"Precious metals are financial assets like currencies, T-Bills and T-bonds. They trade in the multiples of a hundred times the underlying physical, and so people buying them are voting and giving an economic view of the world or a view of the economic world..."

Jeff Christian in testimony to the CFTC

"It's [price manipulation] because gold is a powerful competitive international currency that, if allowed to function in a free market, will determine the value of other currencies, the level of interest rates, and the value of government bonds.

Gold's performance is usually the opposite of the performance of government currencies and bonds. Hence central banks fight gold to defend their currencies and bonds.

The problem is that central bank tactics in this fight affect more than gold; they affect markets generally and eventually destroy markets generally. This destruction of markets now has a name, a name used even by former members of the Federal Reserve Board. That name is 'financial repression.'"

Chris Powell

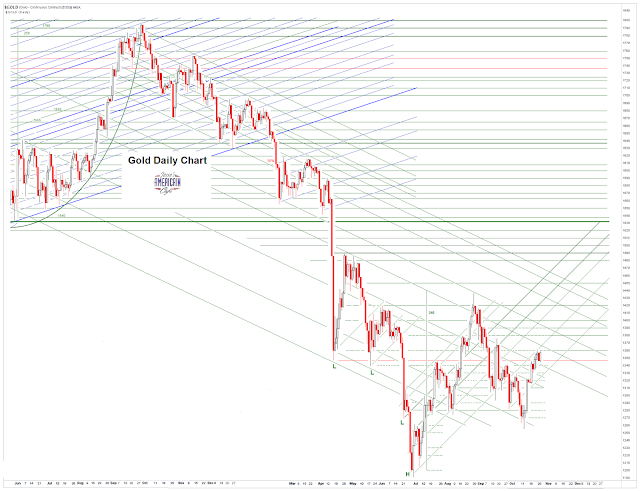

It was capping time, but no real serious hit on the metals on an FOMC day.

Equities maintain an upward bias as it looks like QE as far as the eye can see, at least into next year, lol.

There was no movement in or out of the Comex warehouses, highlighting the ephemeral paper nature of the US exchange.

God's judgement will fall heavily on the self-proclaimed exceptional. Guarding against this is at least, if not more, important than protecting your savings. For what does it profit a man...

Let us all keep this in mind even as the hysteria of the one percent grows, and the lies pile higher, driven by the cold winds of selfishness and self-destructive greed.

Have a pleasant evening. And try to remember those who will not.

Austerity, so the innocent may die, to salve the Banks' and fortunate ones' false pride.