Luckily for the Comex most of the gold deliveries this month have been taken by JPM for their 'house account.'

January is not an active month for the precious metals on the Comex, so the wiseguys only need to muddle through the next couple of weeks, and then it should be clear sailing until February.

I hear the bullion banks are putting some heavy pressure on the miners to hedge their forward production, and even on some central banks to lease more gold. I am a little surprised that there have not been more acquisitive moves on the miners at these fire sale prices.

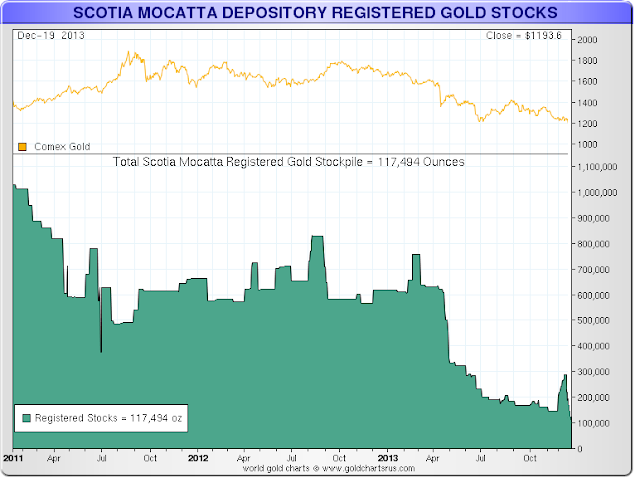

This situation on the Comex is not a default scenario per se. There is plenty of gold available, but it might require higher prices for customers to present their bullion for delivery. Unless of course that customer is a big bullion bank which is playing multiple sides of the same market.

Still, it pays to be prepared I suppose, even for the unlikely. CME Seeks To Broaden Cash Options In Clearinghouse Members Default Rules

Have a great holiday.