banks in trouble with their positions again? It seems like something very odd is going on, and we know that when the banks get too badly offsides the market, the central banks are often willing to extend themselves to help them 'for the sake of the system.'

Gold forwards have gone negative again. This represents tightness in the short term supply of physical bullion. There have been massive drawdowns in Comex deliverable gold and the ETFs this year, without anything at all like it in silver, platinum, or palladium which have held steady or gained over the same time period. And no one seems to notice. Le monde autour est sourd, bien entendu!

I suspect that those who see nothing unusual at all in this, and are seasoned watchers and traders in precious metals, are probably whistling past the graveyard. It will take higher prices to free up more gold to be available for delivery, and that will make it harder to keep tapping the ETFs to obtain physical supply with which to satisfy Asia. It is quite the predicament.

And there remains the fact that the Fed told the Bundesbank that they may have the return of the German people's gold, but not for seven years. This obviously suggests that the gold might otherwise be occupied, spoken for, and encumbered.

There may be a reckoning when the smoke clears, and the quantities actually available to buyers readily on the shelves are revealed at last.

Weighed, and found wanting.

Stand and deliver.